August is typically a volatile month for stocks, and this one certainly fits the bill.

After another rocky session, U.S. stocks on Wednesday finished pretty much where they started. DataTrek Research pointed to a New York Fed research finding that basically all the moves in the S&P 500 going back two decades is tied to the three days around Federal Open Market Committee meetings, and more recently, the Fed’s press conferences and dot plots. Guess who doesn’t meet in August?

Ash Alankar, head of global asset allocation at Janus Henderson Investors, says in the call of the day that financial markets may be shifting to a new era where fundamentals actually matter.

“The era of bad news is good news might be coming to an end,” Alankar said in a phone interview. On Wednesday, for instance, the news that three central banks cut interest rates was greeted by alarm rather than celebration, he pointed out.

Not that the fundamentals, particularly in the U.S., are terrible—interest rates are low, inflation is stable, job growth is still solid, many mortgage borrowers are able to refinance to still-lower payments—but Alankar isn’t a fan of stocks at the moment. He said the firm takes a close look at option pricing, and stocks aren’t pricing in enough downside.

One risk to stocks comes from President Donald Trump, he says. Alankar points out that Trump has elevated tariffs against China every time the S&P 500 has reached highs.

If there’s one thing the market isn’t expecting, it’s inflation. Yet he points out tariffs are on the rise, the Fed is loosening policy, and the labor market is strong—all ingredients for inflation. “If inflation comes, it comes fast,” he said.

Gold—where futures on Wednesday closed at the highest level since 2013—and precious metals look attractive, as do bonds, he says. In stocks, he prefers Japanese and European equities over U.S., and growth over value. Despite the historic gap between growth and value, Alankar says he prefers growth plays because they are long-duration assets.

The market

After a mere 22-point decline for the Dow Jones Industrial Average DJIA, -0.09% on Wednesday, U.S. stock futures ES00, +0.15% YM00, +0.04% NQ00, +0.32% were pointing higher. Europe SXXP, +0.75% and Asia ADOW, +0.13% stocks advanced.

The yield on the benchmark 10-year Treasury TMUBMUSD10Y, +1.61% rose by 5 basis points.

Gold GC00, -0.64% futures fell while oil futures CL.1, +1.72% rose.

The buzz

China remained in the spotlight, with news that the yuan was fixed at the weakest level since 2008—and above the key 7 to the dollar level, at 7.0039—was greeted with relief as it wasn’t as weak as some expected.

Earnings are coming from companies including Kraft Heinz KHC, +0.95%, Viacom VIA, -0.64%, and after the close, Uber Technologies UBER, +1.40%. Uber rival Lyft LYFT, +2.71% late Wednesday forecast rising revenue alongside a $644 million quarterly loss. Jobless-claims data headlines a thin economics calendar.

The chart

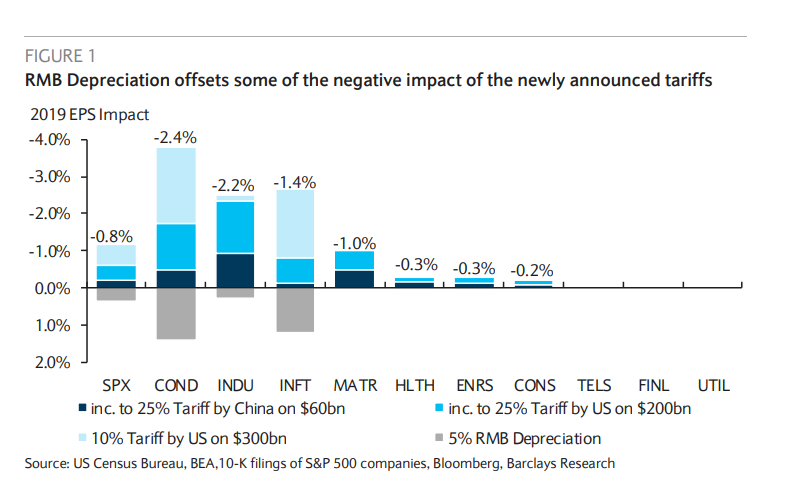

Analysts at Barclays point out that, given the U.S. trade deficit with China, yuan depreciation actually helps U.S. corporate earnings. Combined with devaluation, the drag on earnings for S&P 500 companies from the 10% tariff Trump plans to impose is just 0.8%, though it’s worse for some sectors like consumer discretionary and information technology.

The tweet

The ultimate Rorschach test is guns—households who own guns overwhelmingly voted for Trump in 2016, while households who didn’t overwhelmingly voted for Hillary Clinton—and this tweet of a well-armed coffee shop patron drew a ton of responses.

Random reads

Twitter TWTR, +0.99% locked the account of Senate Majority Leader Mitch McConnell — after the account posted video of the threats directed against the senator.

Britain’s Royal Mint made no pennies, or two-pence coins, for the first time in decades.

Outspoken quarterback Colin Kaepernick says he’s still working out, though no NFL team has made the call.

“Squawkzilla”—the largest parrot that ever lived has been discovered in New Zealand.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Add Comment