(Bloomberg Opinion) — Earnings from both Sony Corp. and Nintendo Co. tell a similar tale: The games sector is looking soft.

Operating income for Sony’s games division declined 12% last quarter, while Nintendo’s fell 10%. A weakened outlook prompted Sony – which gets about 25% of its revenue from games – to cut its full-year sales forecast for that unit by 4.3%.

A global economic slowdown coupled with trade tensions mean that weaker discretionary spending shouldn’t be surprising. Yet one thing neither company can do is blame China.

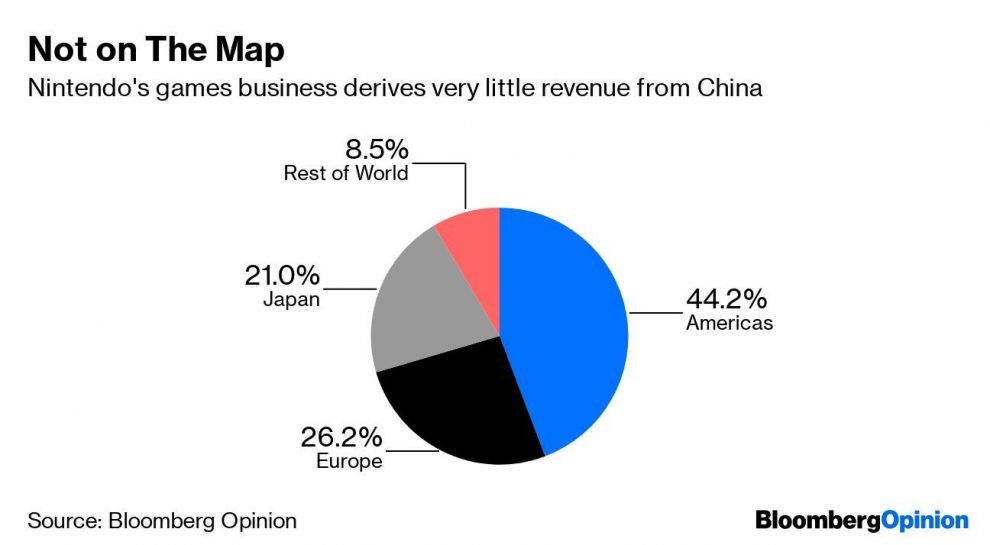

The reason is simple. The country barely features in their revenue breakdowns. Nintendo, whose entire revenue portfolio is tied to games, last year got less than 9% of its sales from a geographical sector called Rest of the World that includes China. Sony, which has a much broader revenue base, garners about 9% from China alone.

There’s a historical reason for this. For 15 years, China banned games consoles altogether. The explanation centered on a belief that games were bad for children and society in general. PC games largely escaped the ban. Today, not only are games welcome in China but various levels of government are actively encouraging entire economies be built around the sector, as my colleague Shuli Ren outlined recently.

The unintended (or perhaps intended) consequence was that by the time consoles were allowed in 2015, the broader sector was dominated by PC games, with Tencent Holdings Ltd. the largest purveyor.

Four years since the ban was lifted, consoles still haven’t made headway while more powerful smartphones make mobile the new engine of growth. I suspect that one reason why consoles haven’t been able to win even a minor slice of the market is the ongoing distrust between China and Japan, which dominates consoles.

Nintendo at least seems to have recognized the headwinds it faces and in April announced it would work with a local partner to release its Switch console in the country. That partner: Tencent.

An announcement from Qualcomm Inc. this week indicates that the U.S. company may also see some potential there, as well as the importance of hooking up with the biggest name in games. A press release announcing that it’s tying up with Tencent came a little out of left field. We’re talking about a U.S. chip designer and a Chinese games and social-media provider. Not a lot of obvious synergies there.

The statement included a lot of buzzwords like “cloud,” “AR/VR,” “5G” and “optimization.” But one item stood out: “Qualcomm Snapdragon-based mobile gaming devices.” Snapdragon is the brand name of its smartphone processor products first launched 12 years ago. A few years ago, Qualcomm extended the lineup to power lightweight laptops. Any smartphone or laptop with Snapdragon, of which there are millions, is in fact a Snapdragon gaming device.

This hints at something more. It’s entirely possible that Tencent and Qualcomm will jointly develop a smartphone, or a games console, or both. Internet companies have tried to make their own phones before. History probably won’t be kind to Facebook Inc. and Amazon.com Inc. in this regard. But given Tencent’s long-standing rapport with its gaming customers and a pent-up demand for a stand-alone portable gaming device, there’s good reason to believe they’ll consider giving it a shot. Qualcomm didn’t respond to a request of comment as of the time of writing.

Tencent has largely avoided delving into physical sales, preferring to remain an internet company. Its tie up with Nintendo suggests that it sees potential not only in another platform beyond PCs and mobile, but in dabbling in hardware. A collaboration announcement with Qualcomm, no matter how vague, hints at the possibility of the Chinese giant going it alone.

Doing so would be wonderful for Qualcomm. An antitrust suit in China four years ago and growing competition from clients such as Huawei Technologies Co. and Samsung Electronics Inc. leaves the U.S. company looking for new ways to ply its wares in the world’s biggest smartphone market and second-largest games market.

Collaboration and cooperation are well and good, but don’t mean much unless they can help move more Qualcomm silicon. Although sorely needed, it’s unlikely that Sony or Nintendo will make a big push into China’s console market. But that doesn’t mean Qualcomm shouldn’t weigh in.

To contact the author of this story: Tim Culpan at [email protected]

To contact the editor responsible for this story: Patrick McDowell at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tim Culpan is a Bloomberg Opinion columnist covering technology. He previously covered technology for Bloomberg News.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”67″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Add Comment