Jay Newman is something of an emerging-markets legend. At Elliott Management, he led their successful campaign to get Argentina to pay out on defaulted debt — which included the seizure of a naval vessel with sailors on board — to the tune of $2.4 billion.

He’s now expecting a debt epidemic. “We are on the brink of an epidemic of emerging market defaults, the scale and scope of which will rival the debt crisis of the 1980s,” he wrote in an op-ed in the Financial Times. “Rate increases by Western central banks, fallout from the COVID pandemic, surging food and fuel prices resulting from the economic fallout of the war between Russia and Ukraine, mismanagement, and outright corruption all are contributing factors.”

The iShares JPMorgan U.S. dollar emerging markets bond ETF EMB, -0.51% has dropped 16% this year.

Most of Newman’s commentary is trained on how private-sector investors should handle the defaults, rather than the broader market or economic impact.

What makes this time different, Newman writes, is China’s role in lending.

Newman, not uniquely it should be said, says China has laid a debt trap to seize key assets across the world. “When Sri Lanka, predictably, found itself unable to satisfy the debt, China sprang the trap, insisting on repayment, offering to exchange debt for further concessions and vast tracts of land, and offering additional cash to help tide the political class over,” he writes.

Related: China has made $385 billion worth of hidden loans abroad

Newman says international financial institutions, Western governments, “chuckleheaded” non governmental organizations and international press will call upon private-sector creditors to offer the likes of Sri Lanka concessionary terms. “Why do that,” he replies. “Unless a debtor demonstrates a willingness and capacity for reinvention, and unless all creditors — including China and the IFIs — agree to disclose the entirety of their claims and agree to negotiate a resolution on commercial terms, any restructuring will fail.”

It should be noted that Elliott has not been reported to be one of Sri Lanka’s major private investors, whose ranks as of April included Fidelity Investments, Lord Abbett, T. Rowe Price, Payden & Rygel and SEI Investments, according to Bloomberg News. Official investors on Sri Lanka’s $35 billion debt pile include the Asian Development Bank, China, Japan, the World Bank and India, according to Sri Lanka’s government.

The buzz

Today’s the day — the Federal Reserve’s plan to start reducing its $9 trillion balance sheet, by letting its pile of bonds roll off without reinvesting, starts Wednesday. The summer time kicks off with a $47.5 billion per month reduction, and once the white pants are put away, the pace moves up to $95 billion every month.

The Institute for Supply Management’s manufacturing index, construction spending and jobs opening reports are all due at 10 a.m. Eastern. St. Louis Fed President James Bullard is due to speak at 1 p.m., and the Fed’s Beige Book is due at 2 p.m. Vehicle makers will be reporting their May sales throughout the day.

Atlanta Fed President Raphael Bostic, in an exclusive interview with MarketWatch, said his suggestion that the central bank take a September “pause” in its push to raise interest rates should not be construed in any way as a “Fed put,” or belief that the central bank would come to the rescue of markets. U.S. Treasury Secretary Janet Yellen admitted to CNN that she was wrong about the direction of inflation.

Salesforce.com CRM, -2.94% shares surged 8% in premarket trade after hiking its earnings forecast for the year. HP HPQ, +0.23% was steady after topping earnings and sales estimates.

After the close, results from meme stock GameStop GME, -9.09% are due, as well as pet products retailer Chewy CHWY, -8.52%, which GameStop chairman Ryan Cohen co-founded. NetApp NTAP, -1.51% and Hewlett Packard Enterprise HPE, -1.20% also are slated to report results.

The markets

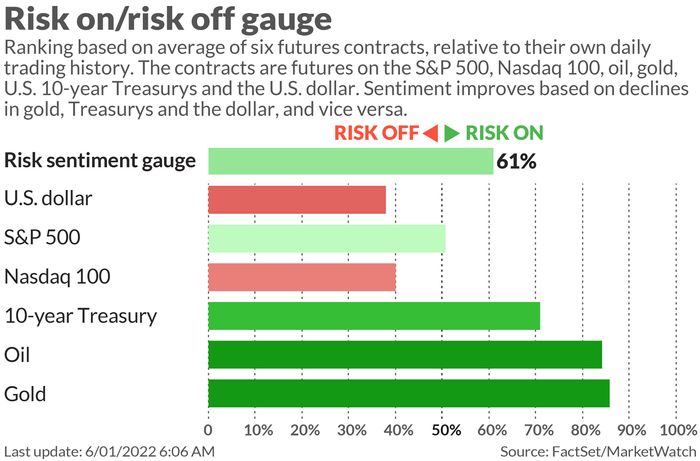

A mixed open ES00, -0.05% NQ00, -0.27% looks in store after the S&P 500 SPX, -0.63% snapped a three-day win streak on Tuesday.

Gold GC00, -0.80% futures fell, while oil CL.1, +1.21% futures rose.

The chart

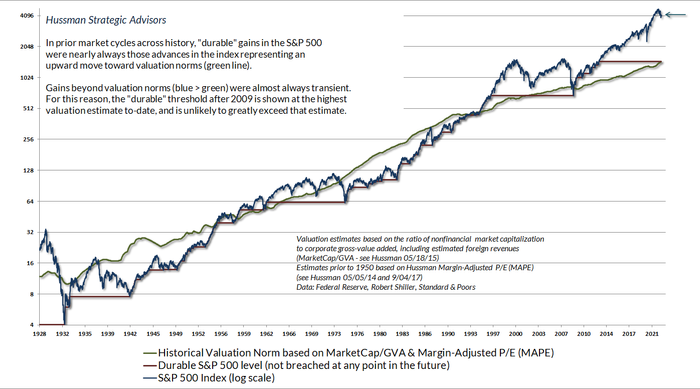

John Hussman, president of Hussman Investment Trust and a long-time bear, says the selling in the stock market still has a long way to go.

“At extreme points like this, it’s useful to remember that risk-management is generous. While market advances in hypervalued conditions can leave investors feeling as if they’re ‘missing out’ on returns, those speculative returns are invariably wiped out over the complete market cycle,” he says.

Top tickers

These were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security |

| GME, -9.09% | GameStop |

| AMC, -0.62% | AMC Entertainment |

| TSLA, -0.18% | Tesla |

| NIO, +4.95% | Nio |

| MULN, +44.90% | Mullen Automotive |

| AMZN, +4.40% | Amazon |

| AAPL, -0.53% | Apple |

| NVDA, -0.74% | Nvidia |

| CRM, -2.94% | Salesforce.com |

| BABA, +2.83% | Alibaba |

Random reads

Tesla CEO Elon Musk appears to be no fan of working from home.

A licensing spat may spell the end of Elvis-themed weddings in Las Vegas.

Mice are terrified, not of cats, but bananas.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.