The Zacks Computer and Technology Sector has struggled to find its footing in 2022 amid a hawkish pivot from the Fed, down more than 30% and widely lagging behind the S&P 500.

A widely-recognized company in the sector, PayPal Holdings, Inc. PYPL, is on deck to unveil quarterly earnings on November 3rd, after the market close.

PayPal offers a payment solutions platform that enables smooth and secure transactions for both customers and merchants. The company’s peer-to-peer payment service, Venmo, is helping to drive solid growth within its total payment volume.

Currently, the company carries a Zacks Rank #3 (Hold) paired with an overall VGM Score of a D.

Let’s take a deeper dive into how the company currently stacks up.

Share Performance & Valuation

Year-to-date, PayPal shares have sailed through rough waters, down more than 50% and widely underperforming the S&P 500.

Image Source: Zacks Investment Research

Over the last three months, however, the selling has slowed down dramatically, with PYPL shares nearly trading in line with the general market.

Image Source: Zacks Investment Research

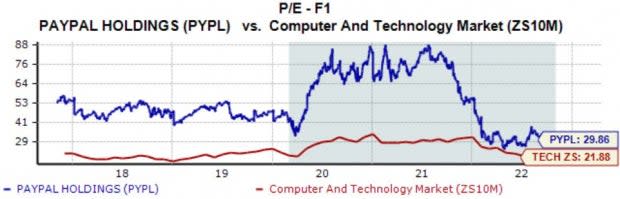

The company’s current forward earnings multiple of 29.9X is undoubtedly on the higher end of the spectrum, representing a 36% premium relative to its Zacks sector.

Still, the value is nowhere near its 48.7X five-year median and highs of 52.5X in 2021.

Image Source: Zacks Investment Research

Quarterly Estimates

Analysts have been bullish in their earnings outlook over the last several months, with four positive earnings estimate revisions hitting the tape. The Zacks Consensus EPS Estimate of $0.95 suggests a 14.4% Y/Y downtick in quarterly earnings.

Image Source: Zacks Investment Research

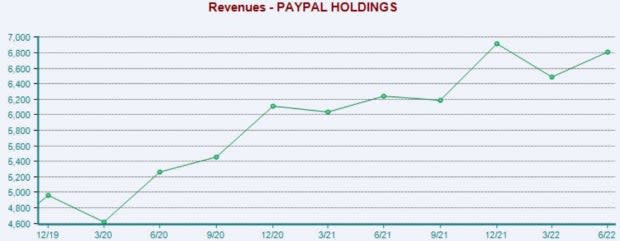

PayPal’s top-line is in better health; the Zacks Consensus Sales Estimate of $6.8 billion indicates an improvement of more than 10% from year-ago quarterly sales of $6.2 billion.

Quarterly Performance & Market Reactions

The payments titan has consistently exceeded bottom-line estimates, registering seven bottom-line beats across its last ten prints. Just in its latest release, PYPL exceeded earnings expectations by 9.4%.

Top-line results tell a similarly positive story; PayPal has exceeded sales estimates in three consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Additionally, it’s worth noting that the market has cheered on the company’s last two releases, with shares moving upward following the print in both instances.

Putting Everything Together

PayPal shares are deep in the red YTD but have traded in line with the general market over the last three months, indicating that the selling has slowed down.

Shares may not entice value-focused investors, with the company’s forward earnings multiple sitting on the higher end of the spectrum. Still, multiples are nowhere near historical levels.

Analysts have been bullish for the quarter to be reported, with estimates indicating an uptick in revenue but a decline in earnings.

The company has consistently exceeded quarterly estimates, and the market has cheered on its latest two releases.

Heading into the print, PayPal Holdings, Inc. PYPL carries a Zacks Rank #3 (Hold) with an Earnings ESP Score of 2.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Add Comment