Sometimes it takes an outsider to fully appreciate something.

Europe’s largest asset manager, Amundi Asset Management, has produced research showing why U.S. stocks have outperformed the world, and why that outperformance may continue.

Admittedly written by two from its Boston office — Craig Sterling, its head of U.S. equity research, and Marco Pirondini, head of U.S. equities — Amundi made a distinction between the U.S. stock market, which is a play on many of the world’s most profitable companies, and the U.S. economy.

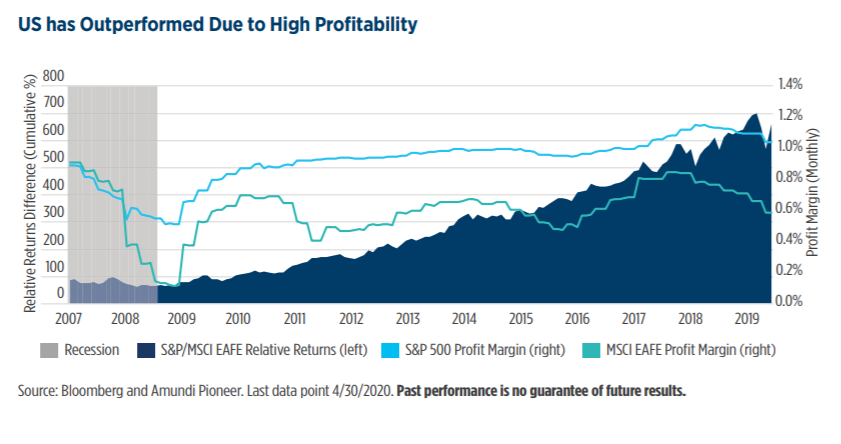

The S&P 500 SPX, -0.64% has outperformed the rest of the developed world, measured by the MSCI Europe, Australasia and Far East index 990300, +0.87%, in 19 out of the last 30 years, and with cumulative returns of 1574% versus 235%. That is no accident, as U.S. companies have higher profit margins and consistently topped their cost of capital.

Amundi expects that outperformance to continue.

“As we consider the aftermath of the pandemic and recession, we believe the economic uncertainty has created a lack of clear earnings visibility, which will likely impair low-return companies even more. Beyond the lower investment in innovation, technology and health care inherent in non-U.S. equity markets, structural and economic pressures persist as growth capital expenditures are restrained,” it says.

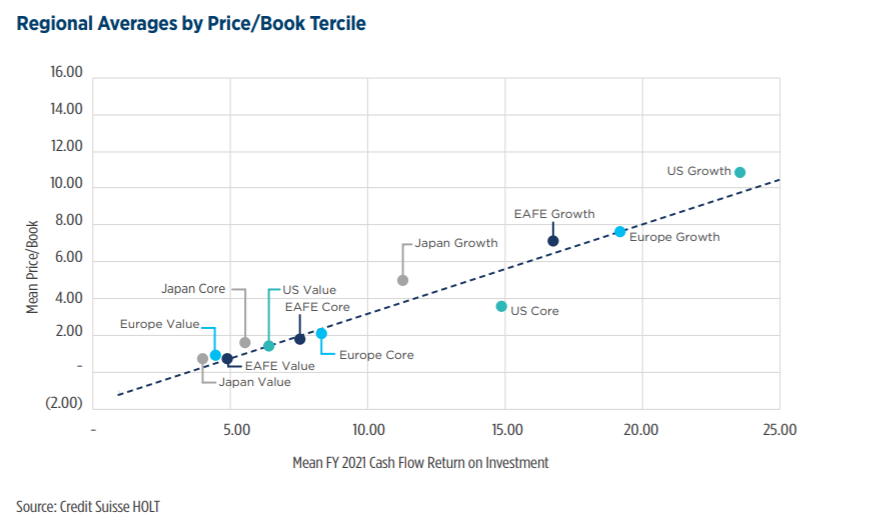

While U.S. valuations aren’t cheap, investors get what they pay for, with a better cash flow return on investment.

Much of the outperformance stems from the U.S. dominance in technology, which the Amundi pair expects to continue. “The combination of world-class universities that develop technology and serve as launching pads for startups to commercialize it, a well-developed venture capital industry, and a cultural willingness to take risk make it difficult for other regions of the world to surpass the U.S.,” the pair says, with only China proving to be a viable global competitor.

Besides tech, monetary and fiscal policies that put greater emphasis on the stock market are an advantage to U.S. equities, as are bigger threats of shareholder activism and merger-and-acquisition activity. Lower taxes and a flexible labor market also provide a boost to U.S. markets, the pair says.

Uniquely, the pair supports the corporate culture of stock buybacks, which are far less prevalent outside the U.S. “A key advantage of share repurchases is that they enable the recycling of capital throughout the economy, so capital may end up in the most innovative hands and not trapped inside of less efficient, more mature companies,” Amundi says.

The buzz

On Tuesday, there were 53,507 new coronavirus cases in the U.S., a three-week low, according to data from the COVID-19 tracking project. China, meanwhile, reported its highest outbreak in weeks — 101 — as Japan and South Korea also see upticks in cases.

It is a big day in Washington, D.C., where the chief executives of the world’s largest tech companies Amazon.com AMZN, -1.79%, Apple AAPL, -1.64%, Facebook FB, -1.44% and Alphabet GOOGL, -1.68% will appear via videoconference before the House Judiciary Antitrust Subcommittee, starting at noon Eastern. The Federal Reserve announces its latest interest-rate decision at 2 p.m., and Chairman Jerome Powell will hold a press conference at 2:30 p.m. Negotiations are expected to continue on a new stimulus bill, with a big rift on issues including whether the $600 a week extra unemployment benefits are extended.

As earnings season continues, General Electric GE, +2.68% reported a wider-than-expected loss but better-than-anticipated revenue and cash flow.

Advanced Micro Devices AMD, -1.97% shares may reach record highs, after the microchip company reported second-quarter earnings that beat expectations and increased its full-year forecast. Starbucks SBUX, -2.38% reported a loss on a 40% plunge in same-store sales, but the coffee chain’s stock rose in premarket trade. Software company Shopify SHOP, +0.88% surged after a much stronger earnings report than forecast.

The market

After the 205-point drop in the Dow industrials DJIA, -0.77% on Tuesday, U.S. stock futures ES00, +0.16% YM00, +0.01% NQ00, +0.42% pointed to a brighter start.

Gold GC00, +0.37% and silver SI00, +0.49% futures advanced.

The yield on the 5-year U.K. gilt TMBMKGB-05Y, -0.104% reached a record low of -0.135% before bouncing higher.

Random reads

MacKenzie Scott said on Tuesday she has donated about $1.7 billion of her fortune over the past year since her divorce from Amazon Chief Executive Jeff Bezos.

A hint? Democratic presidential nominee Joe Biden was photographed with handwritten notes about Sen. Kamala Harris, who many believe will be his running mate.

There is an asteroid near Mars — and it was discovered by two Indian teenage girls.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Add Comment