<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="What Happened: Patrick Little, CEO and President of SiFive Inc. in an interview with Reuters claimed that customer interest in their technology is on the rise.” data-reactid=”20″>What Happened: Patrick Little, CEO and President of SiFive Inc. in an interview with Reuters claimed that customer interest in their technology is on the rise.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Patrick was a former Qualcomm Inc. (NASDAQ: QCOM) executive and was declared the new CEO and President of SiFive on Thursday.” data-reactid=”21″>Patrick was a former Qualcomm Inc. (NASDAQ: QCOM) executive and was declared the new CEO and President of SiFive on Thursday.

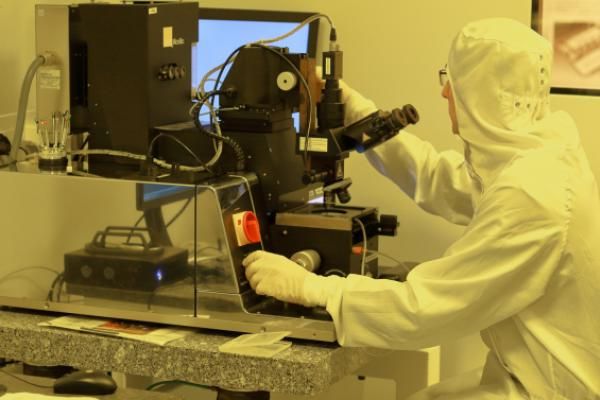

SiFive operates in the commercial RISC-V processor business, an open-source chip technology. Reportedly, since his appointment, Little was contacted by many of the company’s customers “asking to work more closely on major designs.”

“Already, six of the top ten semiconductor companies are working with SiFive,” Little said. “We just got a big basket of funding, and frankly now I know where all that needs to go.”

Since June, the company has raised over $125 million in two funding rounds. In August, SiFive raised million from its Series E funding round led by Korean semiconductor supplier SK Hynix Inc. Whereas in June, it raised $65.4 million from a Series D funding led by existing investors and new investor Qualcomm Ventures LLC.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="Why Does It Matter: Arm’s acquisition by the American company during the United States-China tensions led to concerns that it could directly impact the semiconductor industry worldwide.” data-reactid=”29″>Why Does It Matter: Arm’s acquisition by the American company during the United States-China tensions led to concerns that it could directly impact the semiconductor industry worldwide.

The company’s co-founder Hermann Houser expressed his views against the acquisition, dubbing it a “disaster” for all of Europe.

According to CCS Insights Analyst Geoff Blaber, the Nvidia takeover could drive chip manufacturers to explore engagement with other open-sourced technology companies.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="See more from Benzinga” data-reactid=”32″>See more from Benzinga

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.” data-reactid=”37″>© 2020 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Add Comment