The Dow DJIA, +0.84% and S&P 500 SPX, +1.54% booked their best quarterly performance since 1987, though that doesn’t quite make up for ugly first-quarter losses. Beating all comers was the Nasdaq Composite COMP, +1.87% , up 30% for the biggest quarterly gain since 1999 as technology stocks have largely emerged in decent shape from a tough six months.

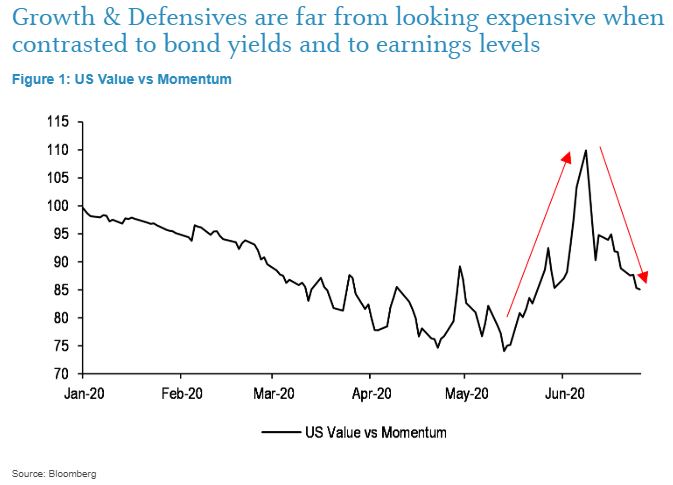

Our call of the day advises sticking with the winners for the rest of the year. “We believe that the U.S will remain the relative regional outperformer and that the style leadership will firmly return to tech and defensives, post the tactical value rally seen in [second half] of May and [first half] of June,” says Mislav Matejka and a team of strategists at JPMorgan Casenove.

Value stocks, often in cyclical industries that perform better as economies recover, have been bouncing back in recent weeks. Laggards in the post-financial crisis rally, they have lured in investors looking for bargains and feeling hopeful about a ‘V-shaped’ recovery.

But Matejka says whatever rotation we’ve seen out of defensive and techs into cyclicals is over. To keep outperforming, value stocks need purchasing managers indexes to show signs of economies expanding. Continued high jobless levels in the second half and fears of a virus resurgence will stop that in its tracks, he adds.

“Our economists forecast that the worst of the labor market weakness is likely behind us; however, the projected path is far from a V-shaped recovery,” and that will make it tough on the consumer, say the strategists.

And defensive and tech stocks are still attractively priced, says Matejka.

His forecast isn’t far off from an investor survey conducted by DataTrek Research, which found 52% of respondents expect technology stocks to beat all other sectors by miles for the rest of 2020.

But Nicholas Colas, DataTrek’s co-founder, says the survey also finds we are headed into a “convictionless market.” A fifth of respondents say they expect the S&P 500 will finish the year 10% higher.

“Every option from ‘really bad’ (down +10% from here) to ‘really good’ (+10%) got basically the same number of votes,” he says. “And we’re only talking about the next six months.”

The chart

Random reads

California’s Golden State Killer admitted to 13 murders.

Iran has sentenced a journalist to death over 2017 protests.

“Buy Apple” started trending after this thread:

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

the year.

Add Comment