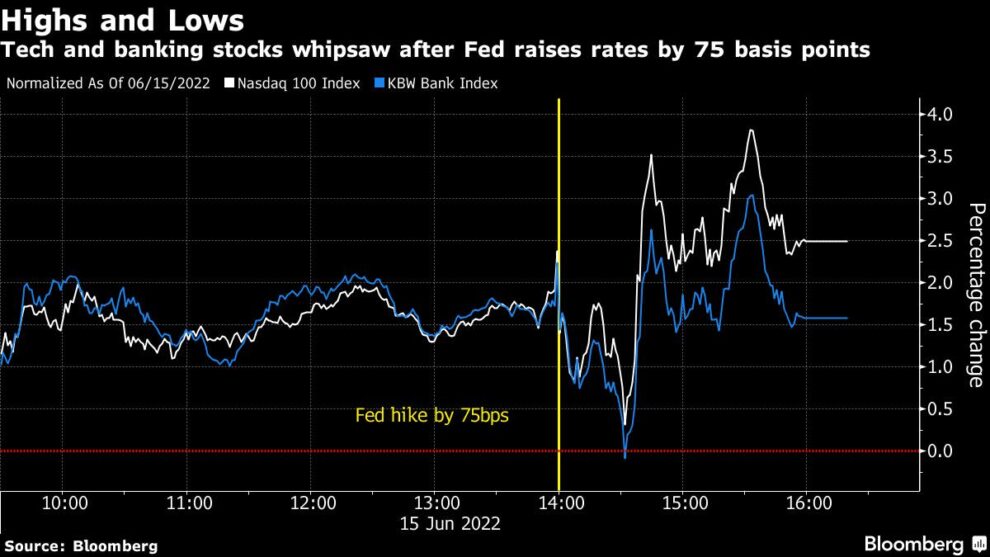

(Bloomberg) — Technology and financial stocks got a boost on Wednesday after the Federal Reserve raised rates by the most in nearly three decades but it ruled out signs of a broader economic slowdown.

Most Read from Bloomberg

The tech-heavy Nasdaq 100 Stock Index rallied 2.5%, the most in nearly two weeks, led by beaten down stocks such as Netflix Inc. The KBW Bank Index of 24 financial stocks rose 1.6%, putting a halt to a five-day losing streak.

Stocks waffled in the aftermath of the Fed’s announcement but later extended gains notched earlier in the day after Chair Jerome Powell said he doesn’t expect Wednesday’s 75-basis point rate increase to become a common occurrence and that he didn’t see signs of a broader slowdown in the economy.

“As far as the initial reaction, we were probably sated with what we got,” said Sameer Samana, senior global market strategist at Wells Fargo Investment Institute. “There are some spots within equities that look attractive.”

Netflix and Amazon.com Inc., which have seen their stocks pummeled this year amid slowing growth and soaring US Treasury yields, posted the biggest gains in more than a month. Netflix jumped 7.5% and Amazon rose 5.2%.

Read more: Apple’s $2 Trillion Market Valuation on Shaky Ground: Tech Watch

In the banking sector, Citigroup Inc. was among the biggest advancers with a gain of 3.5% while Bank of New York Mellon Corp. rose 3.1%. While rising interest rates are typically seen as a boon for lenders, the threat of a recession has weighed heavily on the sector since mid-January. All six of the largest US lenders remain lower by 20% or more this year.

“This Fed rate hike and likely additional ones should help traditional banking revenues grow at the fastest pace in four decades over the next couple of years,” said Wells Fargo banking analyst Mike Mayo.

(Updates with closing prices throughout, additional commentary and futures trading)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Add Comment