There is no question about it: Early retirement is a risk.

There’s no doubt that quitting your full-time source of income in your 30s or 40s and expecting to live not 20, 30, or even 40 more years…try, 60 or more, without a dedicated income for more than half of your life, is a risk.

But for most of us, it’s a calculated risk.

Calculated risks are referred to as “calculated” for a reason. And no, I’m not talking about math or something you do with a calculator. I’m talking about you. You are the only equation that matters.

Early retirement isn’t just financial. It’s organic. The likelihood of living the next 50 or 60 years without a consistent source of income or ever having to worry about money is real for an early retiree

But, it’s all in his or her head. It’s a mind game.

All that organic chemistry that collectively makes up every tiny bit of you is the primary driving force behind early retirement, and the risks of quitting the rat race early aren’t deep-seated in math. Not in the stock market. Not real estate.

They are seated within you.

The risks of early retirement go both ways

I don’t know about you, but I’ve heard too many stories that go something like this:

“My dad retired at 65. Three weeks after retirement, he went in for a routine checkup and the doctors found a baseball-sized growth on his kidneys. He was dead in three months.“

I’m sick of those stories. I hate them. Every one.

People ignore the proven and statistical risks that come from jobs — especially stressful ones. As ABC reports: “A growing body of research stands testament to this fact: lack of sleep has been shown to tax the hearts of the stressed executive and the stressed day worker alike.

“Layoffs,” the report continues, “can take their psychic and physiological toll in the executive suite and on the production line; the burden on those left behind, who work more overtime to shoulder a heavier workload, can be life-shortening; and living in fear of losing a job, or staying put in a hostile workplace, also boosts the risk of an earlier cardiac death.”

I hate the risk of not retiring early more than the opposite. To work the vast majority of our life and then retire during the portion of our life where we’re more likely to get sick is a dreadful thought. To develop cancer. Suffer from mobility-inhibiting aches and pains. It’s painful to even think about.

The highest incidents of cancer occur between 65 and 74 which, coincidentally, happens to coincide closely with the age that we can draw Social Security without penalty: 62. Does anyone else see a problem with this?

To me, it’s way more risky to retire during the period when we’re most likely to develop a health problem than it is much earlier in life.

At what point do we begin to consider the risks of not retiring early and weigh those against the risks of quitting the rat race early?

Risk is a two-way street, my friends.

I’ve been asked before: “What if you develop a debilitating disease and need expensive health care? You’ll never be able to afford it.”

My response is simple: “OK, but what if I don’t?“

Read: How to find the perfect place (for you) to live in retirement

The risks of early retirement

I’m not trying to diminish the risks of early retirement. Risks of early retirement exist. Popular arguments for risks include:

• Heavy index-fund investors are setting themselves up for failure upon the next market crash

• The Trinity 4% rule is based on old and antiquated data

• Early retirees don’t have a diversified asset class, which makes single points of failure likely

• Retiring during a bull market is easy, but it’s not quite as easy once the bull is replaced with a fury little bear

Frankly, none of these arguments are necessarily “wrong”. Yes, heavy-index fund investors do stand to lose money when the market tanks. And yes, the next bear market will test many of us who retired in the last couple of years.

But, let me be clear about the Trinity 4% rule: I hate the term “rule”.

Contrary to popular critique, the 4% safe withdrawal rate is not some one-size-fits-all approach that people must blindly and stubbornly adhere to for the duration of their retirements.

Doing so would mean that we humans are purely robots, programmed to aimlessly march forward using the same cognitive powers that we have always had, unable to think for ourselves, make our own choices and adjust to the times.

A large majority of us are using the 4% rule as a guideline.

Meaning, we choose a number that we believe to be a reasonably safe withdrawal rate and start into our retirements by withdrawing from our investments that amount of money.

But, as well-known personal finance and early retiree Mr. Money Mustache writes (and one who happens to believe in the 4% principle), there are no guarantees in life and we should always adjust our expenditures based on economic conditions.

In other words, critics of the 4% rule are missing the point that many early retirees grasp: We aren’t blindly following any “rule”, here. Early retirement isn’t about rules.

In fact, it’s precisely the opposite. We don’t follow the rules.

The risks inherent in the 4% foundation, along with those of heavy index-fund investing or asset classes are only as serious as the innate willingness of the early retiree to adjust to changing times.

The fact is we humans can endure a lot when we need to.

On paper, it might seem that early retirees are accepting too much risk. But what the paper misses is the motivation and determination of those people and families to do whatever it takes to make it work.

What we’re missing here is the very nature of most early retirees.

We are typically creative and determined. Most of us retired early because we possess a vision for our future that’s light years better than the default behavior of working into our 60s and hoping we have some productive years left.

Most retirees are Gumby-like humans, capable of moving, twisting and contorting to position themselves to accurately confront economic conditions.

If a retiree’s portfolio losses 30% of its value — as many did during the housing market crash of 2008, most adjust their spending habits and lifestyle — like good little human beings capable of making sound adjustments.

We adjust, and our financial situation is no different, especially after retirement when the paychecks stop floating in.

Being flexible is our calculated hedge against risk.

The risks that can hurt us

At the beginning of this post, I said that early retirement is a risk. I still believe it is. But, I believe it’s a calculated risk.

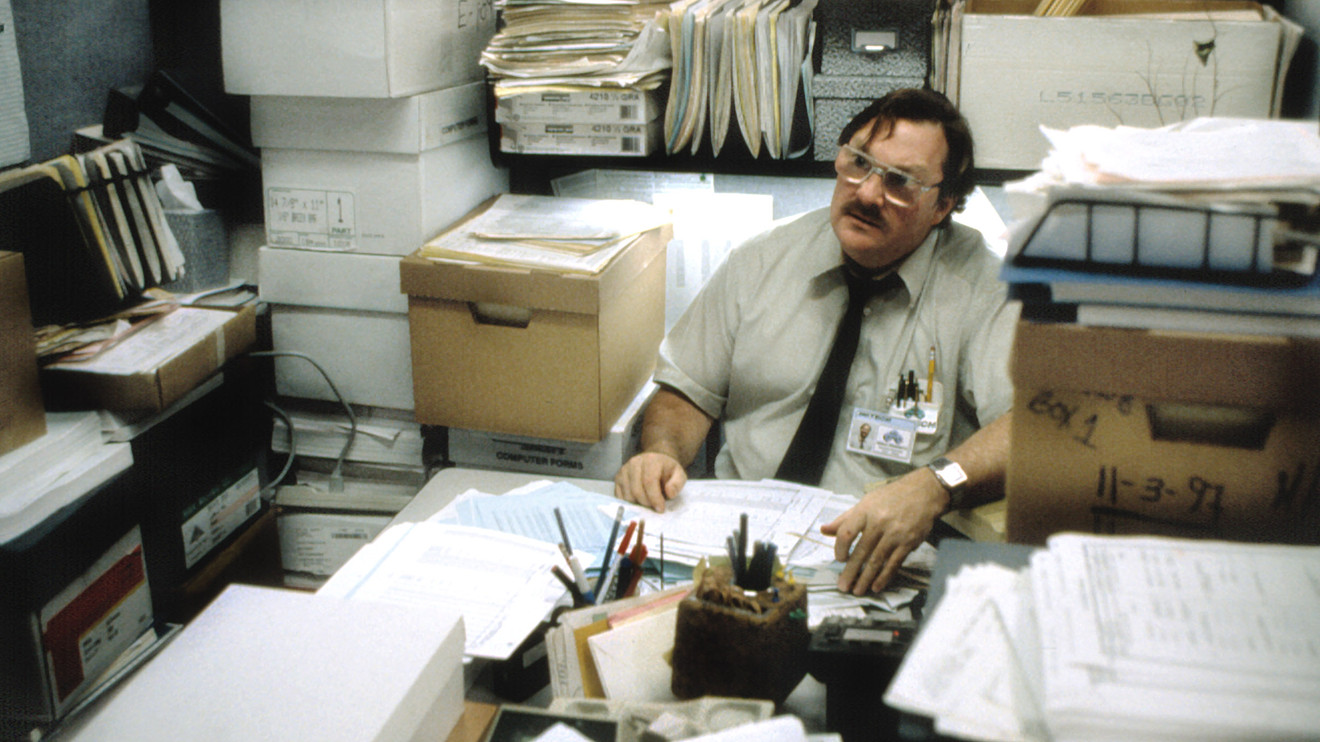

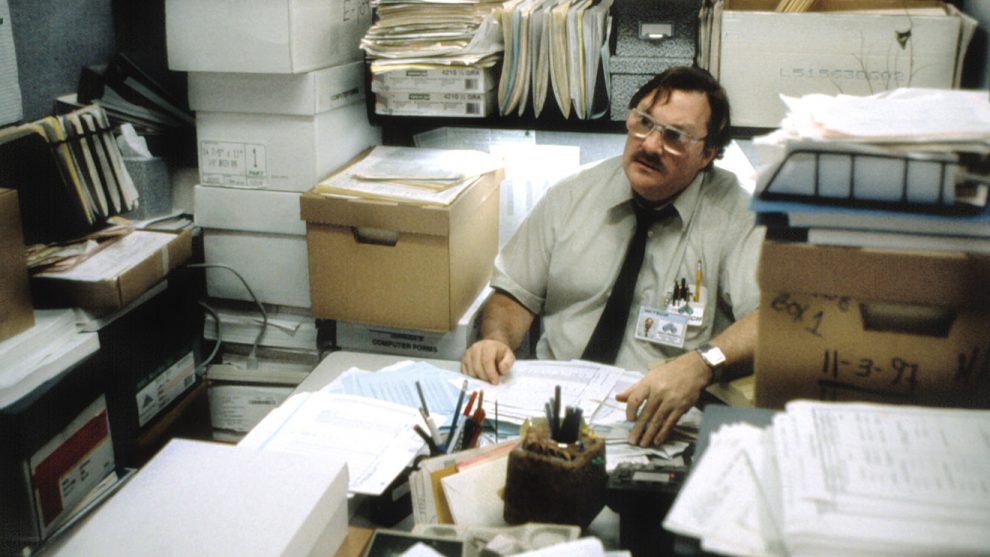

If we don’t retire early, we will be stuck in an office during the most productive years of our life, retiring only when we’re most likely to develop health problems that can significantly affect our quality of life.

Sorry, but it’s not worth it to me. That risk is too great, and based on the numbers, it’s darn near impossible to avoid.

There are risks that we cannot possibly avoid, such as:

• Developing a rapid health problem that requires expensive hospitalization

• A week-long 50% drop in the stock market

• A lawsuit that wipes out your savings

• A car accident that leaves you saddled with medical bills forever

The risks are endless.

Those risks exist for every one of us regardless of whether we hold full-time jobs.

If something happens, I deal with it when it happens. But, I’ll always have the years of freedom to look back on, all those mornings that I got up without a care in the world and the whole day in front of me to do with as I please.

I can’t stomach the risks of spending the rest of my life doing a job that I don’t enjoy. That’s not what life is about.

You only live once. I don’t want to work it. I want to live it.

Add Comment