Billionaire Steve Cohen is one of the few hedge fund managers who almost always dazzles with his outperformance and prescient bets. Cohen, who also owns The New York Mets, founded SAC Capital back in 1992, and since then through 2009 lost money only once. A Bloomberg report earlier this year said that Point72 Asset Management has been able to raise so much cash recently that it’s starting to decline external money. The fund has reportedly raised about about $12.8 billion since 2020.

Point72’s main fund returned about 11% in 2023, and 12% in the previous year.

Billionaire Steve Cohen’s Point72 Asset Management runs a highly diversified portfolio. As of the end of the March quarter, the portfolio’s net worth was over $41.2 billion, with tech stocks accounting for 17% of the total portfolio.

Billionaire Cohen’s Speed and Agility Pays Off

Unlike long-term value investors like Warren Buffett and Seth Klarman, Cohen moves with speed and adapts quickly. He’s been like this for decades. When he was in Wharton School of the University of Pennsylvania, he would often skip classes to watch stock movements at a local brokerage. He took pride in predicting stock movements based on their direction.

Cohen Begins to Focus on Macro Amid Financial Volatility

Cohen, worth over $19 billion, is yet again adapting to the quickly changing global financial landscape as investors demand steady returns. Earlier this year, it was reported that Cohen and his team is expanding macro teams at Point72 as the global economy resets to the new era of high interest rates. The report said that the fund would establish as many as 51 macro trading teams.

Is Nvidia Corp (NASDAQ:NVDA) The Best AI Stock to Buy According to Billionaire Cohen?

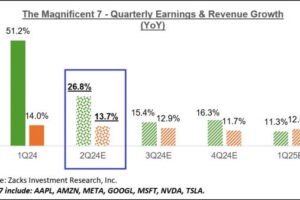

Nvidia Corp (NASDAQ:NVDA) has once again smashed Wall Street estimates with its numbers. In the first quarter Nvidia Corp’s (NASDAQ:NVDA) EPS came in at $6.12, versus the Street’s estimate of $5.59. Revenue totaled $26.04 billion, much higher than the estimated $24.65 billion. In the second quarter Nvidia Corp (NASDAQ:NVDA) expects revenue of $28 billion, while analysts were expecting Q2 revenue at $26.61 billion. Nvidia Corp (NASDAQ:NVDA) has also announced a 10-to-1 stock split.

Steve Cohen decreased his stake in Nvidia Corp (NASDAQ:NVDA) by 55% in the first quarter of 2024, ending the quarter with a $228 million stake in Nvidia Corp (NASDAQ:NVDA).

Patient Capital Opportunity Equity Strategy stated the following regarding NVIDIA Corporation (NASDAQ:NVDA) in its first quarter 2024 investor letter:

“This quarter we entered two new positions, while exiting four positions. Our first new position was NVIDIA Corporation (NASDAQ:NVDA), which we bought early in the quarter. Nvidia is the market leader in designing and selling Graphics Processing Units (GPU), which has recently benefited from the insatiable demand of artificial intelligence (AI) models. The company currently captures 92% market share of data center GPUs and grew revenue, earnings and FCF an astounding 126%, 392%, and 610%, respectively, over the last year. While much of the focus is on Nvidia’s market cap reaching $2.3T, up 230% over the last year, the company’s valuation has actually come down over that period. As of 3/31/23, consensus was valuing the company at 61x forward EPS. This compares to today, where the company is being valued at 37x. While yes, we have never seen a company expand their market cap by so much so quickly, we have also never seen a company grow their fundamental earnings and cash generation so quickly (and which is actually expanding faster than valuation). While competitors are working to enter the GPU space, Nvidia has created a moat around their GPUs with their CUDA software offering. While we do expect the large cloud players to continue to move into the market, we think NVDA can continue to demand top market share. With leading edge technology, an increasing innovation cycle and strong cash generation, the company is well positioned for the increased adoption of accelerated computing and artificial intelligence (AI).

Nvidia Corp. (NVDA) was a top performer in the quarter gaining 82.5% in the period. While the company has had an impressive run, gaining 242% over the last year, the valuation has been supported by the impressive growth in Revenue (126%), EPS (392%) and free cash flow (610%) over the last year. The company has solidified its position in the GPU space supported by its proprietary software CUDA. While we expect competition to increase, we think NVDA can continue to maintain top market share. With leading edge technology, an increasing innovation cycle and strong cash generation, the company is well positioned for the increased adoption of artificial intelligence (AI).”

Billionaire Cohen likes Nvidia but it’s not his top AI pick. NVDA ranks 7th in the list of the 10 Best AI Stock Picks of Billionaire Steve Cohen.

Click to see the complete list of 10 Best AI Stock Picks of Billionaire Steve Cohen.

If you are looking for an AI stock that is as promising as Microsoft but that trades at less than 5 times its earnings, check out our report about the cheapest AI stock.

READ NEXT: Michael Burry Is Selling These Stocks and A New Dawn Is Coming to US Stocks.

Disclosure: None. Nvidia Corp (NASDAQ:NVDA): Best AI Stock To Buy According to Billionaire Steve Cohen? was originally published on Insider Monkey

Add Comment