Trying to understand the millennial generation is not always an easy task, but trying to comprehend their fascination with Snapchat is even more challenging. Snapchat is a multimedia instant messaging app and service developed by Snap Inc. (NYSE:SNAP). One of the key features of the app is that pictures and messages are usually only available for a short period of time before they become inaccessible to their recipients.

Snap defines itself as a camera company operating on a global basis. The core product is Snapchat, which is essentially a camera application on a smartphone with functionalities such as camera, communications, Snap Map, stories and Spotlight that allow users to communicate through short videos or images. It also offers Spectacles, which is an eyewear product that connects with Snapchat and captures photos and video from a human perspective. The company derives revenue primarily from advertising, in which companys target the younger generations.

Founded in 2010, Snap is expected to generate over $4 billion in revenue this year. The company went public in 2017 and currently has a market capitalization of $15 billion.

Popularity and growth

Snapchat has amassed a large and loyal group of active users since its inception. There are approximately 363 million daily active users on the app every day on average. Over 250 DAUs engage with augmented reality features every day. There are over 6 billion AR Lens plays per day and over 250,000 Lens users have used the Lens studio to create content. Over 75% of people aged 13 to 34 in over 20 countries currently use Snapchat.

The penetration based on users per number of smartphones available is 25% in North America and only 7% for the rest of the world, leaving plenty of opportunities for growth. Forty different languages are currently being supported on the app.

Financial review

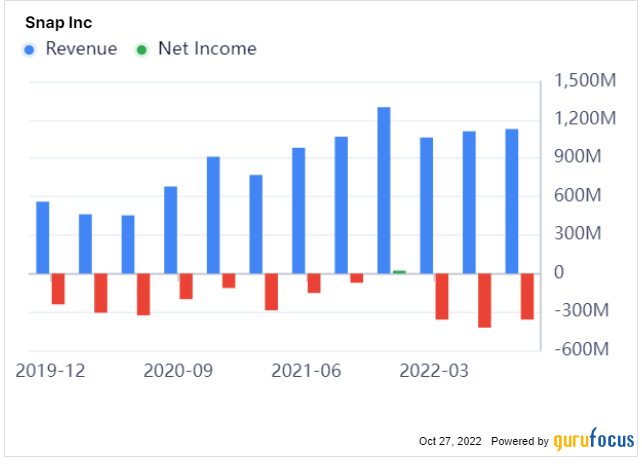

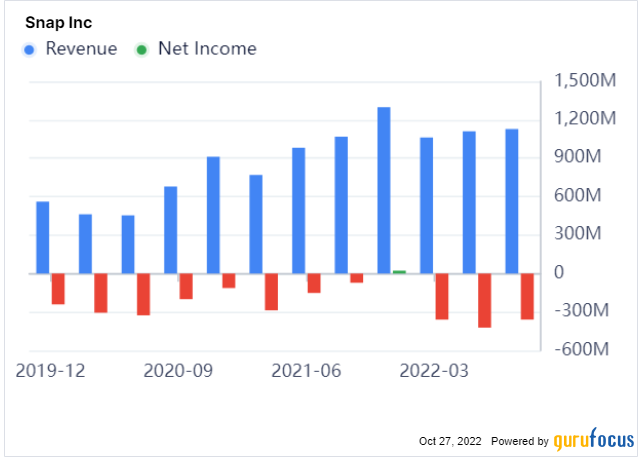

The company reported disappointing third-quarter results last week, with revenue increasing only 6% and a net loss of $359 million, which included $175 million in restructuring charges. Adjusted Ebitda was $72 million, but that adds back a massive amount of stock compensation totaling $343 million. Many analysts and companies leave out stock compensation when reporting financial results, but, as Warren Buffett (Trades, Portfolio) famously said, If compensation isn’t an expense, what is it? And, if real and recurring expenses dont belong in the calculation of earnings, where in the world do they belong?

Snap is still a long way away from generating meaningful GAAP profits.

The companys balance sheet is in reasonably good shape with cash and investments of $4.4 billion. However, the company also holds convertible bonds totaling $3.7 billion. With a strike price significantly above current prices, this busted convert should be treated like debt. The good news is the interest rate on these notes are very low.

DAUs were 363 million in the third quarter, an increase of 57 million or 19% year over year. The number of DAUs increased sequentially and year over year in each of three major regions – North America, Europe and rest of world. Further, the total amount of time spent watching Spotlight content grew 55% compared to the prior-year period. However, the company is having a hard time monetizing its large and growing user base as average revenue per user has fallen to $3.11 in the most recent quarter from $3.49 a year ago.

Valuation

There are no positive GAAP earnings per share estimates from analysts for many years out. Even using adjusted earnings per share and adjusted Ebitda, the company is selling at over 60 times earnings and over 100 times Ebitda.

Price-to-revenue calculations are the only relevant tool here and one analyst is calling for a price target of $11 based on 4 times 2023 revenues.

The GuruFocus discounted cash flow calculator creates a value close to today’s stock price using next year’s adjusted earnings of 36 cents per share as the starting point and a 15% long-term growth rate.

Guru trades

Gurus who have purchased Snap stock recently include Ray Dalio (Trades, Portfolio)’s Bridgewater Associates, Philippe Laffonnt, Paul Tudor Jones (Trades, Portfolio) and Jim Simons (Trades, Portfolio)’ Renaissance Technologies. Investors who sold out of or reduced their positions included Spiros Segalas (Trades, Portfolio), Baillie Gifford (Trades, Portfolio) and PRIMECAP Management (Trades, Portfolio).

Conclusion

Snapchat is an innovative and popular social media and communication tool that is in its early stages of growth. Its addressable market is large and penetration rates on a global basis are still relatively low. However, there is increasing competition, weakening time spent trends and an inability to monetize its user base.

Additionally, these social media apps always face the threat of obsolescence as the next hip thing comes along. I do not think Snapchat will be the next MySpace, but the price to pay for that risk is much lower than today’s stock price.

This article first appeared on GuruFocus.

Add Comment