Yahoo Finance Live anchor Seana Smith highlights four stocks to watch in after-hours trading.

Video Transcript

SEANA SMITH: Dave, well, let’s take a look at some of these movers here after hours. We’ve been talking a lot about Airbnb. Shares off now right around 8%, around $106 a share. The results were actually relatively strong. Topline number coming in, in line with expectations at 2.1 billion. It was the strongest quarter, a record breaking quarter for the company in terms of bookings, just over 103 million. Most profitable quarter ever here for the company. Free cash flow of 795 million. Maybe some of that good news was already baked into this stock. We’re seeing that reaction this afternoon.

All right, let’s take a look at Robinhood. Shares off just about 1%. Now earnings were out, 318 million for the quarter, missing the Street’s estimates. Monthly active users also coming in a bit light at 14 million. The big news out, though, is the fact that Robinhood will be reducing its head count by 23%. CEO Vlad Tenev blaming, quote, a deterioration of the macro environment, saying that the employees that are laid off are going to find out via Slack and email for resources and support of this news. But again, the stock off just about 2% here after hours. 23% of its head count is being reduced.

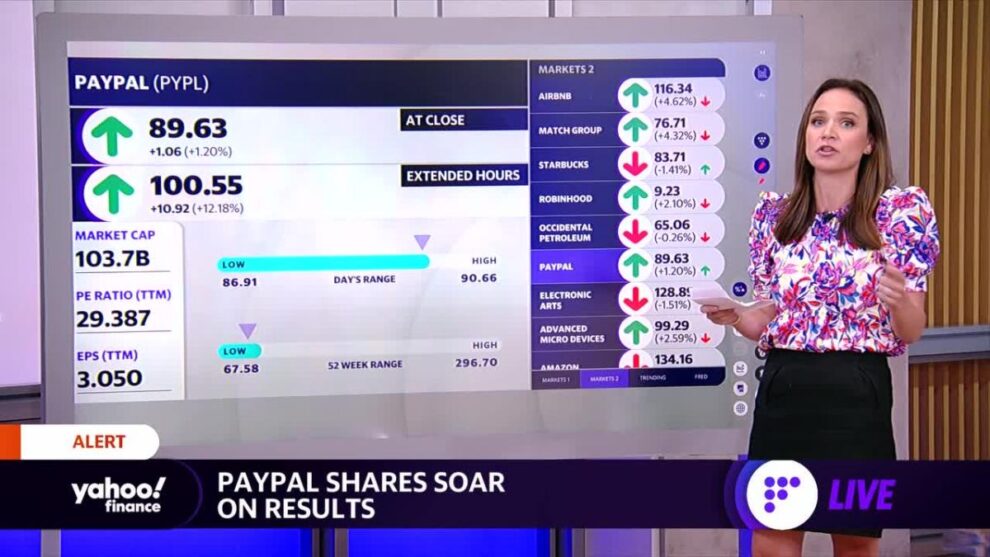

Let’s take a look at PayPal here. Shares popping after hours, up just about 12%, authorizing a $15 billion share buyback. Also the fact that Elliott has invested $2 billion in the company. They see full year active customer accounts added to about 10 million. That was in line with expectations. Total payment volume during the quarter, 339.79 billion. The estimate was for 344 billion, so a slight beat there. But I think a lot of the focus is on that share buyback and also the fact that Elliott has invested $2 billion in the company.

Let’s take a look at Match Group. Now, shares falling here, off just about 23%. The headline numbers aren’t that troubling. Revenue up 12% from a year ago, 795 million. Taking a look at some of these other numbers here, Tinder revenue there up 13% year over year. Yet, we’re seeing the disappointment here in shares with the stock off just about 24%.

I also want to draw your attention to Microstrategy’s Michael Saylor is stepping down from his role as CEO, will shift to an executive chairman role. And now Phong Le, who previously served as the company’s president, CFO, and COO, is going to become the new CEO. Saylor, who was behind Microstrategy’s amassing of billions in Bitcoin, will still serve as chairman of the board, in addition to his new role.

Add Comment