In its latest Household Debt and Credit Report, the Federal Reserve Bank of New York points out that the total outstanding debt for home equity lines of credit (HELOCs) hit a 14-year low of $412 billion at the end of 2018. That sounds quite encouraging.

Keep in mind, though, that HELOCs were shoveled out to almost any homeowner during the housing bubble in the early 2000s. When home prices turned down, HELOCs exacerbated the housing collapse that followed.

Because millions of new HELOCs have been originated in the last several years, let’s take a good look at them and see if they pose new threats.

A HELOC is similar to a business line of credit. The lender uses the house as security and provides a homeowner with a line of credit that has a fixed limit. The borrower can withdraw funds within a time known as the “draw period.” During the bubble era, this was usually 10 years.

What made a HELOC so irresistible was that the required payment was interest-only during the draw period. Lenders marketed them aggressively and shoveled them out to just about anyone who applied.

There was just one catch. At the end of the draw period, the HELOC automatically converted to a fully amortizing loan. The repayment period was usually 15 years. Because the HELOC had to be fully repaid at the end of the 15 years, borrowers could see a huge increase in their monthly payment after the draw period expired. But with home prices soaring in 2005 and 2006, no one thought about that.

The home-equity loan disaster

In a recent column, I discussed an important 2013 article about how the origination of millions of HELOCs exacerbated the housing collapse, especially in California. As I explained, California was the epicenter of HELOC insanity. Many — if not most — of the defaults in California were caused by homeowners whose HELOCs and refinancing of HELOCs put them substantially underwater when home prices turned down.

Another important article about the entire second mortgage problem — HELOCs and home equity installment loans — was published by three Federal Reserve Board staffers in 2012. They had access to Equifax’s credit database and to DataQuick’s database for recorded mortgages.

The researchers discovered that for both HELOCs and home-equity installment loans which originated during the bubble period, the vast majority of these borrowers had defaulted on the second liens within a year and a half of their going delinquent on the first mortgage. Of those who had taken out “piggy-back” second liens at the time of home purchase to avoid private mortgage insurance, 80% had defaulted on the second lien soon after going delinquent on the first mortgage.

Since this 2012 article was published, it has been widely assumed that the home price recovery lifted many borrowers with two mortgage liens out of negative equity. Because of this, little research has been done about the potential problem with second liens and almost nothing was published about it.

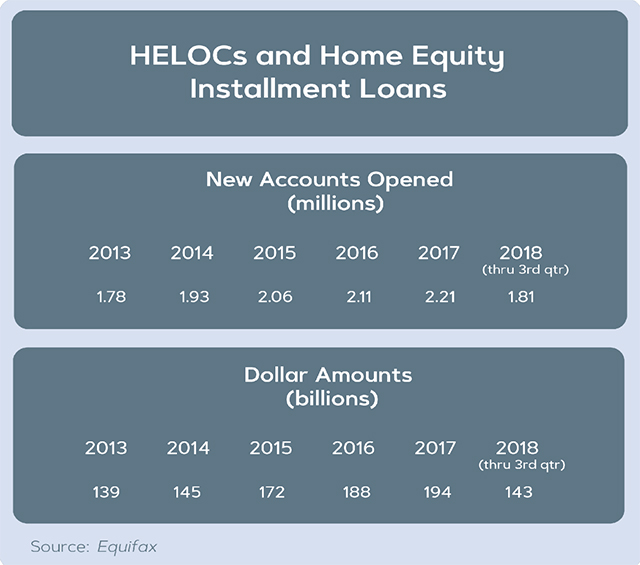

Was this inattention justified? Although origination of second liens plunged after the home price collapse rolled into high gear in 2008, there has been a real resurgence in the past few years. Consider this table from Equifax’s latest Consumer Credit Trends Report:

According to Equifax, between 2013 and the third quarter of 2018, close to 12 million new home equity loans were originated in the U.S. with a total of nearly $1 trillion in new installment loans or HELOC credit limits. Roughly two-thirds of these loans were HELOCs.

Three or four years ago, the standard HELOC had a combined loan-to-value (CLTV) limit of 80%. This meant that together, your first and second mortgages could not exceed 80% of the current value of the property. The restriction gave the lender a 20% equity cushion against another price downturn. A few lenders would go as high as 90% only if you had an extremely high credit score.

Standards have loosened up a lot since then. If you go online, you will see dozens of ads offering tantalizing deals for a new HELOC. In doing a quick search, I found at least 10 lenders that offer a 100% CLTV HELOC if you have a high FICO score and clean credit history. They must be highly confident that home prices will not go down again. Sounds much like 2005 and 2006.

Digging into the data

Why are HELOCs and home equity installment loans a cause for concern? That is a reasonable question. After all, haven’t the worst of them been washed out of the system through foreclosures and refinancing?

One big problem is that we don’t even know how many of these second liens are still outstanding.Despite the Equifax report showing 12 million new HELOCs and home equity installment loans, they asserted that there were 3.2 million fewer home equity loans outstanding at the end of this period than at the beginning.

How is that possible? Few second liens were foreclosed over the past six years. The only other plausible explanation is that millions of these borrowers rolled their second lien into a cash-out refinanced first-lien larger than their previous one. They could do that if their home had increased in value enough so that they had positive equity.

Check this out by going to Freddie Mac’s latest cash-out refinancing report. In it, we learn that between 2013 and the end of 2018, a total of $130 billion in home equity loans was rolled into a refinanced first mortgage. This is only a small fraction of the roughly $980 billion in home equity loans that were originated over these six years.

So how could the dollar value of outstanding loans have declined? It seems clear to me that both the number of outstanding home equity loans and the dollar amount outstanding should have soared. When asked about this, two spokespersons for Equifax failed to respond to my inquiries. Do you really think that Equifax’s figures showing a decline in the value of outstanding second liens make any sense?

California insanity — again

California was the epicenter of cash-out refinancing and HELOC madness during the wild bubble years. There is growing evidence that Californians have learned nothing from the collapse and are once again throwing caution to the wind.

How so? According to a leading mortgage broker in California with a widely-read weekly real estate column, it is quite common for non-bank lenders to offer a HELOC with a combined loan-to-value (CLTV) of 90% and an interest rate of roughly Prime+1%.

For a home-equity installment second mortgage loan, the non-bank lenders are quite willing to do a CLTV of 100% at a fixed rate of 10% and a term of 20 years. This leaves no cushion in case of a home price decline. The mortgage broker explained that borrowers are willing to take this kind of loan because they want the money now and don’t care about the interest rate.

During the craziest bubble years of 2005-07 in California, second liens with CLTVs of 100% had much to do with the home price collapse that followed. Is California setting itself up for a second collapse? Remember that these mortgage brokers also provide loans outside of California.

Should we worry about non-bank lenders?

Non-bank lenders — mainly private firms without a deposit base — have become the dominant mortgage lenders after Dodd-Frank legislation was passed in 2010. Their share of mortgage originations has skyrocketed from 13% in 2011 to more than 50% as of 2018. They stepped in to fill the vacuum left when large banks essentially abandoned lending to low- and moderate income buyers with less than stellar credit. Non-bank lenders dominate mortgage loans, which are guaranteed by the FHA and the VA.

Since non-bank lenders don’t take deposits, they are forced to use lines of credit obtained from banks to provide funding for their loans. In a housing downturn or liquidity crunch, the banks could pull the line of credit and essentially put the non-banker lender — large or small — out of business.

Read: These risk-taking mortgage lenders could trigger the next housing crisis

More: 3 reasons why the housing market isn’t as strong as it seems

In addition to being the primary source of first mortgage loans for those with less than pristine credit, non-bank lenders are now the dominant source for second liens. Their willingness to go up to 100% CLTV for a borrower strongly suggests that they are not afraid to take much higher risks than the banks.

Non-bank lenders don’t provide so-called “liar loans” or mortgages that require no income or asset verification (NINAs), as the sub-prime lenders did during the nutty bubble years. Yet most of their borrowers would qualify as sub-prime under bubble-era classification.

The operations of non-bank lenders are troubling because they look so much like the worst excesses of sub-prime lenders during the height of the bubble insanity.

The operations of non-bank lenders are troubling because they look so much like the worst excesses of sub-prime lenders during the height of the bubble insanity. Employees are simply salespeople who get paid a nice commission for loans sold to borrowers. During the crazy bubble years, sub-prime underwriters who turned down too many loans were severely reprimanded or fired.

An article published a year ago explained that an office of one non-bank lender had a sign which read “If the customer does not buy from us, it’s your fault, not theirs … BE OBSESSED.” The author went on to state that many of the clients of one non-bank lender have “no savings, poor credit, or low income – sometimes all three.” That sounds much like the sub-prime borrower of a dozen years ago.

The main reason these lenders are not concerned about offering mortgages to high-risk borrowers is that the great majority of first liens are securitized and sold as Ginnie Maes to investors. Are the buyers of Ginnie Maes aware of the risks? Undoubtedly they figure that if the FHA and Ginnie Mae survived the housing collapse, they can survive anything. That seems to be a reasonable assumption for them to make.

What you need to consider is that there are almost certainly 15 million (or more) second mortgages outstanding today which could easily put their borrowers under water if home prices turn down again. Since we know what happened during the crash of 2008-11, anything even close to a repeat of that disaster is sobering to ponder.

Keith Jurow is a real estate analyst who covers the bubble-era lending debacle and its aftermath. Contact him at www.keithjurow.com.

More: Out-of-control bubble-era mortgages still threaten to smash major U.S. housing markets

Also see: The housing and mortgage crisis is far from over

Add Comment