An extra $24 a month. That’s how much the average Social Security recipient will get in 2020. That’s according to the Social Security Administration, which said Thursday that the cost-of-living-adjustment (COLA) is being bumped up 1.6%.

Read: Social Security Administration announces lower COLA than in past two years

That pushes the monthly take for the average retiree past the $1,500 mark for the first time, to $1,503, or $18,036 a year. Some 63 million Americans get Social Security and 8 million get Supplementary Security Income (SSI benefits). Some get both. It is also the nation’s largest children’s program, too.

That so many Americans are touched by this gargantuan program makes me wonder this: With the presidential campaign in full swing, how come entitlement spending—about 60% of the entire federal budget—isn’t getting much discussion? It should. Such spending is exploding, fueled by 10,000 baby boomer retirements a day and by seniors who are living longer, often far longer.

In this column, I’ll focus on Social Security and what the leading candidates are saying (I’ll discuss Medicare in a future column).

First this essential info: The two trust funds that pay Social Security’s benefits—the Old-Age and Survivors Insurance (OASI) and the Disability Insurance (DI) trust funds—are running out of money. Come 2035, payouts, which are tied to tax revenues, will have to be cut. The Social Security Administration’s trustees warn future beneficiaries could get about 75% of scheduled benefits.

Now, the top candidates:

President Trump says publicly that he is committed to protecting Social Security. But privately, Trump has talked about reforming it in a second term, claims Sen. John Barrasso (R-Wyoming).

What does “reforming” mean? What do you think it means? Cuts. Here, the president finds some powerful company in Mitch McConnell, the Senate Majority Leader, who has made no secret of wanting to cut entitlements, which be blames—not tax cuts—for running up the deficit.

We’ve already gotten a preview of this with Trump’s own budget proposals, which have urged cuts to both Social Security, Medicare and Medicaid. He has left other breadcrumbs. Years before running for president, he wrote that Social Security eligibility ages should be raised, and that the program itself could be privatized.

Among Democrats, former Vice President Joe Biden has spoken little of Social Security. But his long career in public service offers hints of what he would do in the White House. He has previously suggested means testing for benefits, raising the full retirement age (currently 66 years and 2 months for people born in 1955, rising to 67 for those born in 1960 or later) and/or increasing the cap on payroll tax earnings (which rises next year to $137,700). That each of these ideas involve inflicting pain on voters helps explain why Biden’s not saying much about it.

Massachusetts Senator Elizabeth Warren, who, along with Biden, leads the still-crowded Democratic field, has also spoken of these ideas. But she also has a new and ambitious idea: to give every current and future Social Security recipient a huge boost: An extra $2,400 a year, which would cost, she estimates, $150 billion a year. How on earth would this be said for? Her answer: a new 14.8% tax on ultra high-income earners.

The problem with proposing a specific idea is that it opens you up to specific criticism, and in this case, it comes from John Cogan, a senior fellow at Stanford University’s Hoover Institution. Writing in The Wall Street Journal, he says such an idea should be limited only to those recipients who live below the federal poverty line—in other words, means testing. There’s no need, he says, to shower anyone else with cash.

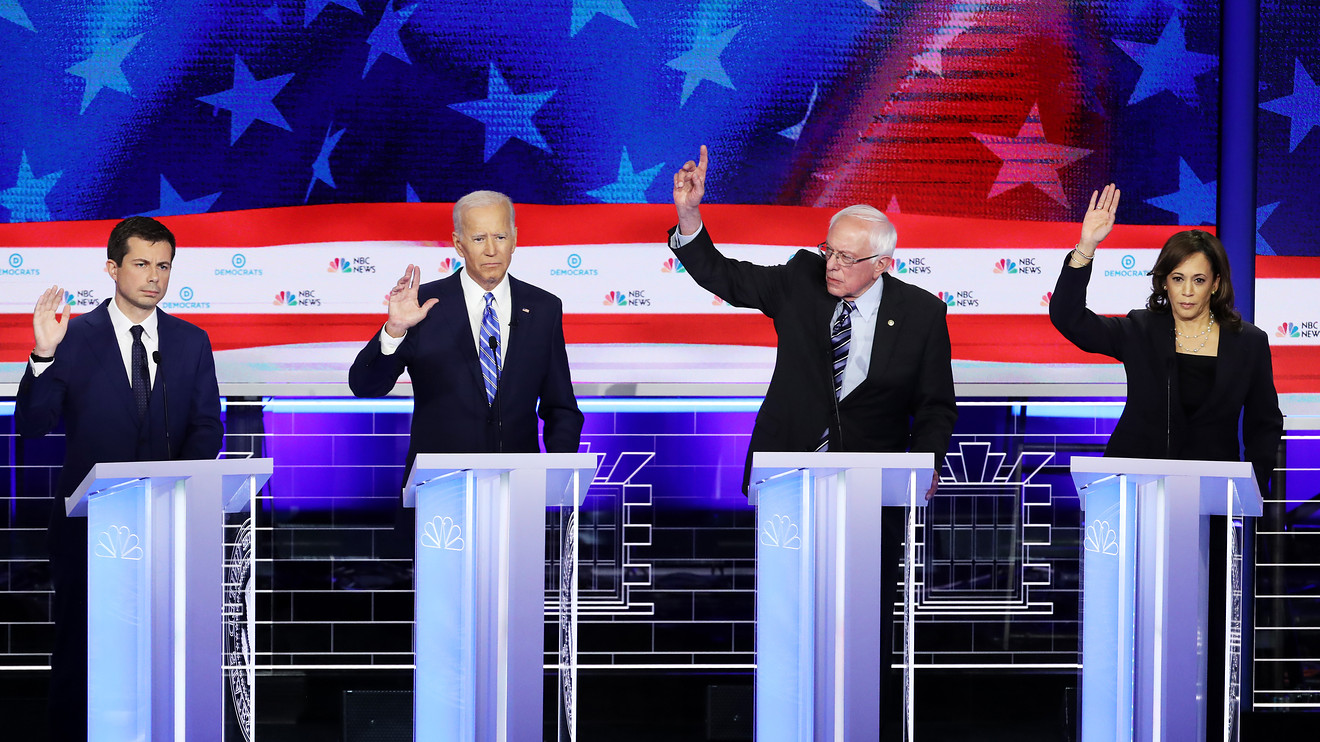

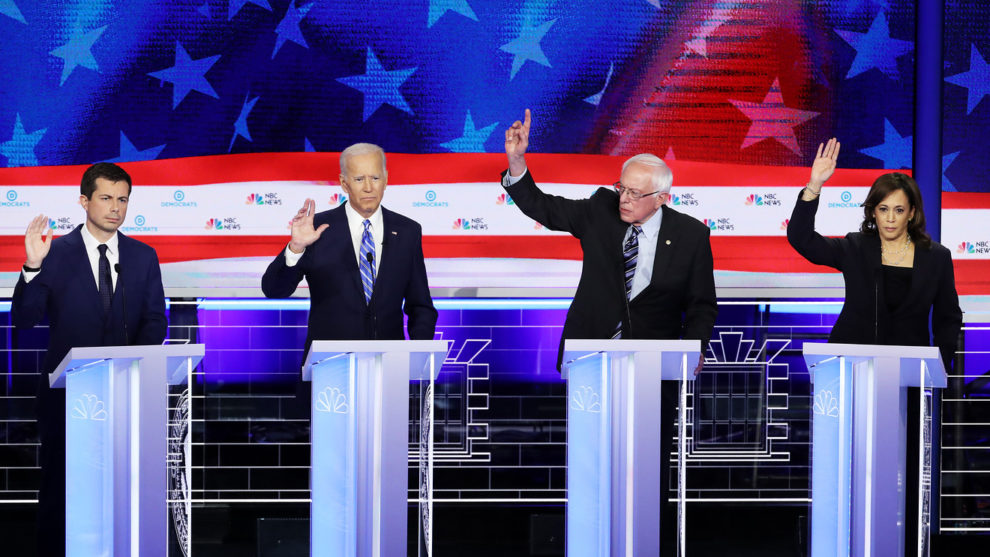

There’s little daylight between ideas floated by other leading Democrats, including senators Bernie Sanders of Vermont, Kamala Harris of California and South Bend, Indiana Mayor Pete Buttigieg. All also generally favor shoring up Social Security in ways described above. Meantime, outsider Andrew Yang has proposed something entirely new: a “Universal Basic Income” of $1,000 a month, to be paid for by taxing corporations. It’s rather murky, because recipients might have to trade a portion of existing entitlement benefits to get it. Here’s a mire detailed look I wrote about this a few weeks ago.

Nancy Altman of Social Security Works, an advocacy group, says if you’re looking for stark differences on this vital program, don’t look for them between Democrats, but between Democrats and President Trump.

“There is a stark difference between the parties,” she tells me, “and even if you believe Trump’s ‘no cuts’ claim, that’s quite different than what Democrats want to do, which is expand Social Security.”

Add Comment