(Bloomberg) — Social media stocks are on course to shed more than $100 billion in market value after Snap Inc.’s profit warning, adding to woes for the sector which is already reeling amid stalling user growth and rate-hike fears.

Most Read from Bloomberg

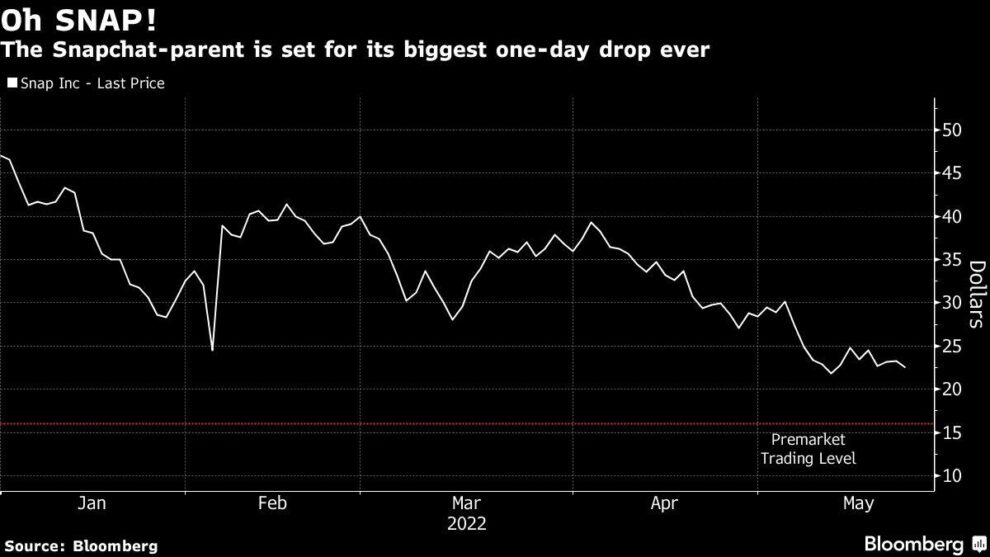

Shares in digital ad-dependent Snap are set for a record one-day drop, down 29% in premarket trading. If that move holds, the company will lose $11.4 billion in value. Added to the value of premarket declines for peers including Facebook-owner Meta Platforms Inc., Google-owner Alphabet Inc., Twitter Inc. and Pinterest Inc., the group may see a $104 billion wipeout.

“At this point, our sense is this is more macro and industry-driven versus Snap specific,” Piper Sandler analyst Tom Champion wrote in a note.

Others on Wall Street agreed, with RBC Capital Markets analyst Brad Erickson noting that the read for the digital advertising space is broadly negative with Meta and Alphabet likely best insulated among the group.

And analysts said the warning implied a fast deterioration in the economic environment as Snap said in late April that its business was growing at 30%. The owner of the Snapchat app, popular with young people for sending disappearing messages and augmenting videos with special effects, now expects revenue and profit below its April outlook.

Premarket moves for the group are weighing on Nasdaq 100 futures, which fell 2% on Tuesday and are set to reverse most of Monday’s advance for the gauge. The tech-heavy index is down 26% this year, wiping several hundred billions in value from the likes of Apple Inc. to other so-called growth peers like Netflix Inc.

Snap and platforms like Facebook are competing for ad dollars at a challenging time. Advertisers are facing a shaky economy as well as recent privacy changes, such as Apple’s tracking restrictions, which have slowed businesses that were booming during much of the pandemic.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Add Comment