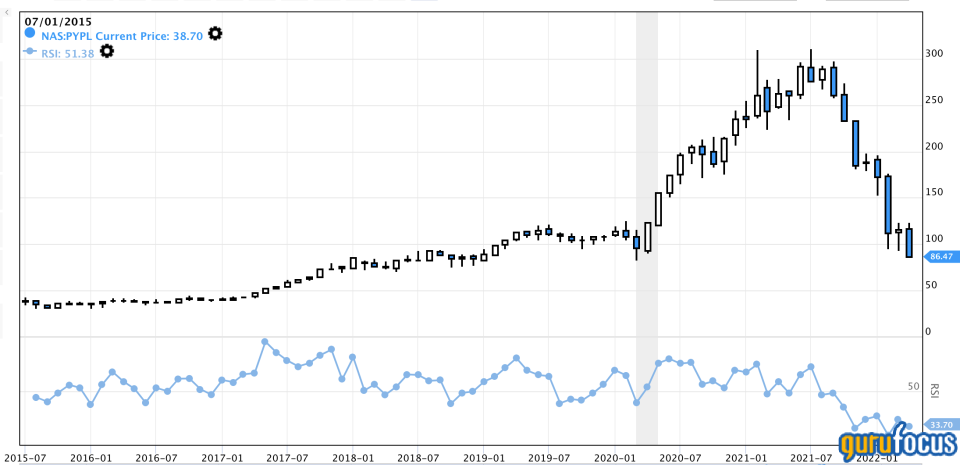

Shares of PayPal Holdings Inc. (NASDAQ:PYPL) have been in freefall for the past year, declining by more than 60%. While some investors may be tempted to buy the dip, the stock still has a long way to drop before it reaches an investable level.

The digital payments sphere is becoming increasingly competitive. PayPal does exhibit strength in some of its segments, such as “buy now, pay later,” however, it likely isn’t enough to change the stock’s trajectory for now.

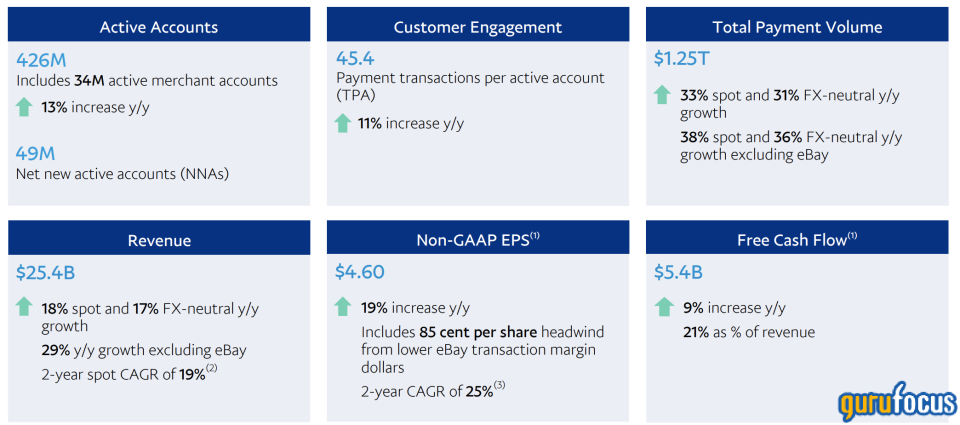

Recent financial results and key metrics

Although PayPal outpaced its fourth-quarter revenue target by $30 million, it missed the earnings estimate by 1 cent per share. It’s needless to say that this wasn’t a massive miss for the company, but it’s undoubtedly damaging considering it is still participating in a growth industry.

Source: PayPal

During the quarter, PayPal experienced further year-over-year growth with new active accounts rising by 13%, payment transactions per account by 11% and total payment volume by 31% on a currency-neutral basis.

All of the company’s financial results seem great at face value; however, upon observing its operating metrics, I was able to uncover its beckoning fragilities.

PayPal’s gross and operating margins have decreased significantly over the past year, suggesting the company’s having to fight a bit harder to maintain its market position amid rising competition in the digital payments space. Sure, inflation did play a role, but PayPal has historically possessed strong bargaining and pricing power with low competition, causing it to operate at high margins. However, the pandemic has encouraged a wave of digital payment solutions, which has certainly added to margin pressure.

Another issue is that PayPal’s earnings per share ratio has declined significantly over the past year. This suggests the stock’s residual value to its shareholders isn’t as lucrative as it was a year ago.

Economic concerns

The World Bank recently revised its global growth forecast downward by 0.9% for 2022, which could have a bearing on the jobs market and PayPal. The first issue with this is that many analysts, institutional investors and retail investors price stocks based on their companies’ sensitivity to gross domestic product growth, so it’s likely that the market overpriced the stock in the same manner as GDP was over-anticipated.

The second reason why the slowdown in real global growth should be an issue is because of jobs and salaries. PayPal is a payment gateway to many outsourced jobs, such as freelancing, and less velocity in payments could lead to subdued account openings and transactions per account.

Pricing the stock

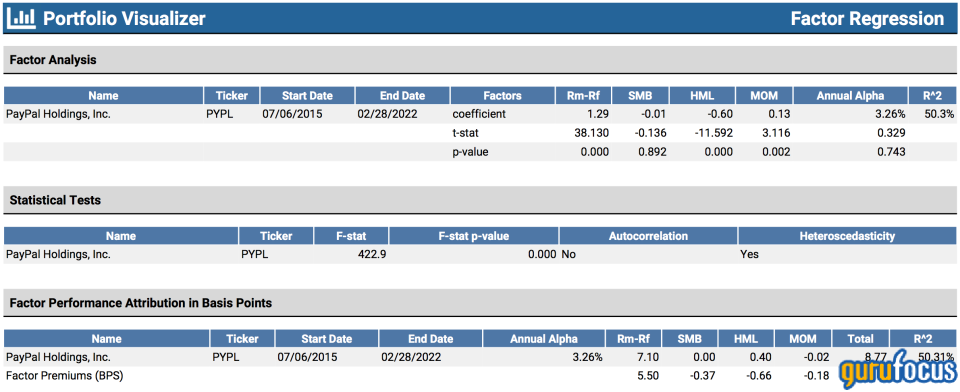

I priced the stock using Mark Carhart’s four-factor model to see how PayPal has historically performed in different market climates. The model illustrates the following:

-

PayPal outperforms the market in a neutral state where the equity risk premium is reached with market efficiency.

-

PayPal underperforms whenever higher book value stocks outperform lower book value stocks.

-

PayPal exhibits more momentum than the broader stock index.

Source: Portfolio Visualizer

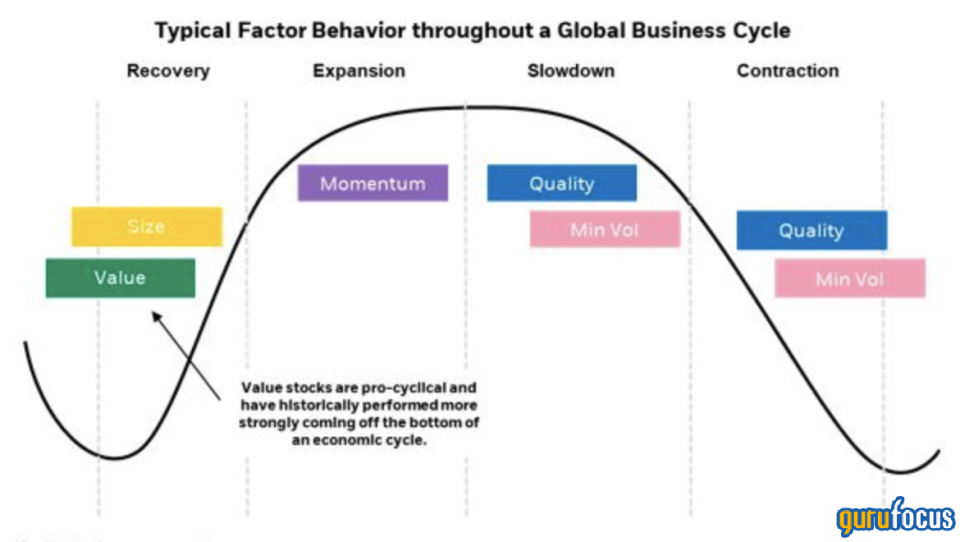

Based on these findings, we can look into the factors individually. I added a quality factor to the observation, which is of great importance because the stock market tends to gravitate toward low volatility and quality during economic slowdowns (which I would argue we may be heading into).

Source: Koyfin

Source: BlackRock on Harvest

The year-to-date results of the factors illustrate that value investing is prevalent; quality, small caps, general large caps and momentum are all struggling. This provides substance to the four-factor model and prompts me to conclude that we’re in a value-orientated market.

Based on PayPal’s history of underperforming the market whenever value stocks outperform, I’d have to say that the stock is priced for further disaster.

A few positives

As illustrated earlier, PayPal managed to post year-over-year growth and still manifested expansion as a company. The digital payments sphere is heating up, but PayPal’s cash and equivalents balance of roughly $9.5 billion allows it to fend off rising competition through excessive research and development spending or acquisitions.

Another matter to consider is the company has lost a significant amount of market value, causing its stock to touch oversold territory with a relative strength index of 33.70. Investors tend to buy in stock dips, and there’s always a danger (for short-sellers) that irrational buying would occur purely because of the stock’s near-oversold status.

The bottom line

PayPal probably still has a long way to drop before it’s set for a recovery. The company-specific operating metrics are declining rapidly, in line with the global macro environment. Furthermore, the Carhart four-factor model indicates the stock could face serious headwinds.

As such, I remain bearish on PayPal for the time being.

This article first appeared on GuruFocus.

Add Comment