It doesn’t make much sense for the dollar to be as widely used as it is. Sure, the U.S. economy is the largest in the world, but the dollar is on one side of 88% of all currency trades, despite the U.S. accounting for roughly a quarter of global gross domestic product. Countries, most notably China and Russia, also are upset the U.S. is able to wield its currency dominance to sanction government officials across the world.

But even as the dollar has fallen 8.5% from the highs of March, according to the WSJ dollar index BUXX, -0.20%, there is still no clear path or even idea on how to replace the dollar’s role in the global financial system. It was only a year ago that former Bank of England Gov. Mark Carney suggested Facebook’s Libra cryptocurrency could be a replacement, an idea that now sounds ludicrous given the project’s struggles, even as Carney’s critique over dollar hegemony proved apt when there was a dollar shortage during the beginning of the coronavirus pandemic.

Brad Setser, senior fellow at the Council on Foreign Relations, makes another point.

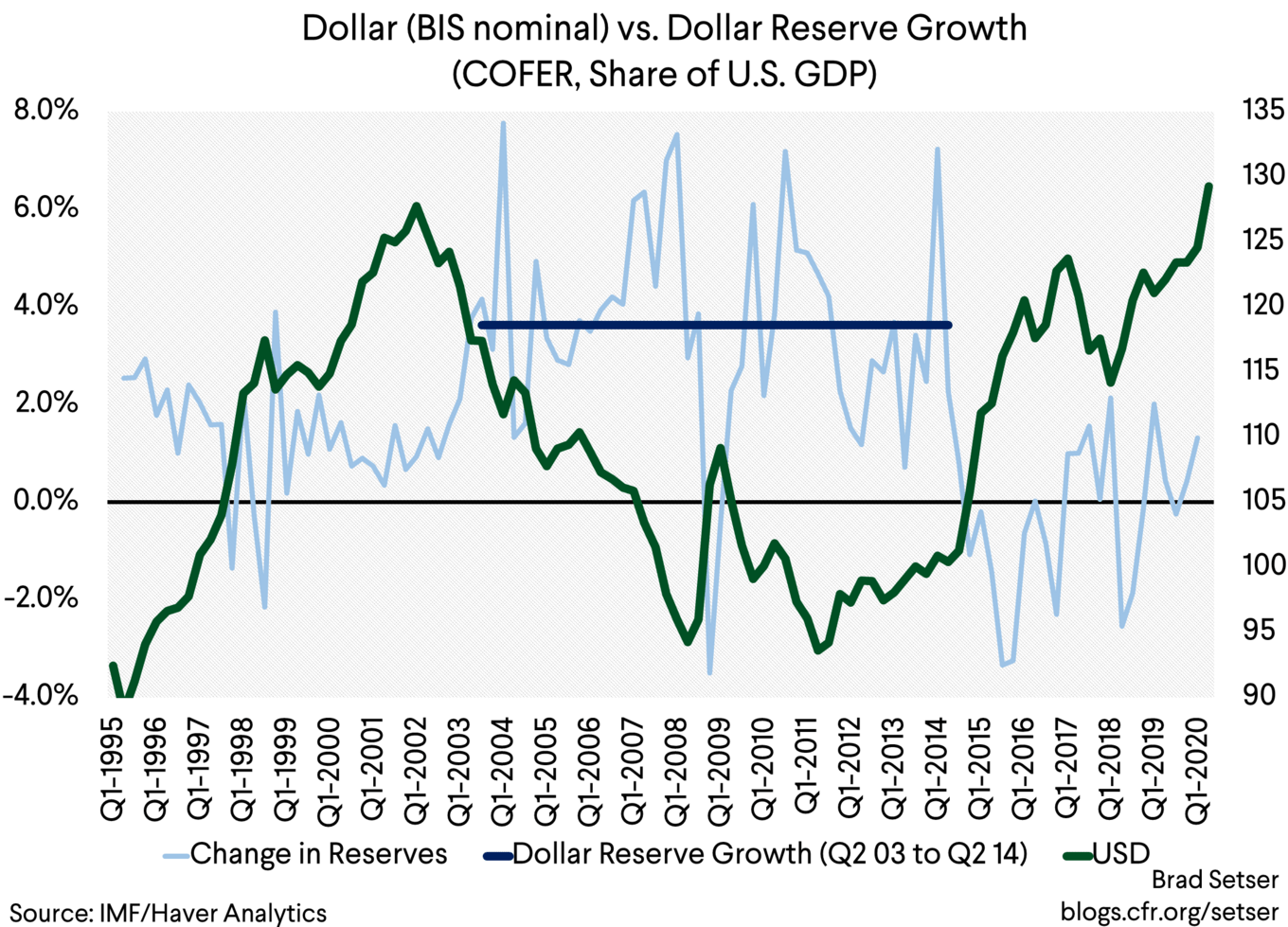

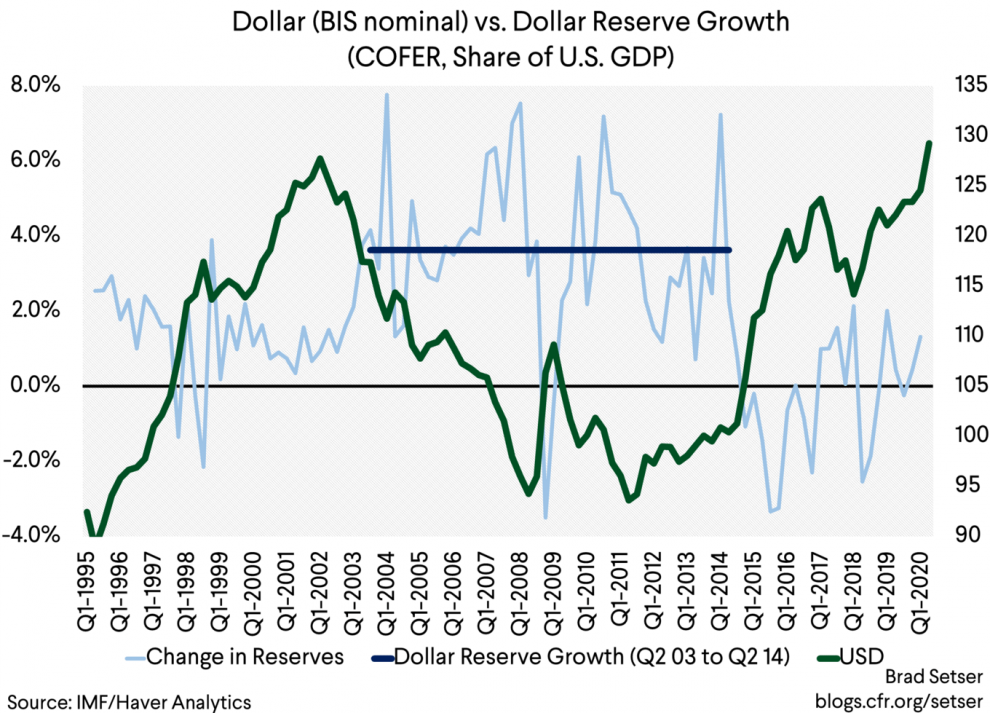

“A weaker dollar tends to lead to more intervention by countries looking to protect their exports in the foreign exchange market, and thus more reserve accumulation,” he says in a blog post this week. “A weaker dollar thus typically results in higher not lower demand for dollars from the world’s reserve managers.”

And how do these reserve managers accumulate dollars? By buying U.S. Treasurys, which comes in handy as the U.S. is issuing debt at a rapid rate, as the latest budget deficit numbers released on Wednesday reinforce.

Setser says a number of countries have been back in the market in June and July actively working to depreciate their currency — singling out Thailand, Taiwan, Singapore and India in particular.

“Many export-based economies with large external surpluses are willing to let their currency fall against the dollar, but they remain reluctant to let their currency appreciate against the dollar when the tide turns. And thus the bulk of the world’s accumulation of dollar reserves has tended to come when the market is pushing the dollar down not up,” he writes.

The buzz

Initial jobless claims data highlight the economics calendar, with Federal Reserve Gov. Lael Brainard and Atlanta Fed President Raphael Bostic due to speak.

Network equipment and software maker Cisco Systems CSCO, +1.92% reported a revenue decline and soft earnings guidance for the current quarter, and announced its chief financial officer will retire.

Conglomerate 3M MMM, +0.53% said sales trends improved in July, and luxury products maker TPR, +0.45% reported a narrower-than-forecast loss.

Apple AAPL, +3.32% is readying a series of bundles that will let customers subscribe to several of the company’s digital services at a lower monthly price, according to a Bloomberg News report.

The U.S. said tariffs on European Union products will remain unchanged, despite efforts by plane maker Airbus to move into compliance with a World Trade Organization decision over state aid. Also on the trade front, a number of U.S. companies have lobbied the White House over the decision to ban the social-media app WeChat, according to The Wall Street Journal.

The markets

Though the S&P 500 SPX, +1.40% is within touching distance of a closing record high, U.S. stock futures ES00, -0.12% YM00, -0.09% NQ00, +0.01% were weaker.

Gold futures GC00, -0.23% fell. The yield on the 10-year Treasury TMUBMUSD10Y, 0.678% eased to 0.66%.

The chart

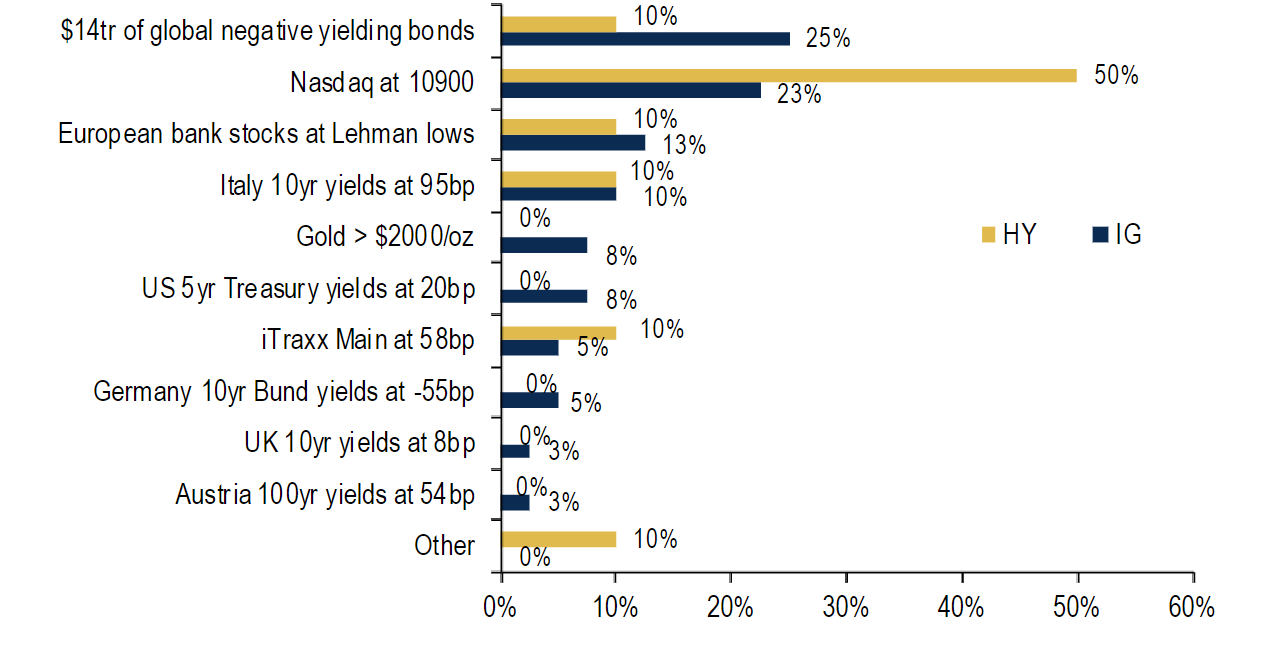

Bank of America took a poll of European credit investors about what worries them. Investment-grade investors worry most about negative-yielding debt and the surging Nasdaq COMP, +2.12%, while high-yield investors are more concerned about the relentless rise in the Nasdaq than anything else. The current depressed valuations of European bank stocks SX7E, -0.72% came in third for both sets of investors. August’s survey, according to Bank of America, also shows that credit investors have gone “all in,” pushing overweights to the highest on record with a net 62% overweight. Not only is what investors call financial repression (central bank action) too hard to fight, supply is set to drop after companies issued debt earlier in the year.

Random reads

Apparently there has been a flood of social-media posts saying Sen. Kamala Harris, Democratic presidential nominee Joe Biden’s running mate, isn’t eligible to be president. She is.

Wind and solar power accounted for a record percentage of electricity in the first half of 2020.

Prince Harry and Meghan, Duchess of Sussex, are now California homeowners.

The observatory featured in the James Bond film “Goldeneye” has had to temporarily shut down.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Add Comment