The positives for this stock market are inching out of the woodwork.

A “real compromise” on the U.S. debt ceiling, which many saw as a black swan for markets this autumn, plus a report that D.C. trade reps will head to Beijing for further talks next week, are keeping things in the green for Wednesday. That’s as we continue to work our way through a mountain of earnings and wait for next week’s Fed meeting.

No doubt, the latter could be a watershed moment for investors, but expectations over the Fed’s ability to fix all that ails the economy and markets may be running a little too hot, warns our call of the day, from James Stack, president of Stack Financial Management and owner of InvesTech Research.

In an interview with MarketWatch, he suggests we ask this: Will the reversal in Fed policy that began last year “restimulate economic growth or simply reinflate investor exuberance?” That’s as he notes the last six months have delivered the strongest stock gains in any six-month period in 20 years.

Stack, whose firm manages over $3.1 billion, has a couple of claims to fame, among them calling the housing market collapse in 2008 and saving his clients from losses. That holds a big lesson for investors, he says.

“The bottom line message from past history is that if we are on a recessionary course, either by the level of debt or the level of overconfidence in the economy, the Fed may not be able to prevent it even with multiple rate cuts,” he said.

Stack thinks we could be two or three years away from a bear market and “one of those great buying opportunities.” For now, he says watch the warning signs that are already creeping up – weakness in small-cap stocks via the Russell 2000 and in transportation names, softness in the manufacturing sector.

If the downturn takes back just half of the current bull market’s gains, “it could mean a loss of close to 40%,” he said.

Opinion: Investors are heavily borrowing to buy stocks — what does that mean for the bull market?

The market

Dow Jones Industrial Average YMU19, +0.32% S&P 500 ESU19, +0.28% and Nasdaq NQU19, +0.32% futures are solidly higher. Gold GCQ19, -0.26% and oil US:CLQ19 are down, the U.S. dollar DXY, +0.26% is up. Europe stocks SXXP, +0.97% are nearing 7-month highs, with Asia markets ADOW, +0.18% also up.

Read: Oil prices not reflecting severity of Iran crisis as tensions escalate in Strait of Hormuz

The buzz

Earnings are rolling in from toy maker Hasbro HAS, +0.79% biotech group Biogen BIIB, +0.52% BIIB, +0.52% Harley-Davidson HOG, -1.64% Coca-Cola KO, -0.33% conglomerate United Tech UTX, +0.42% airline JetBlue JBLU, +0.26% and defense group Lockheed LMT, +0.19% this morning.

After the close, chip maker Texas Instruments, fast-food group Chipotle CMG, -0.54% (preview) , Snapchat parent Snap SNAP, +0.93% SNAP, +0.93% (preview) and Visa V, +0.74% will report.

Apple AAPL, +2.29% could be nearing a deal to buy chip maker Intel’s INTC, +2.15% modem business.

A flaw in Facebook’s FB, +2.00% Messenger Kids app was letting kids talk to unapproved strangers.

Boris Johnson is the new leader of Britain’s Conservative party. He’ll meet the Queen and officially become Prime Minister Wednesday. U.K. stocks shot up on that news. Here’s what’s next for markets.

The National Association of Realtors will report existing home sales later this morning.

The chart

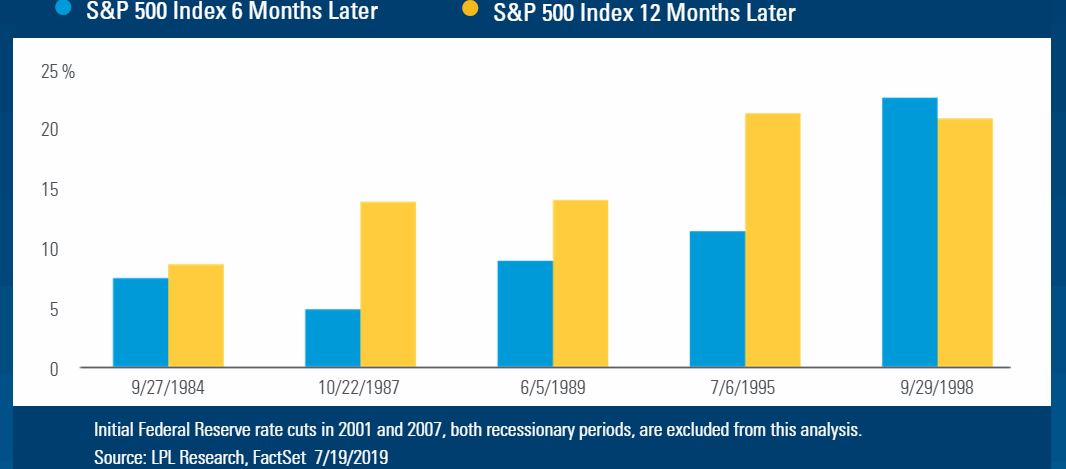

The S&P is up 20% so far this year and so close to 3,000 you can taste it. But with investors “giddy” about the potential for Fed rate cuts, LPL Financial’s chief investment strategist John Lynch said he’ll stick with the index even though it’s 1% away from their year-end 3K target.

“The last five times the Federal Reserve (Fed) began cutting rates outside of recessions (1984, 1987, 1989, 1995, and 1998), the S&P 500 rose an average of 11.1% over the subsequent six months and 15.8% over the next year, as shown in the LPL Chart of the Day,” said “ride-the-wave” Lynch, in a note to clients.

The tweet

Random reads

Russian warplanes veer into South Korean airspace

Redditor asks for each state’s best recipe. Utah brings funeral potatoes

Louisiana police officer fired for social media post about Rep. Alexandria Ocasio-Cortez

Declaw your cat, end up in jail in New York

German con-artist won’t cash in on Netflix show based on her life, if New York state has anything to say about it

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Add Comment