The specter of antitrust action against four of the largest tech companies in the world has evolved into a parlor game among some in Silicon Valley: What antitrust suspect is the most vulnerable to a government-imposed action if it comes to that?

According to a range of experts contacted by MarketWatch, Facebook Inc. FB, +0.85% and Apple Inc. AAPL, -0.34% are most at risk if government regulators are serious about pursuing antitrust actions against Big Tech, though each of the four—Alphabet Inc. GOOG, +0.94% GOOGL, +1.09% and Amazon.com Inc. AMZN, -0.36% are the other two giants reportedly under scrutiny—face exposure in different ways from various agencies and countries.

“We’re finally getting to a place where we’re going to interrogate these unprecedented concentrations of information, and the power that accrues to them,” Shoshana Zuboff, a Harvard Business School professor and author of “The Age of Surveillance Capitalism: The Fight for a Human Future at the New Frontier of Power,” told MarketWatch.

She said Makan Delrahim, the Justice Department’s assistant attorney general, tipped his focus in a speech last week in Tel Aviv, assessing one or two “significant players” in internet search, social networks, mobile and desktop operating systems, and electronic book sales.

See also: DOJ antitrust chief warns Big Tech, noting Standard Oil parallel

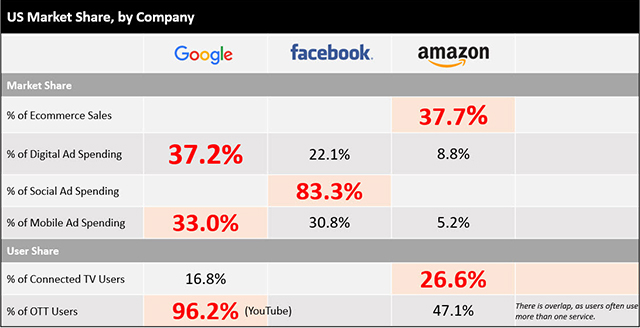

“Just two firms (Google and Facebook) take in the lion’s share of online ad spending,” Delrahim noted. (Market researcher Gartner estimates Google and Facebook will command 75% of digital ad revenue world-wide by 2020.)

Each of the four companies could be penalized to some degree—from injunctive (Apple) to structural (Facebook)—but a breakup of any kind is “highly unlikely,” says Herbert Hovenkamp, a professor at the University of Pennsylvania who teaches at both its law and business schools.

Those who closely follow U.S. regulators don’t expect radical changes but prescriptive measures that mollify lawmakers and privacy advocates. The big investment banks seem to be operating under the same presumption. For now, none of the four companies under regulatory scrutiny have received downgrades from top-level Wall Street firms.

For more: Analysts say not to worry about Big Tech’s antitrust investigations

One reason may be that while European regulators have a mandate to protect small companies, their U.S. counterparts focus on “consumer welfare” so it might be hard to argue lower prices (in the case of Amazon) or better products (Google, Apple and Facebook) are hurting consumers, Jefferies analyst Brent Thill concluded in a June 12 note.

However, at the very least, they all could endure yearslong depressed market values, as International Business Machines Corp. IBM, +0.25% and Microsoft Corp. MSFT, +0.01% did before them when they were targets of federal antitrust probes, as Goldman Sachs pointed out in an analysis last week.

“We believe that not all FAANGs will survive this battle,” Needham analyst Laura Martin wrote in a June 17 note, noting a widely used acronym for large tech companies. “The fact that the FTC now has jurisdiction over Facebook and Amazon weakens their position as an investment alternative vs. Apple and Google (DOJ jurisdiction).”

MarketWatch asked Hovenkamp, Zuboff, and other experts to assess the regulatory threats for all four companies. They are listed here in order of consensus risk that some type of action will be taken.

The 15-year-old company has achieved its status as the de facto social-media option for more than 2 billion members, allowing it to devour 83% of U.S. social ad spending this year, according to eMarketer, in part through acquisitions.

Tim Wu, a professor of law, science, and technology at Columbia University professor, estimates Facebook snapped up at least 92 companies—many of them competitors that included WhatsApp and Instagram—since 2007 without the federal government challenging one purchase. It shut down 39 companies, some of which may have represented future competitors, Wu says.

Some analysts claim Instagram, which Facebook acquired for $1 billion in 2012, is now worth about $100 billion, largely because it is the most popular social network among teens, according to a Piper Jaffray survey.

“The rest have plenty of enemies banging pots, especially Amazon, but in terms of the actual law, Facebook is the low-hanging fruit,” says Wu, author of “The Curse of Bigness: Antitrust in the New Gilded Age.”

Don’t miss: Four reasons why antitrust actions will likely fail to break up Big Tech

Vanderbilt University law professor Rebecca Allensworth puts it more bluntly: She considers Facebook the most vulnerable of the four because of “its dominant status in an easily defined market.” The solution is obvious, she says: Cleave off social-media properties WhatsApp and Instagram, which were acquired for a combined $20 billion since 2012.

UBS analyst Eric J. Sheridan, in a June 17 note, believes Facebook is the most exposed company to fines, potential revenue headwinds, impact on valuation and potential for breakup. He maintains a buy rating on Facebook shares and price target of $177.47, 5% below its current price.

Apple

A U.S. Supreme decision in May that allowed consumers to move forward with a long-running lawsuit that claims Apple used its market dominance to inflate prices via a 30% commission at its App Store. The company’s tactics with the App Store also makes it susceptible to regulatory action, antitrust experts contend.

“There is a pretty good claim against Apple for its exclusive dealing with its App Store,” says Hovenkamp. “This could lead to an injunctive remedy.”

While exclusivity is not inherently anticompetitive, Delrahim noted in last week’s speech, there are cases where a company may use exclusivity “to prevent entry or diminish the ability of rivals to achieve necessary scale, thereby substantially foreclosing competition.”

European regulators are already looking into the fees the iPhone maker charges companies to sell through its App Store after Spotify Technology SPOT, -0.97% accused Apple of “tilting the playing field to disadvantage competitors,” the Financial Times reported in May.

Instinet analyst Christopher Eberle said services, the fast-growing Apple division that includes the App Store, faces risk beyond its legally contested 30% fee. Regulators are likely to look at the limits Apple places on competitors to advertise and promote lower subscription pricing available away from the App Store, he said, which could impact revenue at the division, which grew 24% to $37.2 billion in 2018.

Alphabet

The Silicon Valley behemoth has extended its influence far beyond search and social media and into artificial intelligence, robotics, and renewable energy through 270 acquisitions, according to Wu.

Only one deal, its 2010 acquisition of travel search firm ITA, was challenged by the federal government, though it was conditionally approved. A subsequent FTC probe led to no action in 2013, yet a more narrow Justice Department case could pose problems, predicts Needham analyst Martin.

Google’s practice of “forcing handset markets to pre-install Google apps on the Android operating system” has clear parallels to the exclusivity issues that were at the center of the Microsoft antitrust case, a case that Delrahim often cites, Evercore ISI analyst Lee Horowitz said in a June 15 note.

The European Commission has already banned these practices, setting a clear precedent for the Justice Department to follow. (Since 2017, the EC has fined Google more than $9 billion for anticompetitive practices.)

Additionally, the lack of app store price competition on Google Play Store could stifle broader digital innovation because of restrictive monetization practices, another vector by which Delrahim believes uncompetitive markets could impose consumer harm, according to Horowitz.

Yet there is no easy solution for Google in the U.S. A breakup could easily lead to an even more powerful entity.

Read: If the government breaks up Google, would it be worth more?

Needham analyst Martin believes Google would benefit the most from a breakup, with an upside to shareholders of about 148% — or $1,579 per share. Google’s Search business alone is worth about $600 per share, she said, and YouTube is worth about $200 per share. She maintained a buy recommendation and price target of $1,350 in a June 10 note.

“There’s a chance” YouTube is spun off, Hovenkamp told MarketWatch, “but it requires a showing that a market would be more competitive.”

Amazon

The most curious investigation could revolve around Amazon, which could face a broad FTC probe as well as heightened pressure from Europe.

“In retail, many of its systemic practices are recognizable as traditional monopoly power,” Harvard professor Zuboff argues. “It elbowed out smaller competitors in book selling, health and beauty products – you name it.”

But U.S. regulators are unlikely to touch Amazon because it doesn’t dominate any particular market, UBS’ Sheridan said in his June 17 note. “In the case of any company breakup, we see unlocked value for GOOG and AMZN as the various pieces within the companies would likely warrant a higher valuation,” he wrote. “Given Amazon’s lower market share (as a % of retail sales), we think AMZN is less impacted in this scenario.”

Cowen analyst John Blackledge estimates Amazon Web Services would be worth $500 billion as a separate company, making it one of the world’s 10 most valuable companies.

For more news: Big Tech was built by the same type of antitrust actions that could now tear it down

However, under the European interpretation of regulatory issues that protect small companies, Amazon could face turmoil, says Thibault Schrepel, assistant professor in the department of public economic law at Utrecht University in Amsterdam.

Margrethe Vestager, head of competition policy in Europe, in April said a full EU probe into Amazon’s use of data on its third-party merchants could come later this year. She and others are concerned Amazon could be using sensitive information about its competitors’ products to its own advantage.

There is a complication, however. Her term ends in October.

Add Comment