Why are stocks busting out all of a sudden?

Last week, tariffs on Mexico increased the chances that the Federal Reserve would cut rates. Investors obviously like that. So, stocks rallied. This week, Trump backs off those same tariffs. Investors apparently like that, too. Stocks again are rallying.

Josh Brown of Ritholtz Wealth Management, please explain.

“The market wanted to go up. I don’t think it mattered what happened. We just use these things as a reason after the fact to look smart,” the CEO of the New York City-based investment advisory firm wrote. “That’s how it works. It’s not meant to be intellectually satisfying. It’s meant to take money away from people who think they can explain things. Worst traders and managers I know are the guys with answers for all this stuff. Get used to it.”

Instead of “after the fact to look smart,” let’s allow our call of the day to give some forward-looking flavor on where he believes all this is headed.

Mike Wilson — “Wall Street’s most bearish analyst,” according to the Zero Hedge blog — says there’s one big risk out there for investors…

That he’s right.

“The macro and micro economic data continue to deteriorate,” wrote Morgan Stanley’s chief investment officer, pointing to weak durable goods orders, disappointing capital spending, soggy retail earnings, lackluster freight shipments, and a “very soft” employment number as evidence of an economy running on fumes.

“This raises the risk of my core view playing out — that companies will do whatever it takes to protect margins,” Wilson wrote. “And while labor is the last lever they pull, they will use it if they need to.”

Don’t be so quick to blame U.S.-China trade tensions, either, he said. “The economy was already slowing and escalation potentially makes things worse.”

And if you’re waiting for a lower interest rates to ignite a rally… don’t.

“A rate cut after a long hiking cycle tends to be negative for stocks, in contrast to a pause like in January, which is typically positive,” Wilson said. “I’ve been vocal about the likelihood of U.S. earnings and the economic cycle disappointing this year. Specifically, I’ve argued that the second half recovery many companies have promised and investors expect is unlikely to materialize.”

He’s not seeing enough evidence to change his mind. In fact, Wilson’s team is looking for GDP to hit the skids in the second half.

“If you listen to what the markets have really been saying this year, they seem to agree with our view that growth will disappoint whether there is a trade deal or not,” he said. “Therefore, we continue to recommend investors stay defensively positioned… with overweights in areas like utilities and consumer staples.”

The market

Dow YM00, +0.34% S&P ES00, +0.31% and Nasdaq NQ00, +0.35% futures are off to a positive start. Oil CLN19, +0.31% is also rising, as gold GCQ19, -1.03% takes a risk-on breather. The dollar DXY, +0.33% is up after last-week’s job-related hit and the Mexican peso USDMXN, -2.2768% is on a tear.

Europe stocks SXXP, +0.17% are up and Japan’s Nikkei SHCOMP, +0.86% led the rest of Asia ADOW, +1.07% higher.

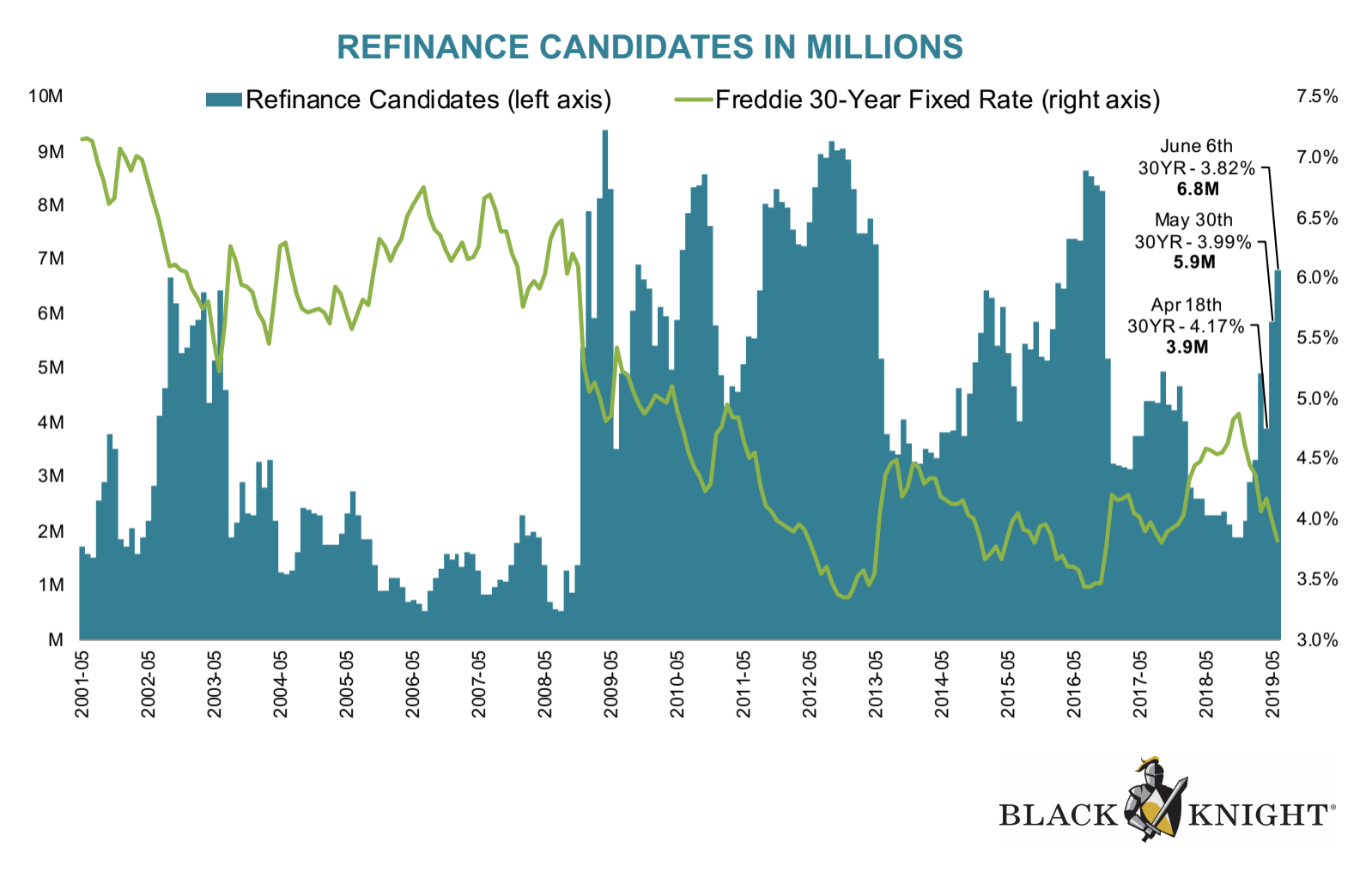

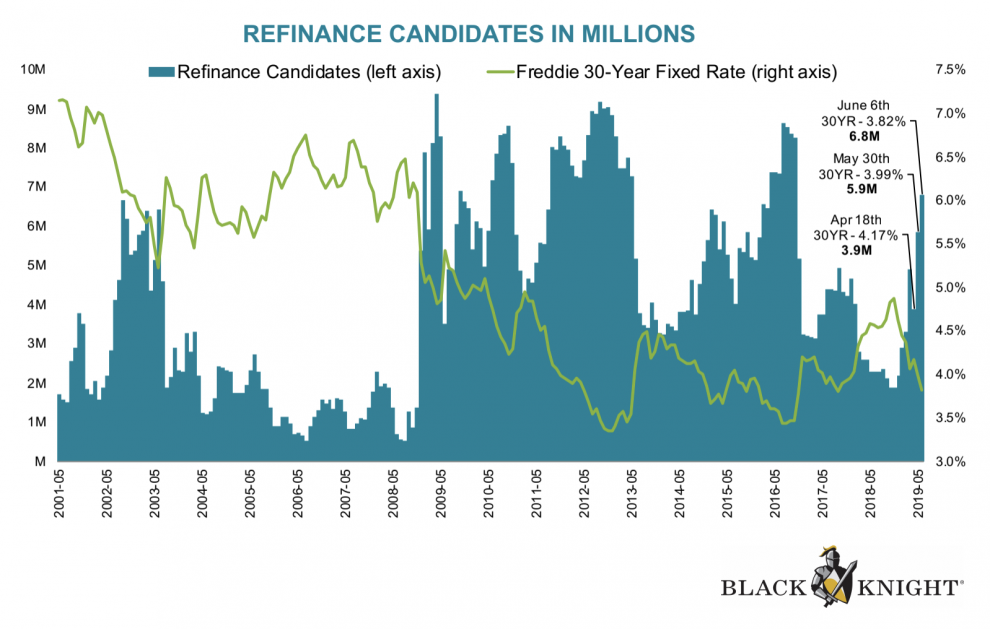

The chart

Put the stock market on the back burner and focus on refinancing that mortgage. As our chart of the day from Black Knight shows, almost 7 million people are now eligible to save at least 75 basis points, that’s a million more than a week earlier.

Read: Rates slump to 2-year low — but consumers may not bite

The buzz

Where does Microsoft MSFT, +2.80% go from here? The software giant just surged into record territory and is now valued at more than $1 trillion. Amazon AMZN, +2.83% and Apple AAPL, +2.66% , both well below their highs, are a distant second and third, respectively.

Deal news

The quote

“The Golf On Your Own Damn Dime Act of 2019” — That’s former White House ethics chief Walter Schaub criticizing the president for those pricy golf outings. “How about a law that says anytime POTUS visits a property on or adjacent to a golf course, he/she must pay for all costs incurred by the entourage from the minute he/she left the White House until he/she is back inside the White House?” Schaub tweeted after Trump ran up a hefty tab on his visit recent to his course in Ireland.

How did his round go? Here’s one of the lowlights:

The stat

$150 billion — That’s how much the video game space will be worth this year, according to research firm Newzoo’s latest estimates. The industry’s’ biggest event of the year — the Electronic Entertainment Expo (E3) — kicks off Tuesday. Get ready for plenty of product buzz.

The tweet

The economy

A light data calendar today includes the Job Openings and Labor Turnover Survey at 10:00 a.m. Eastern. Retail sales will be the big number to watch, but that’s not until Friday. Before that, the Consumer Price Index is slated to be released Wednesday.

Random reads

While much of the rest of the world embraces credit cards and virtual payments, Germany is sticking with cold, hard cash.

Are we about to have our first ever president with student debt?

Vegetarian Burger King fans aren’t going to like this.

These are the best bars in America, according to Esquire.

Nerd alert! These old friends have been playing Dungeons & Dragons for a long — LONG — time.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Add Comment