Some 40 million people have had their student-debt payments paused because the government thinks they need the help. But one big financial technology company, which refinances student loans, disapproves of the public policy and wants the payments resumed immediately to help its bottom line.

SoFi Technologies, a financial technology company involved in the student loan refinancing business, is suing the Department of Education over the student loan payment pause.

In a suit filed in federal court late last week, the company alleges that the latest extension of the COVID-era pause on student loan payments, interest and collections “is unlawful on multiple grounds.” The company is asking the court to invalidate and set aside the pause, or at a minimum, require student loan borrowers who aren’t eligible for the Biden administration’s debt relief plan to start repaying their loans.

SoFi SOFI, -0.60% claims the payment pause has hurt the company’s profitability. As part of its business, the company offers to refinance borrowers’ federal student loans, theoretically at a lower interest rate. In its complaint, the company says that before the payment pause began in March 2020, SoFi originated $450 million to $500 million in refinanced federal student loans per month. In 2022, SoFi was originating about 10% of the volume in refinanced loans compared to 2019, according to court documents. The company lost as much as $400 million in total revenue since the payment pause started and up to $200 million in profits, SoFi claims.

“The Moratorium has eliminated the primary benefits of student loan refinancing,” the company wrote of the payment pause in court documents.

In its complaint, SoFi alleges that the HEROES Act, a 2003 law that allows the Secretary of Education to take steps to ensure student-loan borrowers won’t be left financially worse off in a natural disaster, or national emergency, doesn’t authorize the latest extension of the pause, which the Biden administration announced in November. At that time, officials said they would continue the freeze on payments and collections until 60 days after a court rules on the legality of the Biden administration’s debt forgiveness plan or 60 days after June 30, 2023, whichever comes first.

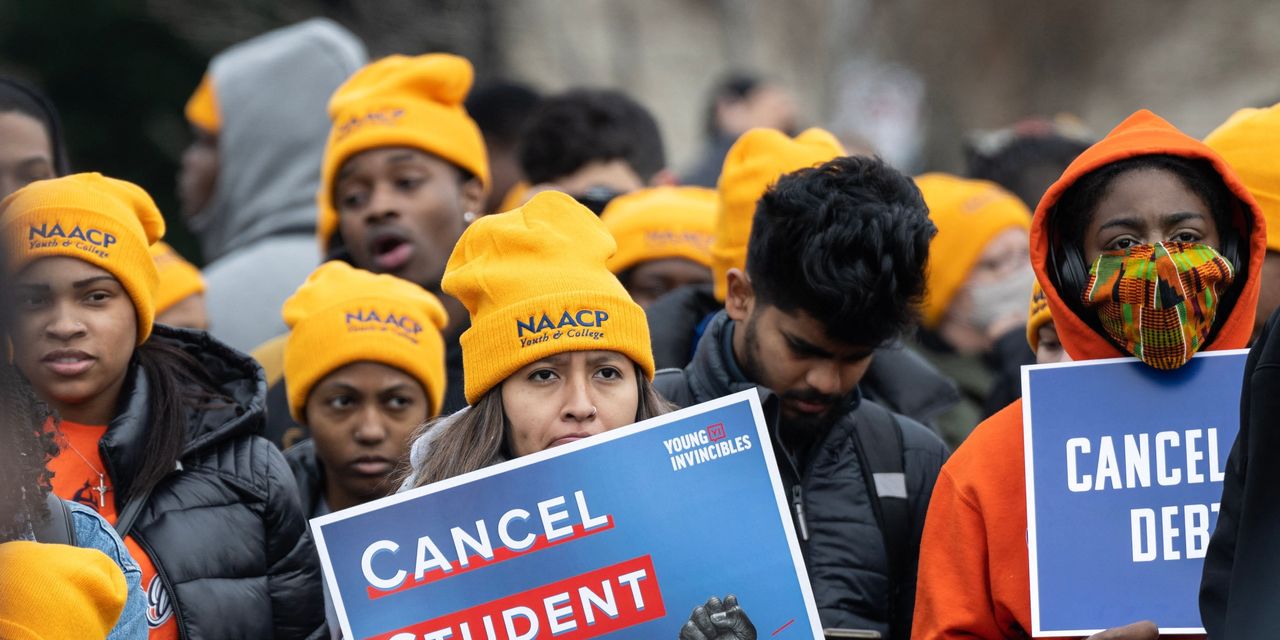

Last week, the Supreme Court heard oral arguments in two cases challenging the Biden Administration’s debt relief plan, which would cancel up to $20,000 in student debt for a wide swath of borrowers. SoFi echoed some of the arguments made by the plaintiffs in those cases in its lawsuit, saying that the relief offered through the payment pause isn’t as targeted as Congress intended when writing the HEROES Act.

The Biden administration has maintained that Congress authorized the Secretary of Education to carry out a debt relief cancellation program of this size through the HEROES Act. The Department of Education didn’t immediately respond to a request for comment on the SoFi suit. But during oral arguments last week, Elizabeth Prelogar the Solicitor General of the United States, who was representing the Biden Administration, said the payment pause “is right in the heartland of what the HEROES Act aimed to do.”

“It was critical relief that was rushed out at the beginning of this devastating pandemic to ensure that we didn’t see spikes in delinquency and default across the nation,” Prelogar said.

SoFi also invoked the major questions doctrine in its complaint, a legal theory at issue in the two cases before the Supreme Court. The major questions doctrine is relatively new, but when the court led by Chief Justice John Roberts has employed it in the past, they’ve found it to mean that an executive agency is overstepping its authority unless Congress explicitly authorized an action.

“The major questions doctrine requires ‘clear congressional authorization’ before an agency is allowed to claim such extraordinarily broad power,” SoFi’s complaint reads. “No such clear authorization exists here.”

Last week, the Biden administration urged the Supreme Court not to analyze the student loan cases through the major questions lens, arguing that the threshold should only apply to situations where the government is regulating — not where it’s providing a benefit.

During oral arguments last week, the Supreme Court’s conservative majority seemed skeptical of the Biden administration’s student debt relief plan. Despite that setback, experts say there are ways the plan could still survive.

Add Comment