Think 2019 has been hectic? You ain’t seen nothing yet.

According to our call of the day from John Mauldin of Mauldin Economics, 2020 “will be the most volatile year in history” for investors

“The last few weeks marked a turning point in the global economy. It’s more than the trade war. A sense of vulnerability is replacing the previous confidence — and with good reason,” he wrote in his latest market update. “We are vulnerable, and we’ll be lucky to get through the 2020s without major damage.”

Mauldin pointed to supply shocks, the trade war, interest rates, unproductive debt and the mess in Europe as just some of the factors poised to create the perfect storm, but it’s one volatility bomb, in particular, that could blow up best-laid plans.

“Remember when experts said to keep politics out of your investment strategy?” he asked. “We no longer have that choice. Political decisions and election results around the globe now have direct, immediate market consequences.”

Of course, the most consequential of all: The 2020 U.S. election. And Mauldin doesn’t sound too hopeful about any of the scenarios.

“None of the possible outcomes are particularly good. I think the best we can hope for is continued gridlock,” he said. “But between now and November 2020, none of us will know the outcome. Instead, a never-ending stream of poll results will show one side or the other has the upper hand.”

Markets will be a mess, bouncing up and down with each headline, Mauldin warned, and that will inspire politicians and central bankers to react. To “do something.” That something, he said, will probably be the wrong thing.

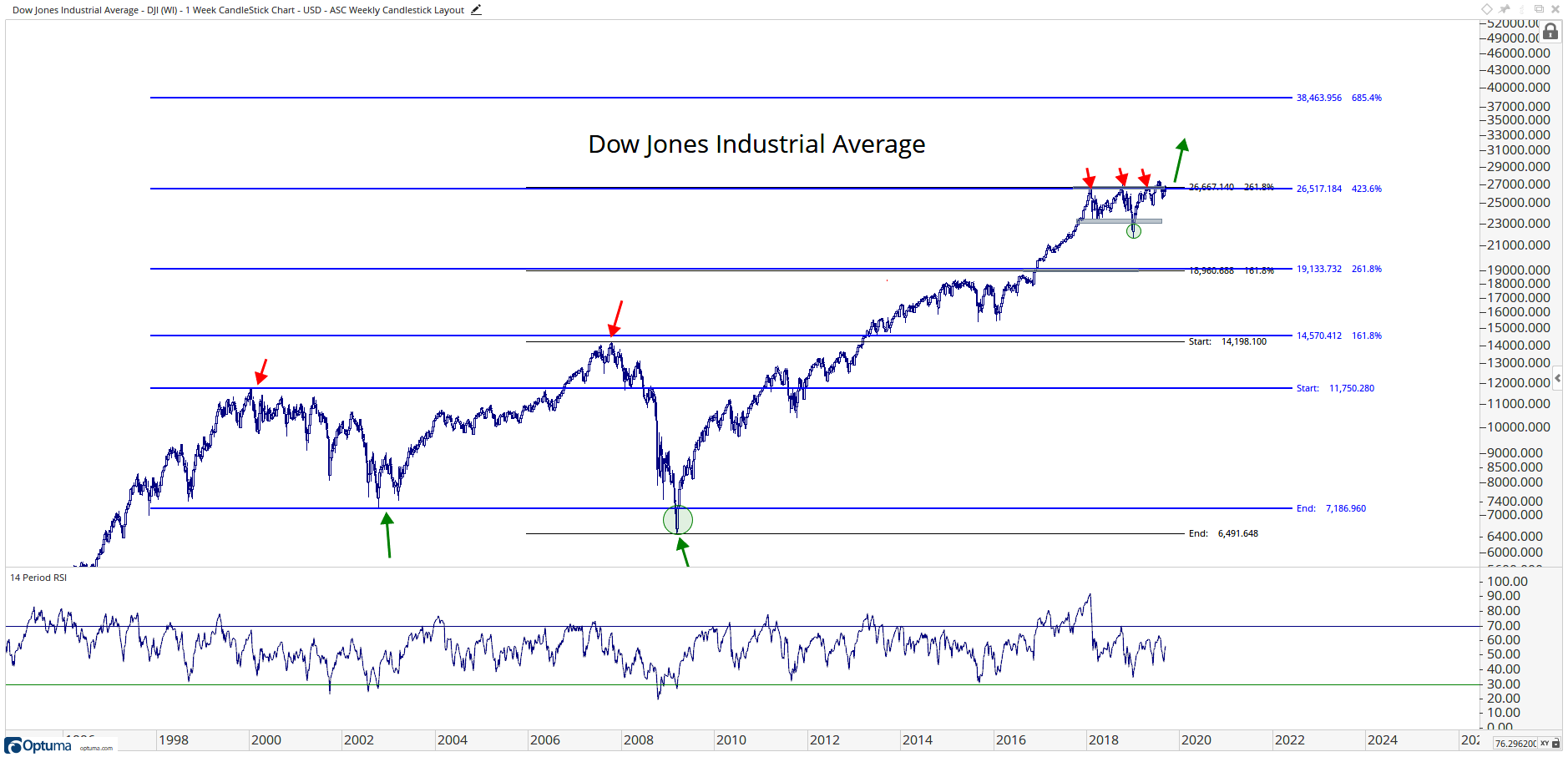

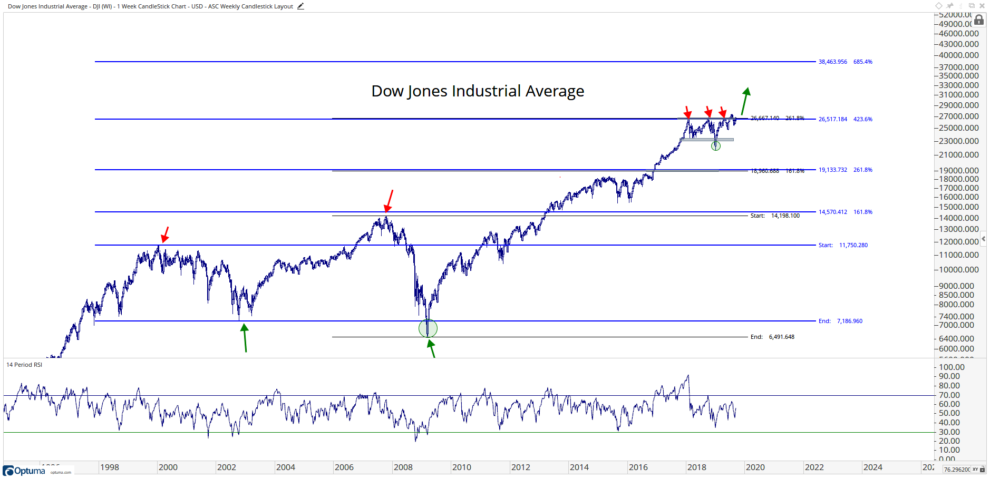

The chart

While Mauldin is expecting a nasty stretch, J.C. Parets of the All Star Charts blog is feeling rather bullish on global markets after chewing on the trendlines. From London UKX, -0.76% to South Korea 180721, +0.52% , he’s seeing upside all over the world. But it’s the bright green signal flashing on the Dow Jones Industrial Average DJIA, +0.01% that has him most optimistic:

“A breakout through 26,700-27,000 could spark a new leg higher, and I believe that is the higher probability outcome,” he wrote. “For the world’s largest and most important markets, I don’t see what there is to be bearish about.”

The market

The Dow DJIA, +0.01%, S&P SPX, +0.12% and Nasdaq COMP, +0.13% are all moving slightly higher as trading gets underway. Gold GC.1, +0.23% is also in the green as is silver SI00, +0.59%. Oil CL.1, +1.49% is inching higher toward $57 a barrel, with investors eyeing news of a new Saudi oil minister, while the dollar DXY, -0.13% is barely budging.

Europe stocks SXXP, -0.15% edged higher, while Asia markets ADOW, +0.42% ended in positive territory.

The buzz

AT&T T, +3.86% rallied after activist investor Elliott Management disclosed it took a stake in the telecom giant and sought a meeting with management. Apple AAPL, +0.80% is hosting a big event on Tuesday, with fans looking to eat up some news about new iPhones and a new Apple Watch, apparently. Apple might also talk about its streaming TV service, among other things. The company has also been denying it violated Chinese labor laws.

Reports that WeWork’s WE, +0.00% IPO is looking rocky just keep coming. Citing sources, and on the heels of similar reports, the WSJ says the company is now considering a valuation below $20 billion. That would be a steep drop from the lofty $47 billion mark where WeWork last raised private capital this year.

Hurricane Dorian moved on from the islands and North Carolina (Alabama’s fine) to unleash havoc on far-eastern Canada, with hurricane force weeks that knocked out power to hundreds of thousands of people before weakening late in the day.

The tweet

The economy

On a quiet day, data-wise, the consumer credit tally from the Federal Reserve hits at 3:00 p.m. Eastern. We’ll get a look at August retail sales and the August consumer price index as the week dies down. Read:Why the coming recession could force the Federal Reserve to swap greenbacks for digital dollars

The stat

Warner Bros. Pictures via Associated Press

Warner Bros. Pictures via Associated Press $91 million — That’s how much AT&T’s T, +3.86% Warner Bros. said “It: Chapter Two” earned from North American ticket sales in its first weekend on the silver screen. Only its predecessor earned more for a September release.

The quote

Speaking of Stephen King: “It feels good to be at least semi-respectable. I have outlived most of my most virulent critics. It gives me great pleasure to say that. Does that make me a bad person?” That’s from the “It” writer’s interview with the Guardian that was published over the weekend.

Random reads

Sick of all the action flicks like I am? Here’s the math.

The hellish future of Las Vegas, and not for all the typical reasons you might think.

Republicans didn’t used to go to Trump hotels. They do now.

Feeling down? At least you’re not the NFL’s Miami Dolphins.

Former James Bond actor says it’s time for a woman to step up to the spy plate.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

Follow MarketWatch on Twitter, Instagram, Facebook.

Add Comment