After a frantic regulators-to-the-rescue weekend that sparked a rally for U.S. equity futures on Sunday night, the atmosphere has turned more cautious, except for still-partying tech futures. That’s as lots of banks are in the red ahead of Monday’s open.

Nervous investors may be wary of more shoes dropping following the Silicon Valley Bank fallout that is resurfacing great financial crisis memories for some more long-toothed traders. And no rest for the wicked as the next update on consumer prices hits Tuesday.

Read: SVB collapse means look out for more stock-market volatility, say analysts.

Here’s Jim Reid and a team of strategists at Deutsche Bank, neatly summing up a whirlwind few days: “SVB’s woes are a combination of one of the largest hiking cycles in history, one of the most inverted curves in history, one of the biggest bubbles in tech in history bursting, and the runaway growth of private capital. The one missing ingredient not involved here is a U.S. recession.”

It’s just more of the boom-bust cycle we’re stuck in, says Reid. “That being… too much stimulus -> very high inflation and an asset bubble -> aggressive central bank hikes -> inverted curves -> tighter lending standards/accidents -> recession.”

Onto our call of the day from Goldman Sachs, where economists say the rescue of SVB and other depositors will tie the Fed’s hands next week.

“In light of recent stress in the banking system, we no longer expect the FOMC to deliver a rate hike at its March 22 meeting with considerable uncertainty about the path beyond March,” said a team led by chief economist Jan Hatzius in a note to clients late Sunday.

Hatzius and Co. had expected a 25-basis point hike next week. “We have left unchanged our expectation that the FOMC will deliver 25bp hikes in May, June and July and now expect a 5.25-5.5% terminal rate, though we see considerable uncertainty about the path,” they said.

They clearly aren’t alone as Fed fund futures indicate the chances of the Fed hiking interest rates by 50 basis points next week have fallen from 70% to zero in recent days.

But some say the Wall Street banking behemoth is getting ahead of itself:

Capital Economics, meanwhile, is siding with Goldman here: “Even if the authorities are successful at putting a firewall around the problems at SVB and Signature Bank, the lags with which policy operates are a reason to adopt a more gradual approach to policy tightening from here,” said Neil Shearing, group chief economist.

Note, Goldman also said that while the Fed has stemmed the panic over SVB and Signature Bank, it remains to be seen whether the FDIC would similarly address other such lenders if they were smaller than the two banks in question.

Last word and perhaps a testiment to nervousness around banks, goes to Mark Haefele, chief investment officer at UBS Global Wealth Management who told clients this: “We remain least preferred on financials in our US strategy and recommend investors who have above-benchmark weights in global financials (15% of the MSCI ACWI) to revisit their exposure.”

The markets

After soaring late Sunday in the wake of measures to curb SVB panic, Nasdaq-100 futures NQ00, +0.66% and S&P 500 futures ES00, +0.22% remain higher, but Dow futures YM00, -0.13% are in the red. The two-year Treasury yield TMUBMUSD02Y, 4.342% is down 31 basis points to 4.284%, the dollar DXY, -0.32% is off 0.4% and gold GC00, +1.01% is up $28.30 to $1,895.80 an ounce. For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

At the end of a hectic weekend of negotiations, U.S. regulators say Silicon Valley Bank SIVB, -60.41% depositors will have access to their money, with no fallout for U.S. taxpayers, though share and bondholders appear to be out of luck. Depositors of crypto-friendly New York-based Signature Bank SBNY, -22.87%, closed Sunday by its state regulator, have received similar guarantees. The Fed also announced a new emergency loan program for banks in trouble to ease contagion risk.

But there’s some chaos for banks on both sides of the Atlantic. Tainted by similarities to SVB, First Republic Bank FRC, -14.84% is down 60%, despite getting a Fed and JPMorgan funding boost and reassurances by its founder and CEO on Sunday.

Read: Stablecoin issuer Circle to transfer $3.3 billion in cash held at Silicon Valley Bank to BNY Mellon

SVB’s U.K. arm has been bought for £1 by HSBC HSBC, -3.84% HSBA, -4.34% in a deal brokered by the country’s Treasury and Bank of England. U.S.-listed HSBC shares are down 2%, while Credit Suisse shares CS, -3.97% CSGN, -11.06% are off 9%, hitting a new record low.

Shares of pharma group Provention Bio PRVB, -7.59% are up 259% after French drugmaker Sanofi SAN, -1.50% said it would buy the fellow pharma group in a deal worth $2.9 billion.

Apart from CPI on Tuesday, the week will also bring other important data including retail sales, producer prices, housing updates and the Empire State manufacturing survey.

Best of the web

Some of the worst casualties of SVB’s collapse were companies developing solutions for the climate crisis.

Armed with human hair and used clothing, a Philippine island’s residents are trying to keep an oil spill from marring pristine beaches.

“Everything Everywhere All at Once” dominated the Oscars, nabbing best picture and other awards. Check out the biggest speeches, snubs and other viral moments.

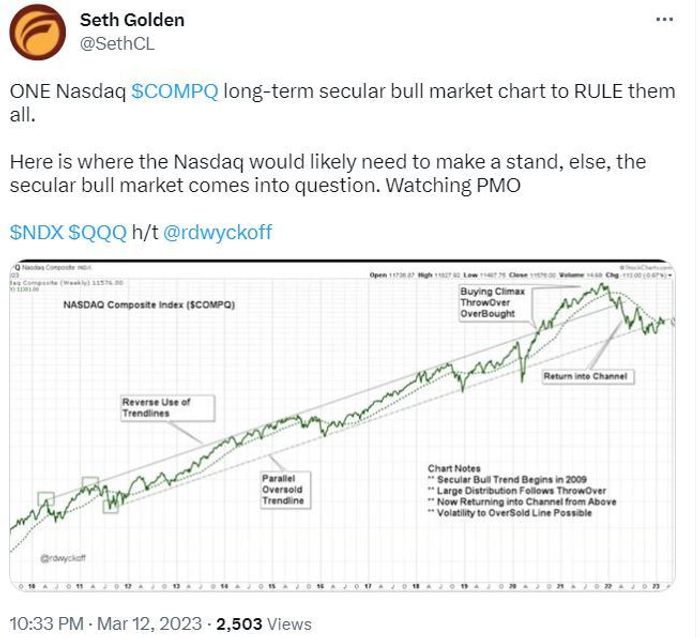

The chart

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

| TSLA, +0.30% | Tesla |

| BBBY, +8.94% | Bed Bath & Beyond |

| FRC, -14.84% | First Republic Bank |

| SIVB, -60.41% | SVB Financial Group |

| AMC, -4.78% | AMC Entertainment |

| GME, -1.54% | GameStop |

| TRKA, -24.78% | Troika Media |

| AAPL, -1.39% | Apple |

| NVDA, -2.01% | Nvidia |

| APE, -10.67% | AMC Entertainment Holdings preferred shares |

Random reads

Vasectomies: A guilt-free path to March Madness viewing.

£250,000 will buy you Britain’s “loneliest home,” which requires a 20-minute hike from your car and a complete renovation.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch

writers.

Add Comment