(Bloomberg) — Big investors love many things about Tesla Inc. Volatility isn’t one of them.

Most Read from Bloomberg

Despite a trillion-dollar valuation, pole position in the electric-vehicle business and entry to the S&P 500, the world’s sixth-largest listed company is subject to greater swings than any other U.S. megacap technology stock, with 21 daily moves of at least 5% to the upside or downside this year.

“It is not a name we would recommend to our clients,” said Edmund Shing, BNP Paribas Wealth’s chief investment officer, citing volatility brought about by high levels of interest among retail investors.

Tuesday’s sharp about-turn in the stock, without any fundamental catalyst, highlights the unpredictability. Tesla shares jumped as much as 4.3% in New York, despite a Monday postmarket disclosure that Chief Executive Officer Elon Musk had exercised options and sold more shares. The string of sales by Musk had caused the stock to fall about 15% since his Twitter poll asking followers whether he should sell shares, wiping nearly $200 billion off the company’s market value.

Tesla’s volatility has frequently spilled over to other EV stocks, making it a hallmark for the group. The most recent examples are a five-day rally in newly public Rivian Automotive Inc., taking its valuation past Volkswagen AG on Tuesday, and a 19% surge in Lucid Group Inc.’s shares after the company said it remained confident in its ability to produce 20,000 units in 2022.

Still, it’s hard to completely ignore a stock that’s up 47% in 2021, after surging more than eightfold the year before.

Shing recommends gaining exposure through exchange traded funds or other passive investing methods. “We prefer our clients to take indirect exposure that way, so as to benefit from some diversification and the offset to volatility that other stocks can provide.”

Indeed that’s been the general narrative in the latest regulatory filings from institutional investors. Hedge funds have increased the amount of exchange-traded funds in their portfolios in the third quarter, while decreasing their exposure to single stocks, according to 13F filings.

Retail’s Sugar Rush

Tesla’s addition to the S&P 500 late last year didn’t go down too well with institutional holders averse to volatility. They included Mark Stoeckle, chief executive officer and senior portfolio manager at Adams Funds.

With a 2%-plus weighting on the U.S. benchmark index, Stoeckle had to look beyond Tesla’s frequent wild swings and buy in, he said by phone.

At the other end of the spectrum, amateur traders have been gobbling up Tesla stock through call options — used to position for gains in stocks. According to Goldman Sachs Group Inc., Tesla and Amazon.com Inc. represented more than half of the single-stock options traded in early November.

But Musk’s near $8 billion stock sale might act as a deterrent, at least for now. “The recent fall might have put off some retail investors,” said Jim Dixon, a sales trader at Mirabaud Securities. The alternative for them is Rivian Automotive Inc., he said.

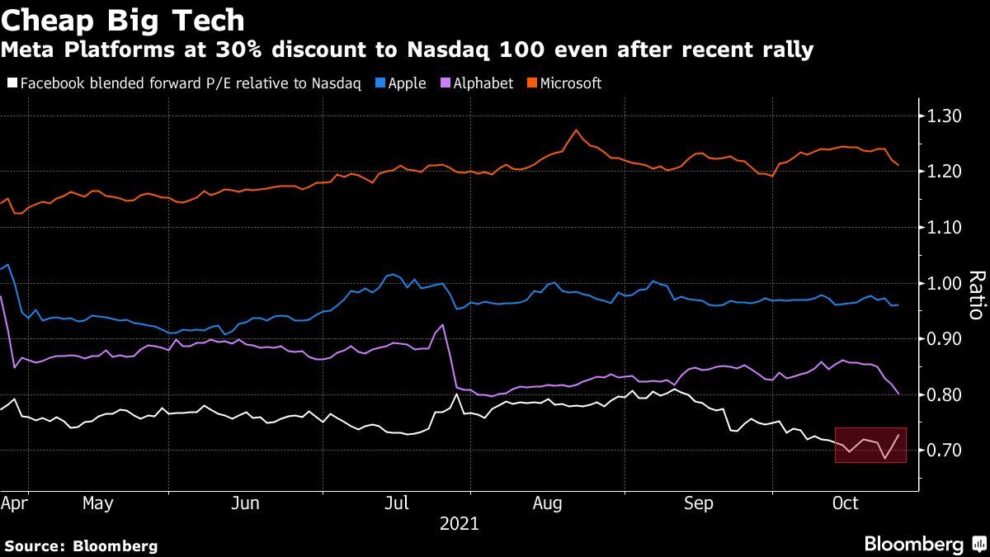

Tech Chart of the Day

Top Tech Stories

-

Epic Games Inc. Chief Executive Officer Tim Sweeney renewed his attack on Apple Inc. and Alphabet Inc.’s Google as the world’s dominant mobile duopoly before calling for a universal app store that works across all operating systems as the solution.

-

Cloud Village Inc., the music streaming arm of Chinese gaming giant NetEase Inc., is considering reviving plans for an initial public offering in Hong Kong, according to people familiar with the matter, having put the listing on hold earlier this year.

-

Asian gaming companies, including Tencent Holdings Ltd., got a boost following a media report that China’s regulators are set to resume approving new games.

-

JPMorgan Chase & Co. is suing Tesla for $162 million, seeking payment for warrants that expired above their strike price.

(Updates stock moves throughout, adds details in third and fourth paragraphs.)

Most Read from Bloomberg Businessweek

©2021 Bloomberg L.P.

Add Comment