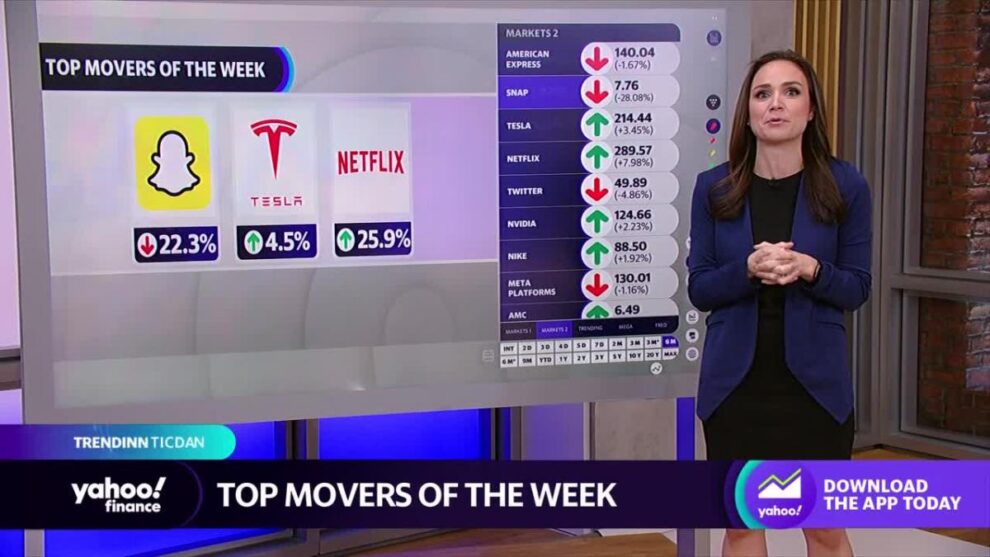

Yahoo Finance’s Seana Smith breaks down the top tickers for the week.

Video Transcript

SEANA SMITH: Let’s take a look at some of the biggest movers of the week. First off, Snap. Now it moved on the heels of its earnings report. The company posted a further slowdown in sales in its most recent quarter. And it also signaled no growth here going forward. When you take a look at Snap shares, closing the week well in the red. The five-day chart there, you can see it off just around 22%. It’s the latest sign that advertisers are still cutting back on spending. The disappointing results dragging some competitors lower today. Meta and Pinterest, both of those stocks ending the day in the red. You can see that off just over 1%. Pinterest, on the other hand, off 6 and 1/2%.

Another big mover of the week is Tesla. Now shares sank after the company missed on third quarter revenue and warned that deliveries may fall just short of that 50% annual growth target. Despite that miss, CEO Elon Musk, he, of course, remained upbeat on the earnings call, telling analysts that Tesla remains, quote, “pedal to the metal,” even as a potential recession looms. Now shares fell about 6% on Thursday, but taking a look at the week to date chart, you can see it up still in the green, up just around 4.6%, selling the week at 214.44 a share.

Now let’s round it out with Netflix. The stock also moving on earnings, but this time, a surprise beat on subscriber growth is sending the stocks soaring. Now, shares soared about 13% earlier this week. It’s been a top performer in the S&P. This coming after the gain of 2.4 million new users during the third quarter, more than double what they had just projected a quarter ago. The streaming giant also giving details on how it plans to crack down on password sharing. Take a look at this five-day chart. You can see the shares up 25%, selling the week at 289.57. On a year to date basis, though, still well in the red, with shares off just over 50%.

Add Comment