(Bloomberg Opinion) — It’s hard to believe after Snap Inc.’s shambolic stumbles over the last two years, but the company truly looks to be on the right road.

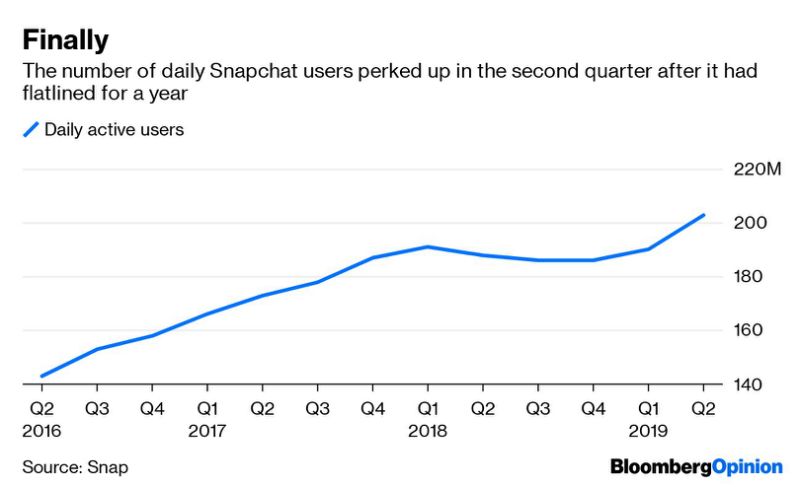

Snap said on Tuesday that its Snapchat app increased the number of daily users in the second quarter at a rate not reached since before the company’s 2017 initial public offering. Importantly, Snap offered evidence that its long-promised revamp of its Android app was keeping people more active and engaged. And revenue, particularly in the all-important U.S. advertising market, rose at a rate that investors should expect from an eight-year-old company but that Snap has not delivered regularly.

It’s too soon to declare mission accomplished for Snapchat, but the second-quarter results — assuming they were not a blip — validate decisions made by Snap management and show that even in the unforgiving consumer internet surf, companies are capable of picking themselves up from largely self-imposed wipeouts. (See also: Twitter.)

A recovery was an outcome that was hard to believe after Snapchat pushed through a reviled redesign of its app that it may not have thought through clearly; CEO Evan Spiegel used up executives like facial tissues; the company couldn’t seem to set sensible priorities; and an emboldened Facebook Inc. copied many of Snapchat’s alluring features and stole the affection of many of its fans.

It’s still possible that the recovery is not real and that Snapchat loyalists will devote more of their attention to Facebook’s Instagram, YouTube and the short-video site TikTok. Snap investors have also driven up Snap’s stock this year — it has nearly tripled in 2019, although shares before Tuesday’s earnings results remained below the 2017 IPO price.

The share rebound this year has made Snap’s stock a pricey investment. As of the U.S. market close on Tuesday, stock buyers were paying about 11 times the company’s expected revenue in the next year. That valuation will most likely jump after Snap’s stock price surged 11% in after-hours trading on Tuesday.

I’m cautious about Snap because of its incoherent management decisions, lack of accountability and eye-roll-inducing hubris. I’m not entirely convinced that Snapchat’s audience will be very big and that an app used mostly for messaging will have a lasting business without significant changes.

But Snap deserves credit for what it has done right, including recent features such as a gender-swap filter that hew to its dumb fun ethos, a growing lineup of short-video entertainment series and emerging options for businesses to sell products on Snapchat. It’s also healthy if Snap succeeds. It’s good to have strong alternatives to Google and Facebook for people’s time and advertisers’ budgets, and frankly we should all want companies with novel product ideas like Snap to find financial reward.

Snap has been a genuinely creative product hampered by its management and aggressive rivals. Don’t call it a comeback yet for Snap. Let’s just say the company may finally be capable of fulfilling its potential.

To contact the author of this story: Shira Ovide at [email protected]

To contact the editor responsible for this story: Daniel Niemi at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Shira Ovide is a Bloomberg Opinion columnist covering technology. She previously was a reporter for the Wall Street Journal.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”35″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Add Comment