(Bloomberg) — The Philippines’s mid-term election brings with it a set of unexpected winners and losers for the economy.

Voters in the Southeast Asian nation go to the polls on May 13 to elect new lawmakers and local government officials. Elections usually provide a lift to the economy as candidates ramp up spending to lure voters. This time around though, delays in approving the budget have led to a slowdown in public expenditure, hurting growth and offsetting the consumption boost.

Data on Thursday showed the economy expanded 5.6% in the first quarter, the slowest pace in four years. The central bank followed with an interest-rate cut on the same day.

Here’s a look at the possible effect of elections on the economy:

Consumption

A recovery in consumer spending was already expected given the sharp slowdown in inflation from nine-year highs in 2018. Political campaigning will likely lift that further.

While mid-term elections are usually smaller in scale than the presidential race, candidates still spend heavily on meals, transport services and publicity materials for their sorties, said Michael Ricafort, an economist at Rizal Commercial Banking Corp.

“Some candidates also dole out various giveaways for voters and other local officials in an effort to win more votes — another boost for consumer spending,” he said.

Consumer Stocks

Consumer firms are already feeling the lift, with some even performing better than the main Philippine stock exchange index ahead of the vote. Snack-food maker Universal Robina Corp. reported a 7% sales increase in the first quarter, while liquor company Ginebra San Miguel Inc. posted a 141% jump in profit.

“The election season usually brings us good results,” San Miguel Corp. President Ramon Ang said on Thursday, expecting a boost in consumption also as inflation cools. The Philippines’ largest company reported an 18% drop in profit in the first quarter on the back of higher taxes.

Investment

The delay in approving the 2019 budget halted funding for new projects curbed investment at the same time that borrowers are facing higher interest rates.

The boost from government spending that typically comes during an election year isn’t evident this time. Investment growth slowed to 6.8% in the first quarter from 10.3% the year earlier, with the construction segment showing the sharpest decline to 5% from 10.8%.

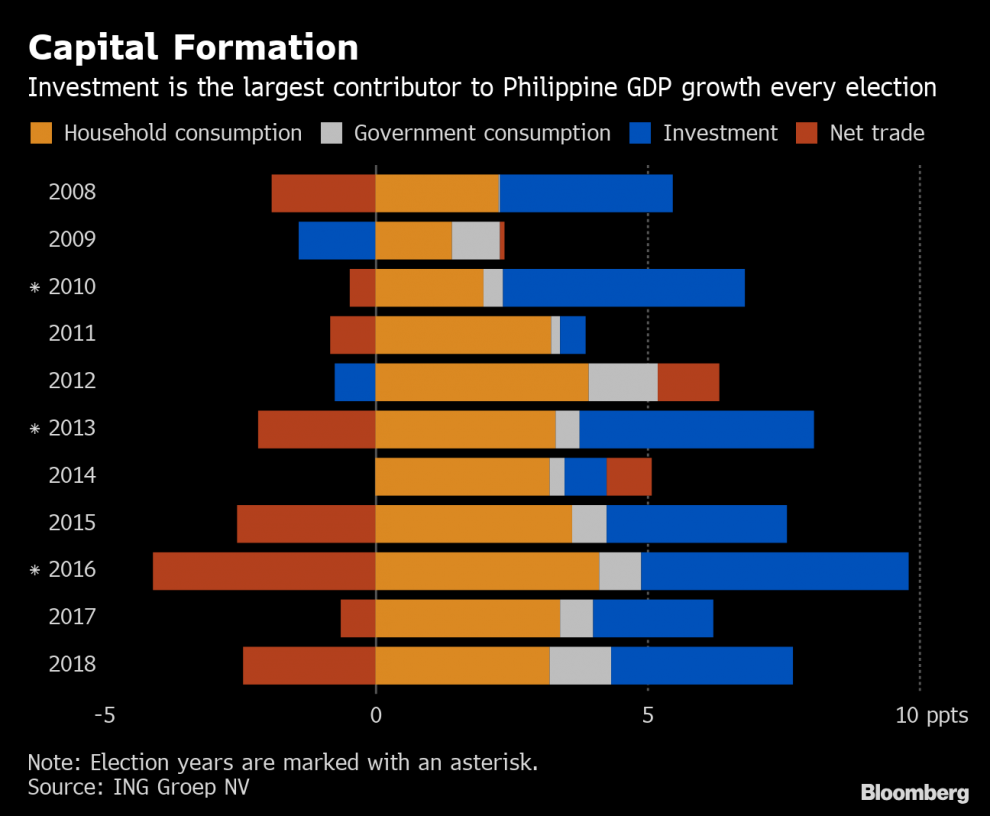

Historically though, companies aim to get most of their major outlays done “before any game-changing results from the vote,” said Nicholas Mapa, senior economist at ING Groep NV. Government construction also ramps up as incumbents look to cement their re-election bid through their projects and rush to complete them ahead of the election-related ban on spending, he said.

Advertising

The nation’s two largest broadcasters, which traditionally benefit from candidates’ television and radio commercials, could miss out on part of this revenue stream this year.

With Filipinos among the world’s heaviest Internet users, politicians are shifting more of their budgets to campaign across multiple social media platforms like Facebook, Twitter, Instagram and YouTube, according to Jonathan Ong, an associate professor at the University of Massachusetts.

“Rather than expensive prime-time TV or radio advertising, politicians are finding they can capture voters through more specific metrics and engagement on social media,” Ong said.

–With assistance from Kristine Servando.

To contact the reporter on this story: Claire Jiao in Manila at [email protected]

To contact the editors responsible for this story: Nasreen Seria at [email protected], ;Cecilia Yap at [email protected], Clarissa Batino

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com” data-reactid=”66″>For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.

Add Comment