It’s the time of year to look back over the last 12 months, but one strategist reached back to the 19th century to describe what’s going on.

In 1898, Swedish economist Knut Wicksell said equilibrium was only attained if the marginal return on capital is the same as the cost of money, notes Kit Juckes, the London-based head of currency strategy for French bank Société Générale. (Here’s a nice summary of Wicksell’s views, from the St. Louis Federal Reserve.)

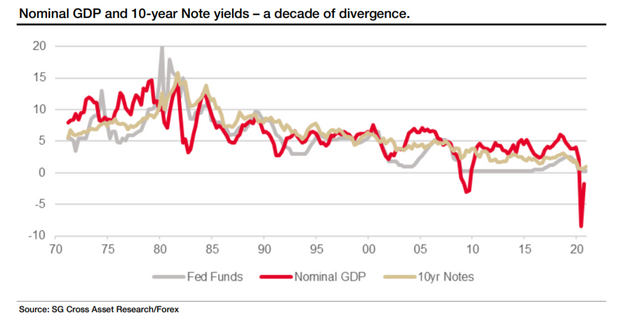

Fast-forward a bit, and Juckes points out that the yield on the U.S. 10-year Treasury has averaged 6.2% over the last 50 years. During that time period, nominal gross domestic product growth (real GDP growth plus inflation), also has averaged 6.2%.

That is, of course, a far cry from present conditions, where the 10-year yield can’t break 1%, and the economy has been contracting over the last 12 months. And even over the last decade, 10-year yields have been trailing GDP growth.

Juckes nearly summarizes what has happened. “Central banks spent the 1980s getting inflation under control, but the 1990s saw the emergence of downward pressure on CPI [consumer price index] inflation in particular, from a number of sources: baby boomers entered the labor force, the Soviet Union’s collapse massively boosted Europe’s labor force, China’s entry into the world economy changed supply of a host of goods, technology had a similar effect and for good measure, labor unions became far less powerful,” he writes.

After the 2008-09 financial crisis and during the COVID-19 pandemic, “interest rates are glued to the floor.” But even as inflation is under control, Juckes says it is obvious economies aren’t in equilibrium, as low interest rates have sent “asset prices into orbit. And while that is lovely for those who own assets, it increases inequality, fuels political division between asset-rich and asset-poor, and leaves the Fed hostage to equity markets because they can’t afford to trigger a correction in indices that would send the U.S. economy back into recession. That gives markets far too much power over policy,” he says.

The next rate hike cycle will peak even lower than the last one — the effective Fed funds rate was 2.4% in 2019 — “because equity valuations will make it so.” Juckes says this disequilibrium will leave the global economy fragile and prone to another crisis.

The buzz

Pharmaceutical company AstraZeneca AZN, +1.05% on Wednesday said the coronavirus vaccine it has developed with the University of Oxford has been approved by the U.K. government. The U.S., meanwhile, said the U.K. strain that spreads more quickly has been identified in Colorado. Hospitalizations reached a daily record of 124,686 on Tuesday, according to the COVID-19 tracking project, as California extended its lockdown.

Congressman-elect Luke Letlow, a Louisiana Republican, has died at age 41 from coronavirus.

The fate of both the $2,000-per-person stimulus check, as well as the defense bill previously vetoed by President Donald Trump, is still in question in the U.S. Senate. Analysts expect the upper chamber to kill the additional stimulus-check legislation approved in the House, but the proposal has won support from a handful of Republicans even as Majority Leader Mitch McConnell has blocked a vote.

With polls extremely close on the key Senate races in Georgia, President-elect Joe Biden and Vice President-elect Kamala Harris will separately travel to the Peach State to campaign for the two seats, the Biden press office said. Democrats would take control of the Senate if they win both elections.

The U.K. Parliament is expected to easily clear the trade agreement reached with the European Union.

The markets

After the S&P 500 SPX, -0.22% and Nasdaq Composite COMP, -0.38% fell all the way to the second-highest level in history, U.S. stock futures ES00, +0.33% NQ00, +0.30% were again pointing upward.

The U.S. dollar DXY, -0.26% fell. The yield on the 10-year Treasury TMUBMUSD10Y, 0.951% was 0.95%. Bitcoin BTCUSD, +2.92% rose as high as $28,752, a fresh record, according to CoinDesk data.

The tweet

There was a lot of discussion on social media about this CNBC interview with Interactive Brokers IBKR, -1.20% chairman Thomas Peterffy, where he said for the first time in its history, its customers were net short out-of-the-money stock options. “It’s usually about Tesla TSLA, +0.35% and Amazon AMZN, +1.16% and Apple AAPL, -1.33% — that’s where most of the action seems to be. So the Robinhood folks are long these options and Interactive customers are short these options,” said Peterffy. Robinhood is the brokerage that many young investors trade on.

Random reads

A Greek nurse erected his own intensive care unit after not liking the treatment options available when his wife, her parents and her brother got COVID-19.

Archives reveal a comedian’s prank call to test out an impersonation may have saved the government of former U.K. Prime Minister John Major.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

Add Comment