(Bloomberg) — Sony Corp. has created one of the hottest gadgets of the year in the PlayStation 5, but its launch has been marred by scalpers who are buying up scarce supplies and threatening the long-term health of the company’s most important product.

Scalpers, who buy devices at retail and then resell at a higher price, have long been a challenge in the games business. But the problem is particularly acute this year because the coronavirus has squeezed production and pushed more console sales online — where scalpers use sophisticated bots to buy up the PlayStation 5 and Microsoft Corp.’s Xbox.

Furious gamers are calling out resellers for charging $1,300 or $1,400, almost triple the retail price, on sites like eBay and Twitter. “This is a launch disaster,” one Twitter post declared, vowing not to cave to usurious prices. “Scalpers can keep them.”

The threat is that Sony’s struggles in the first weeks of the launch could hurt its ability to draw gamers and developers to the new platform, undermining profits for years to come. A console’s debut is supposed to set off a virtuous cycle of consumers rushing to buy the devices, while developers release games that capitalize on new graphics and processor capabilities, sending demand on both sides surging. Sony risks suffering the opposite.

“The PlayStation 5 could miss a critical chance to get into a good hardware-software upward spiral,” said Kazunori Ito of Morningstar Research. “The peak of the platform will likely be low and the platform’s total revenue earned won’t be as strong as we hoped for.”

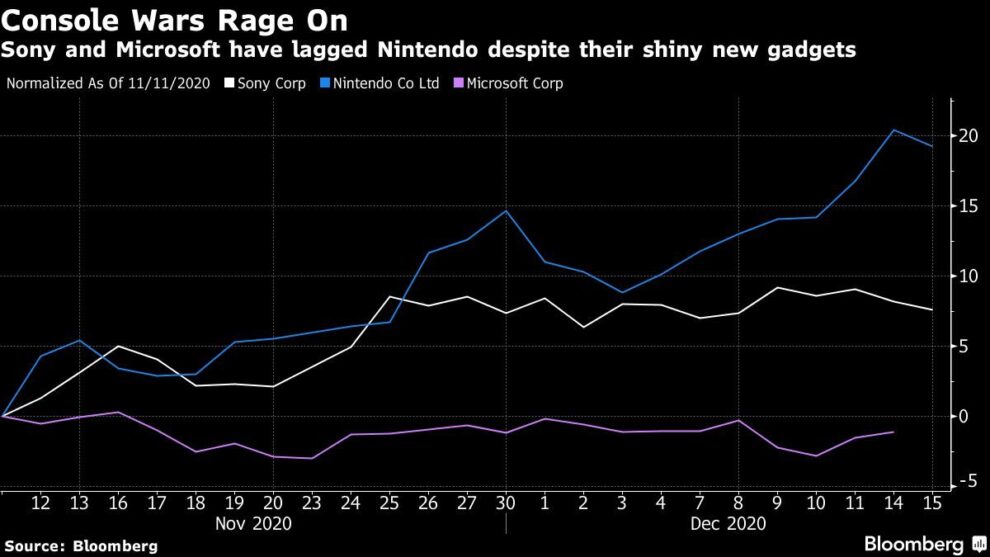

The company’s share price rose 2.7% to a 19-year high on Wednesday amid undiminished and growing enthusiasm for gaming stocks that saw rival Nintendo Co. surge by 6.6%.

Scalpers deploy bots that constantly monitor online stores for changes in inventory and supplies, then automatically place orders and check out in seconds when devices become available. The technique is based on familiar web-crawling or scraping technology, but is specifically tailored for e-commerce and can sometimes jump to the front of order queues.

“One bot preventative action we implemented just hours before the PlayStation 5 event on Nov. 25 blocked more than 20 million bot attempts within the first 30 minutes alone,” U.S. retail giant Walmart Inc. wrote in a statement Tuesday. The company is asking others in the retail industry to join it in lobbying lawmakers to address the bot issue.

Evidence of Sony’s trouble is clear in what’s known as the tie ratio, or the number of games sold for each console. A healthy ratio for a new console is around one, meaning each person who buys a machine also walks away with at least one game. The figure is important because the PlayStation 5 is sold at a loss, while games are lucrative.

So far, Sony appears to be seeing sales of about one game for every three devices — compelling evidence scalpers are hoarding the consoles. First-month estimates from Japan’s Famitsu show Sony sold around 213,000 PlayStation 5 consoles in the country, while the top three titles sold less than 63,000, excluding digital downloads. Sony’s Spider-Man and Demon’s Souls were the top games, while the third was an outside software company. For comparison, Nintendo sold a half million Switch consoles in its first four weeks on the domestic market, and the top three titles accounted for roughly the same number.

“Even if we consider digital download software purchases, the percentage of sold PlayStation 5s actually in use is not that high, meaning the current demand is constrained by profit-taking resellers,” said Hideki Yasuda, analyst at Ace Research Institute. The PS5 is compatible with PlayStation 4 game and comes with Astro’s Playroom pre-installed, so players may not be immediately compelled to buy new titles.

Sony’s scalper headaches are aggravated by struggles in production. The company has said it aims to sell more than 7.6 million PlayStation 5s by the end of March, beating the previous-generation console’s performance.

But the pandemic has created shortages throughout the industry’s supply chain, crimping the ability of companies from Sony to Apple Inc. to ramp up output. Key suppliers, including MediaTek Inc., have said chip availability will be constrained through the first half of 2021. Strong demand from electric-vehicle makers, among others, has been consuming capacity for some parts used in the PS5, according to people familiar with its supply chain.

Of particular concern for Sony, production yields for the PS5’s main, custom-designed processor remain inconsistent and have hurt its ability to meet demand, said the people, asking not to be named because the details are private. The company may have to rely more on air freight to deliver consoles to retailers, cutting further into its profits, they said.

“By air is at least 10 times more expensive than by sea when the world is in a normal condition, and the gap is likely wider now,” said Yasuda of Ace Research.

Sony’s latest shipment forecast is still well above the 7.6 million mark, although not as high as it had targeted earlier, one of the people said.

Sony declined to comment specifically on production figures or scalpers.

“While we do not release details related to manufacturing, nothing unexpected has happened since PlayStation 5 mass production has started and we have not changed the production number for PS5,” a spokesman said.

Inadequate supply risks derailing the cycle of a successful console introduction, with new software titles that in turn catalyze hardware interest. One major Japanese publisher was sufficiently spooked by the early market response that it’s held internal discussions over whether to delay its PlayStation 5 games, according to a person familiar with the talks.

Retailers are taking extreme measures to stymie scalpers. GameStop Corp. didn’t tell its own staff about new console shipments to U.S. stores this week until an hour before arrival so real customers could buy them. In Japan, Nojima Corp. had workers manually review every purchase order to screen out scalpers. Yet resellers have already made about $35 million off of PlayStation and $24 million from the rival Xbox that launched at the same time, according to one estimate.

Many customers blame Sony for not doing more to boost supply — and eliminate profits for scalpers.

“The real test for the PlayStation 5 is whether the hardware would continue to sell well even when there’s enough supply,” said games industry consultant Serkan Toto. “You need good games to convince gamers to switch over to the PlayStation 5, you need more outside publishers to release games on the PlayStation 5, and you need to ship more hardware.”

(Updates with share price and Walmart quote)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2020 Bloomberg L.P.

Add Comment