(Bloomberg Opinion) — In the glossary of business jargon there’s a term beloved by financial analysts but that journalists find especially grating: the “equity story.”

It’s the sort of non-speak that can be explained far more simply: Why should you invest in a given company? That’s something that WPP Plc Chief Executive Officer Mark Read, an operations guy, has yet to answer adequately when it comes to the firm he took over a year ago from Martin Sorrell, something of a finance wonk.

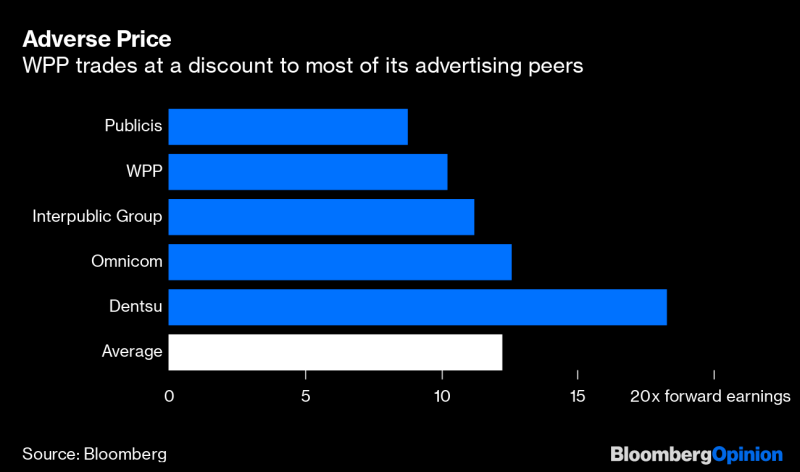

The task should sit at the top of priorities for John Rogers, the retail executive appointed as WPP’s new finance chief on Tuesday. That’s not to say that Read hasn’t been busy since taking the helm of the world’s largest advertising holding company. He’s clinched deals to sell assets worth 3.6 billion pounds ($4.4 billion), merged divisions to cut costs and improve efficiency, and stanched some of the revenue declines in North America. The share price has recovered to outperform archrival Publicis Groupe SA since Read announced 2021 growth targets in December.But the London-based company’s shares are still trailing its other major peers — Omnicom Group, Interpublic Group and Dentsu Inc. — when compared to expectations for earnings a year out. Investors are hungry to understand just how WPP’s new guard will translate all of that action into solid, durable growth.

Read’s predecessor Sorrell had a seemingly straightforward formula to deliver just that. He promised investors annual earnings per share growth of between 5% and 10%, a pledge he tended to keep until recent years. He did so with a personal recipe of strict targets for organic revenue growth, profitability improvements, stock buybacks and acquisitions and a little sugar on top, a 50% dividend payout ratio. The approach kept shareholders happy and the stock steadily ticking upwards for years.

Echoing that formula isn’t realistic in the current era. A shift toward digital marketing on platforms such as Google and Facebook and the incursion of consultancies into the advertising market means dependable revenue growth is far harder to realize. And knuckling down on costs can make it yet harder still. In an attempt to keep the focus clear, Read changed WPP’s bonus policy to place greater emphasis on sales growth than profitability improvements.

Rogers, who will join from U.K. grocer J Sainsbury Plc where he had been CFO for 6 years, has a difficult act to follow at WPP. Paul Richardson had a lower public profile than Sorrell, but he led WPP’s finance operations for 23 years. The firm generated an average return of 10% a year in that period.

Rogers’s more recent background running Sainsbury’s Argos general-merchandise retail division, which it acquired in 2016, should serve him well, according to media consultant Alex DeGroote. It’s given him valuable experience integrating businesses and managing a vast property portfolio. But a lack of experience in the advertising industry and in North America mean he’s unlikely to be tasked with fixing WPP’s operations in the U.S. and Canada, where revenue declines have dragged down the rest of WPP.

His main role will therefore be to help Read crystallize a realistic vision for the company that can reinvigorate investors. Optimism is currently muted: analysts’ average 12-month target price is just 8% above the level at which WPP is currently trading. If Read is making the necessary operational improvements, Rogers needs to help turn that into a better story.

To contact the author of this story: Alex Webb at [email protected]

To contact the editor responsible for this story: Melissa Pozsgay at [email protected]

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Alex Webb is a Bloomberg Opinion columnist covering Europe’s technology, media and communications industries. He previously covered Apple and other technology companies for Bloomberg News in San Francisco.

<p class="canvas-atom canvas-text Mb(1.0em) Mb(0)–sm Mt(0.8em)–sm" type="text" content="For more articles like this, please visit us at bloomberg.com/opinion” data-reactid=”52″>For more articles like this, please visit us at bloomberg.com/opinion

©2019 Bloomberg L.P.

Add Comment