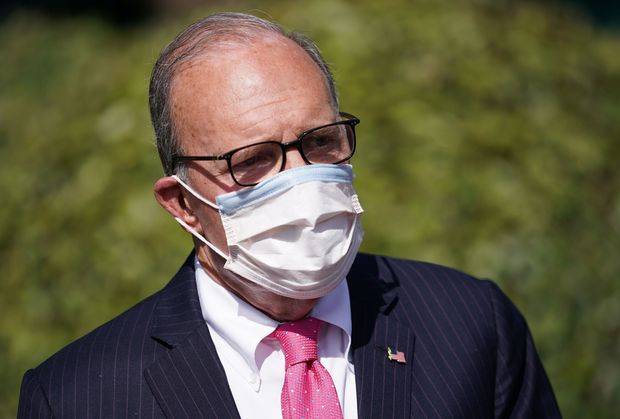

Director of the National Economic Council Larry Kudlow speaks to reporters after a TV interview outside of the West Wing of the White House in Washington, DC on October 9, 2020.

mandel ngan/Agence France-Presse/Getty Images

Private briefings from two senior White House aides to a conservative institution at the outset of the coronavirus outbreak led investors to short the stock market and even load up on toilet paper, according to a published report.

According to the New York Times

That led William Callanan, a Hoover board member, to write a memo to David Tepper, the founder of hedge fund Appaloosa Management, and a Tepper aide, the report said. Callanan allegedly wrote that he found it striking that they both mentioned their concerns, unprovoked. The email was then circulated to other Appaloosa employees, who discussed the memo with other investors. The report said the memo helped convince investors to short the stock market.

Philipson, publicly, told a business conference the White House was taking a “wait-and-see” approach on the economic impact, which he limited to the fallout on the U.S. from Chinese lockdowns. Philipson also pointed out the deaths from flu each year don’t make a material impact on the economy.

“We have contained this. I won’t say [it’s] airtight, but it’s pretty close to airtight,” Kudlow said on CNBC.

Callanan told the New York Times the confidential memo the newspaper received was different from what he sent to Tepper, though he didn’t say in what way, and that it was based on extensive research and publicly available information. The report said Callanan also briefed another well-known investor. Callanan, now a consultant, previously had stints at Soros Fund Management, Duquesne Capital and Fortress Investment Group.

Tepper, also the owner of the Carolina Panthers NFL team, initially denied receiving the memo before later telling the New York Times that Appaloosa already had placed its bet on the market to fall before receiving it.

Tepper did raise concerns publicly about coronavirus at the beginning of February.

Philipson said he doesn’t remember the specifics of his talk to Hoover, though he acknowledged making comments to that effect. Kudlow said he didn’t think his comments to Hoover were any different than he had made on CNBC, and pointed out the case tally at the time was less than 20.

The New York Times report didn’t identify who stocked up on toilet paper.

The S&P 500 SPX, -0.66% topped out on Feb. 19, and had only fallen 1.5% by the time the Hoover briefings began. The S&P 500 was down by 13% from its peak by the end of the week.

The benchmark index is up 8% this year.

Add Comment