Go ahead, blame remote work.

The office sector has been the biggest drag on real-estate investment trusts in 2022, which is shaping up to be their second-worst year on record, according to Morgan Stanley’s REIT outlook.

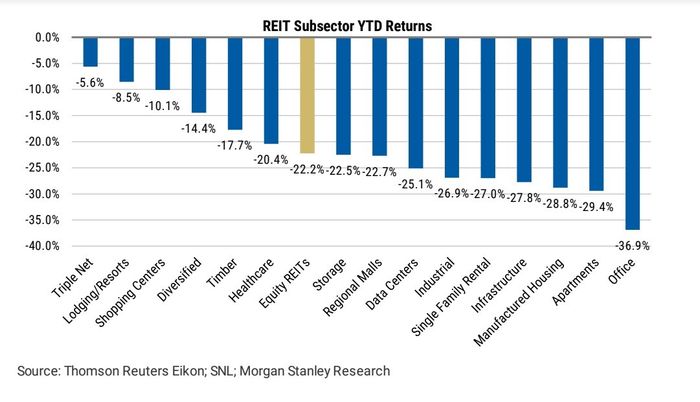

Total returns were pegged at nearly -37% (see chart) on the year through Dec. 9, ranking office as the biggest drag on REITs. Overall, REITs were headed for a roughly -22% total return, on pace for the worst year after 2008, according to the Morgan Stanley team.

Shares of office REITs are sinking.

Thomson Reuters Eikon; SNL; Morgan Stanley Research

“REITs had a tough year,” the team wrote Friday. But they also expect more pain in 2023, given that REIT and S&P 500 earnings both likely still need to reset lower, as do commercial real-estate prices.

“Indeed, [commercial real-estate] prices are still up +7.3% [year over year] and we see prices falling -15% over the next 12-24 months for apartment and industrial, -27% for quality retail, and -37% for office,” they wrote.

The U.S. housing market sputtered this year after the Federal Reserve in March kicked off its campaign of interest-rate increases to lower inflation. The toll on commercial properties, however, has been harder to detect, outside of lingering low levels of workers returning to the office, slashed REIT equity prices DJDBK, -2.68% and redemption limits recently placed on several major private real-estate funds.

REITs invest in all types of real estate, from hotels to office towers to industrial lots, and own an estimated $4.5 trillion in assets across the U.S., according to data from the National Association of REITs.

The Dow Jones Equity REIT Index DJDBK, -2.68% was down 24.7% on the year through Friday, while the S&P 500 SPX, -1.11% was $19.1% lower on the year, according to FactSet.

Distressed commercial-property sales have been relatively few this year but could tick up in 2023, when billions of dollars in loans come due and landlords face much higher interest rates and likely lower property values.

Major technology companies have been announcing plans to reduce office space, including Facebook parent Meta Platforms Inc. META, +2.82% and Twitter, now owned by Tesla Inc. TSLA, -4.72% CEO Elon Musk, who has reportedly stopped paying rent at Twitter’s offices.

Now read: ‘It was not sustainable or real’: Tech layoffs approach Great Recession levels

In another sign of potential stress to come, some $162 billion of maturing loans in commercial-mortgage bond deals come due in 2023, the most in the next decade, according to CRED iQ, which tracks property data.

Add Comment