Netflix Inc. (NASDAQ:NFLX) has historically leaned on subscriber growth to drive its top line. However, the video streaming landscape has grown fiercely competitive over the years, leading to the company’s slowdown in subscriber growth for the first time last year.

Nevertheless, its robust subscriber growth over the past several quarters indicates the event was somewhat of a blip. Moreover, its management team is pivoting to explore new revenue-generating strategies, including introducing ad-supported, lower-cost subscription plans and implementing fees for password sharing. Hence, there is still plenty to like about the stock.

Furthermore, the company’s strong track record over the past decade is a testament to its ability to execute its new initiatives effectively. It remains committed to producing high-quality original content that keeps its viewers hooked. Though the company’s stock seems to be fairly valued, the shift in discount rates following the Federal Reserve’s upcoming changes could see its price growing past its 52-week high of $393.60.

That being said, let’s dive a little deeper into the Netflix story to assess its attractiveness at this time.

Subscriber growth is key

It is understandable why the bears are sounding the alarm about Netflix’s business based on the the past few years. Revenue growth has slowed down substantially from its historical averages. However, it continues to grow its subscribers at an encouraging pace each quarter, which points to more upside ahead.

For streaming companies, subscriber growth is critical in spinning the flywheel. The formula is straightforward; increased subscribers lead to higher revenues, which enable greater investments in fresh content. As a result, this positive cycle effectively retains the current subscriber and also lures in new viewers.

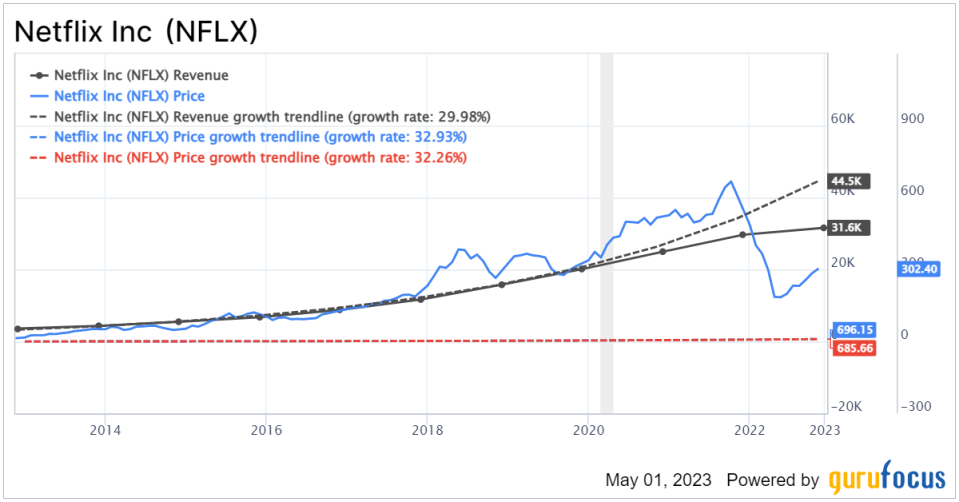

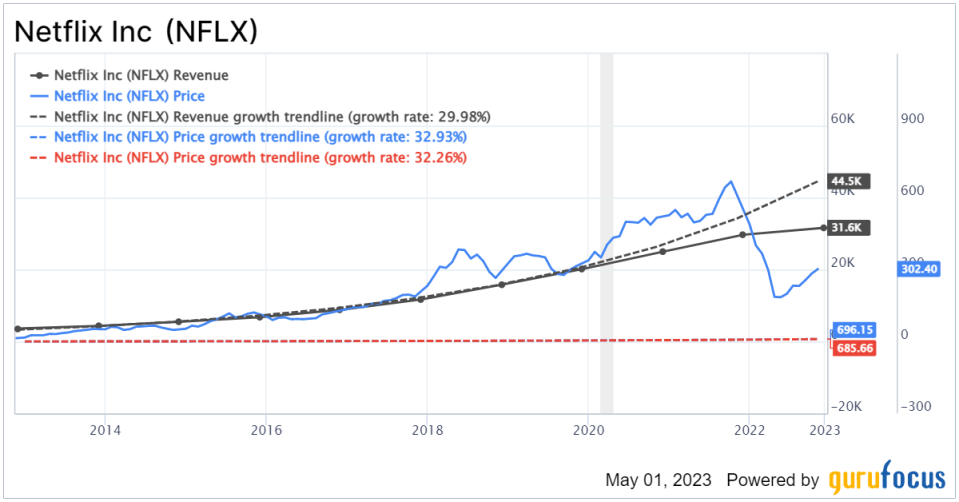

Before getting to the positives, though, having a clearer picture of the company’s revenue performance is important. In the past 12 months, its average revenue per share growth has slowed down to 5.80%. In contrast, the company’s average revenue per share growth rate over the past three years was 16.20%, while 10 years showed a healthy 25.30% per year. Moreover, the chart below shows the slowdown as Netflix’s revenue growth lags its historical growth rate.

Revenue growth has lagged over the past couple of years due to post-pandemic headwinds, intensifying competition in the streaming space, macroeconomic challenges and a slowdown in average revenue per user.

Objectively speaking, the slowdown in revenue growth is concerning, but most of it is due to the evolving dynamics of the streaming market and the weaknesses in its business environment. Perhaps what is more noteworthy is that the streaming pioneer continues to grow its subscriber base at a remarkable pace.

In the first quarter, it managed to amass an impressive 1.75 million new subscribers, taking its membership numbers past 232.50 million. Moreover, it has set on an addressable market of over one billion broadband households, which also includes roughly 500 million connected TV customers. Hence, it still has a massive growth runway ahead of it.

An enticing future

The landscape of television consumption is evolving at a rapid pace. Still, Netflix accounts for an estimated 10% to 20% of TV time in the U.S. It leaves plenty of room to grow and outpace its competition. Moreover, some of its peers, such as Disney (NYSE:DIS), are slashing their content budgets, creating an opportunity for the company to add to its viewership base.

Furthermore, we see how proactively the company has grown its addressable market. It has implemented robust strategies, such as offering an ad-supported, lower-cost subscription tier and cracking down on password sharing. Its “borrowers” base it a whopping 100 million globally, leaving untapped potential subscribers offering a promising windfall in sales.

Expanding horizons and emerging markets across the globe could add significantly to its growth potential. As we advance, Fortune Business Insights predicts the global streaming industry will skyrocket by 19.9% annually, reaching an eye-watering $1.6 trillion valuation by 2029.

The bottom line

Netflix’s historical subscriber-driven growth strategy has faced challenges due to rising competition. Despite a slowdown in subscriber growth last year, recent quarters have shown a robust resurgence, proving it was merely a hiccup. Moreover, it is now exploring new revenue avenues to bolster its success over the long run, positioning it as a juggernaut in the streaming sector for years to come.

While revenue growth has slowed, its stellar subscriber growth numbers remain key to driving the streaming giant’s monster success. With its massive addressable market, its growth prospects remain as vast as ever. Additionally, its proactive approach includes introducing ad-supported plans and password sharing crackdowns, enabling it to tap into a borrowers base of 100 million globally.

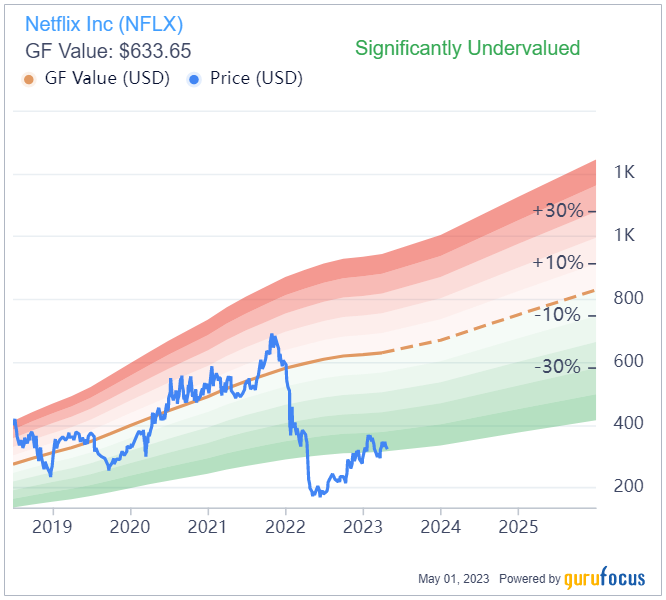

Though some would consider it is trading at a premium multiple, its long-term outlook suggests the sstock will surge to new heights, offering incredible value for shareholders. In fact, its GF Value is at a whopping $633.6, making it significantly undervalued.

This article first appeared on GuruFocus.

Add Comment