After a tumultuous period in which the stock lost most of its value, Netflix Inc. (NASDAQ:NFLX) is finally gaining steam again. The company’s pivoting into a more diversified business model and its stock seems grossly undervalued.

Furthermore, Netflix recently received recognition from investment banks on Wall Street, which has been a rare occurrence since the turn of the year.

Based on these developments, it may be a suitable investment for those seeking intrinsic value for long-term gains.

Upgraded by Evercore

Earlier this weeek, Evercore ISI upgraded the stock to outperform based on the premise that its revenue growth potential is not baked into Wall Street’s expectations. The financial services firm claims Netflix’s advertising revenue could galvanize its growth and add much residual value to the balance sheet.

Advertising Revenue Pipeline

After experiencing declining subscription growth for the first time since its inception, Netflix has decided to introduce advertising revenue to its business model, which it claimed could reach 40 million recurring viewers by next year’s third quarter.

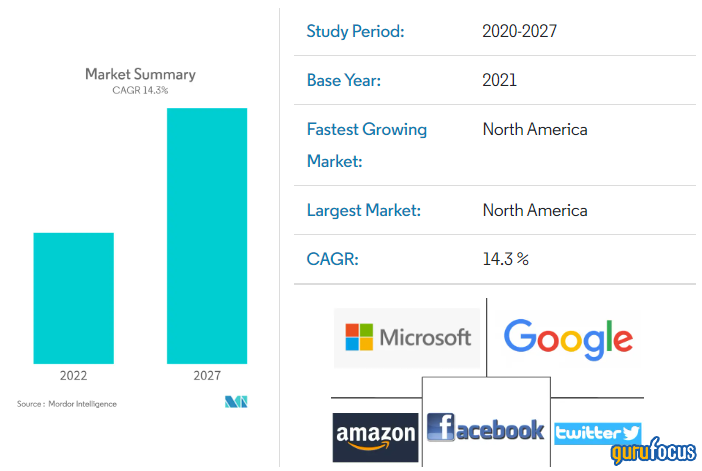

Whether or not Netflix achieves its target is debatable. However, exposure to an industry with a compound annual growth rate of approximately 14.3% sure is a nimble move by the company’s C-suite.

Source: Mordor Intelligence

Key growth ratios

Netflix produces a staggering 31.2% return on equity, implying it is a secular growth asset. In addition, the stock’s return on capital employed ratio of 18.18% conveys robust net of tax operating profits relative to its net working capital.

Collectively, Netflix remains on a solid growth trajectory despite numerous concerns over stagnating subscriber growth.

Absolute and relative valuation metrics

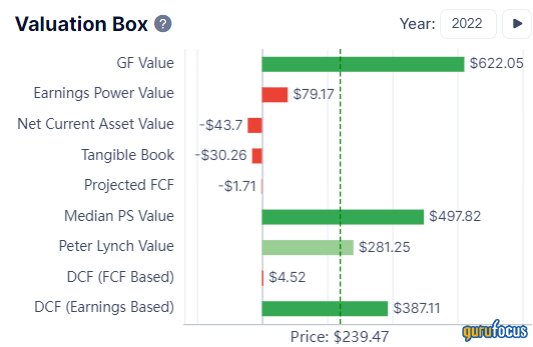

An earnings-based discounted free cash flow analysis shows Netflix’s stock is significantly undervalued as its fair value exceeds the $387 handle. Of course, sensitivity analysis needs to be performed as the current economic climate is unstable; however, even with a 20% margin of safety, the stock would still be undervalued.

Relative valuation metrics validate the stock’s absolute valuation. For instance, Netflix’s price-sales ratio of 3.20 implies the stock s undervalued by 62.10% if compared to its normalized five-year average.

Lastly, Netflix carries a Piotroski F-Score of 6 out of 9, meaning the company’s balance sheet, liquidity and operational performance are consistent. Therefore, it is likely that the mentioned valuation metrics will hold true unless a systemic shock occurs.

Concluding thoughts

Based on recent data and its key business drivers, Netflix’s stock is full of potential. The company’s advertising revenue could refuel growth and buy time for its subscription segment to foster new ideas. Moreover, key metrics imply that the stock is undervalued, with embedded growth being a key feature.

This article first appeared on GuruFocus.

Add Comment