The last trading day of the week has it all, so buckle up.

It has been a tale of two Internet giants, with Amazon AMZN, -1.35% shares down as its record earnings run ground to a halt, while those of Google parent Alphabet GOOGL, -0.33% are up after better-than-expected results late Thursday. So far, tech stocks seem ready to look on the bright side.

We’ll see if the upbeat tone for Friday sticks when gross domestic product data hits later. A bad-news-is-good-news outcome may help firm up expectations for an interest-rate cut when the Federal Reserve meets next week, and could give stocks an end-of-week lift.

Read: Economy won’t get a great grade for the 2nd quarter, but GDP to show bright spots

Markets clearly would like to see a sense of urgency from central banks, given the negative reaction to ECB President Mario Draghi, who on Thursday failed to lay out concrete plans for any interest rate cuts or stimulus, even as he spoke of “worse and worse” economic conditions.

That brings us to our call of the day from billionaire hedge-fund manager Kyle Bass, who says look out, because the Federal Reserve is losing its punch when it comes to making a dent on the economy with rate cuts.

“I think in early 2020, you are just going to see softness in the U.S. economy. We might have shallow recession, but if we do…we will immediately go to zero rates,” the founder and chief investment officer of Hayman Capital Management told CNBC in an interview late Thursday.

And once you’ve taken interest rates to nearly zero, they really are “less and less effective,” Bass says. If that’s the way the wind is blowing this time, he says investors will want to stick to long-term assets like real estate — apartments and office buildings — and long-term bonds.

Note, the last time the Fed pushed interest rates close to zero was in December 2008, when they hit an all-time low of 0.25%. And the 10th rate cut in just over a year still didn’t stop the recession that followed.

That was the gist of what we heard earlier this week from Stack Financial Management’s president James Stack, who spoke to MarketWatch about the Fed’s record in preventing a recession and market crash.

“We have to keep in mind that the Federal Reserve started easing in 2007 before the recession started, and then subsequently made 12 rate cuts and was virtually powerless in preventing the unwinding, the downward path in recession,” said Stack, who predicted the dot-com and last housing bust.

Read: Spotting the next bear market, from money manager James Stack, who sidestepped two of them

Opinion: Your 5-point plan for surviving the coming stock-market downturn

The market

Dow YMU19, +0.29% , S&P 500 ESU19, +0.31% and Nasdaq NQU19, +0.42% futures are rising.

Gold GCQ19, +0.29%, oil CLU19, +0.73% and the dollar DXY, +0.11% are all up. Europe stocks SXXP, +0.36% are mixed, while Asia markets ADOW, -0.62% mostly fell.

The buzz

Twitter TWTR, -1.58% shares are climbing after revenue, user numbers beat forecasts. Consumer goods group Colgate CL, +0.91% and McDonald’s MCD, +0.78%. Apart from Amazon and Alphabet, chip maker Intel INTC, -1.44% posted upbeat results late Thursday, and it was the same for Starbucks SBUX, +0.36%. Both those shares are moving higher.

Opinion: Even Intel doesn’t seem to know what’s going to happen with Intel

Shares of CannTrust Holdings CTST, -4.41% are climbing after the Canadian cannabis producer forced out its CEO and president amid a scandal over illegal pot growing.

Telecoms group Comcast CMCSA, -0.58% says it will launch its NBCUniversal streaming service by April 2020, and cater big to “The Office” fans.

Chinese officials say FedEx FDX, -0.08% may have broken the law by holding back more than 100 packages from Huawei, after the U.S. put that tech company on a blacklist.

The chart

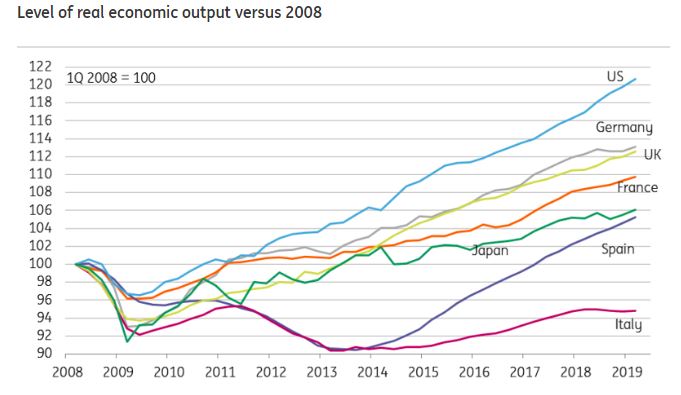

How does the U.S. economy stack up to the rest of the world? Dutch bank ING provides our chart of the day that shows just how the U.S. has been sprinting ahead of the rest of the world over the past 10 years:

ING

ING

Random reads

No friendly fire. North Korea tells southern neighbor recent missile test was a warning

The $100 bill. We love it.

Democratic presidential candidate Tulsi Gabbard sues Google for trying to muzzle her

Diary of a Deutsche Bank trader: “The day I lost my job”

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Add Comment