Like many people her age, 28-year-old writer Kristine lives with her parents. “It’s both embarrassing and a necessity,” she told MarketWatch.

“I am an only child, so it’s just my parents and me at home,” she said. “Anything communal — family cellphone bill, cable, food at home, family vacations — my parents will pay for. But I pay for lunch at work, and I pay for my Netflix NFLX, -0.17% account.”

She’s got plenty of company.

Roughly half of millennials and Generation Z expect to be financially reliant on their parents in their early 20s.

And most young Americans don’t agree with Kristine’s confessed embarrassment, according to a study released this week by TD Ameritrade AMTD, +0.79% . (Parents had a slightly different opinion.)

Though roughly half of younger millennials and Generation Z members expect to be financially independent in their early 20s, according to the new study, and over 90% of parents surveyed expect their kids to be financially independent by the age of 25, previous research suggests those are optimistic goals. Despite a decade-long expansion and record-low unemployment, studies suggest that between 60% and 70% of 18- to 34-year-olds rely on their parents for financial assistance.

Participants in the TD Ameritrade online survey of more than 3,000 people conducted by Harris were grouped into three categories: Generation Z (ages 15 to 21), young millennials (ages 22 to 28) and parents (ages 30 to 60).

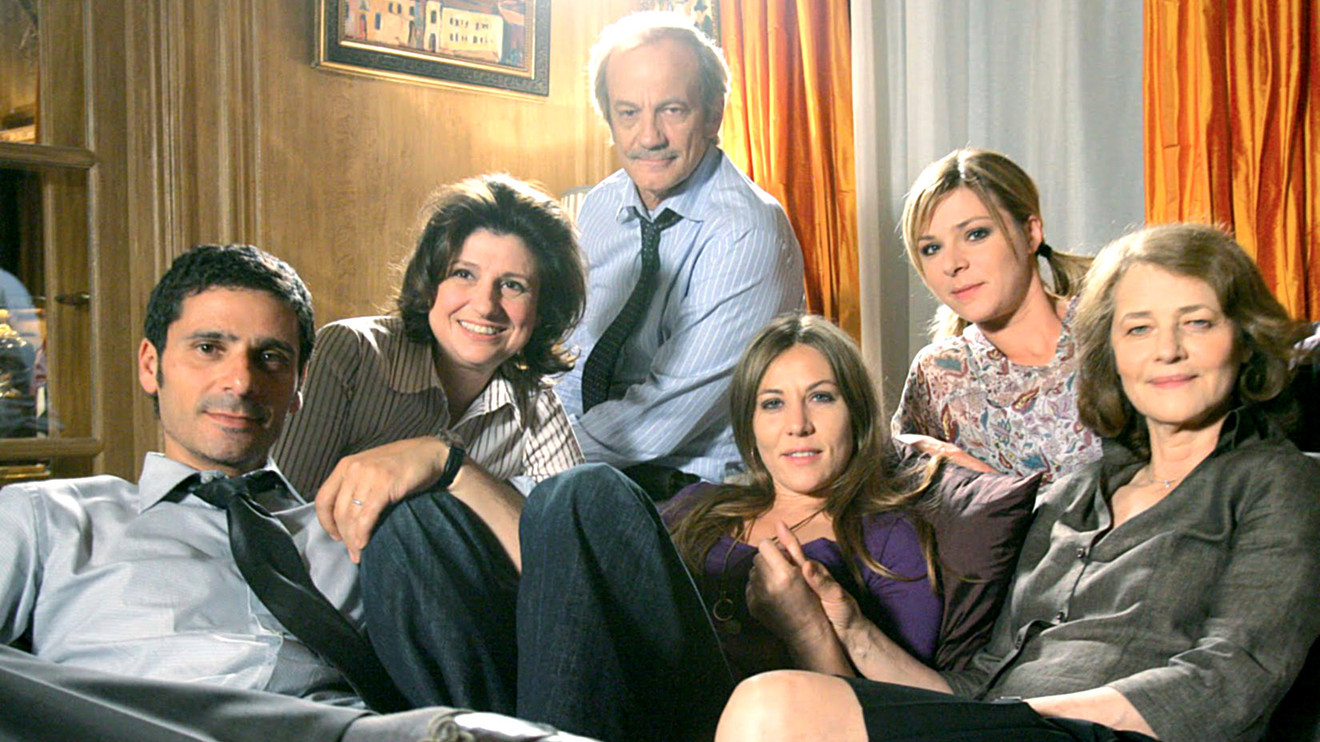

Some 63% of millennials say their mom and dad are their best friends, and 77% of parents feel the same way.

For all those groups, reality can be the enemy of aspiration. Kristine aimed to move out of her parents’ place, located within a 30-minute commute of New York City, by 25, but lost her job. She began freelancing, and paying a New York rent without a dependable paycheck did not seem possible without some assistance. She now has a steady job, but “it’s an hourly wage, and it’s much less than what I was making in the job I had when I was 22,” she said.

For millennials who are financially reliant on their parents and/or still live with them, there doesn’t appear to be much associated shame, and, fortunately, the TD Ameritrade survey found, both parties regard each other as friends,with 63% of the millennials saying their mom and dad are their best friends, and 77% of parents feeling the same way.

Roughly 15% of millennials live with their parents, up from 10% of Generation X members when they were in their 20s and 30s, the Pew Research Center found.

“At 30,” said Kristine, “I should probably figure it out.” Until then, living with her parents has allowed her to save some money and do the work she wants to do. “I’ve had a lot of conversations with my parents about the privilege of being able to pursue a career in journalism,” she said. “This isn’t something I would be able to do if my parents didn’t live near the city and I couldn’t live with them.”

Student loans and rising rents don’t help

Young people living off their parents’ generosity in decades past may have been seen as freeloaders. But today, parental help is seen more as a financial imperative.

“Financial help from your parents is an economic necessity for this generation,” Lindsey Pollak, author of “The Remix: How to Lead and Succeed in the Multigenerational Workplace,” told MarketWatch. “This generation has been faced with the highest level of student-loan debt in history.”

‘Financial help from your parents is an economic necessity for this generation. It’s unfair to compare a 30-year-old today to one 30 years ago.’

Over 40 million borrowers collectively owe about $1.5 trillion in student debt. This is up from $600 million a decade ago. One in six of these borrowers has debt that’s greater than his or her annual income, and the average borrower owes almost $30,000 upon college graduation.

This wasn’t the case three decades ago, Pollak said. “It’s unfair to compare a 30-year-old today to one 30 years ago,” she added. In the past 10 years alone, the number of borrowers who owe more than $100,000 has quadrupled.

For the most part, meanwhile, the U.S. economy is doing well. It’s been growing for a record stretch of 121 months, or more than a decade, and the unemployment rate recently hit its lowest point since 1969 at 3.7%. Despite these improvements, wages aren’t moving much — at least, not in the right direction. Real wages have effectively declined by 0.8% in the past year, according to the PayScale Index.

Rent increases are outpacing wage increases. In San Francisco, the median monthly rent for a one-bedroom apartment is $3,690, according to Zumper. In New York City, it’s $2,870.

In San Francisco, the median monthly rent for a one-bedroom apartment is $3,690. In New York City, it’s $2,870.

While narrow majorities of Gen Z and millennial survey respondents predicted they’d ultimately fare better financially than their parents have, Jason Kirsch, the author of “The Millennial Advantage” and the president of Grow, a financial-planning company for millennials, advises all of his clients to try to get as much money from their parents as possible. “Even if they have a good job, the best possible financial decision they can make is asking their parents for money, either as a gift or as a loan,” he said.

‘Parents could end up as an enabler’

It can be taken too far, he conceded. “Most professional motivation for our generation is purpose-driven,” Kirsch said. “So even if kids are getting money from their parents, they are still likely to be motivated at work.” He adds one caveat: “Parents could end up as an enabler if they are giving too much money.”

Christine Russell, a senior manager of retirement and annuities at TD Ameritrade, also said there was a possibility of giving kids too much money. “Are you borrowing from your parents to fund a lifestyle that you haven’t earned yet?” she asked.

Failure to launch can take a toll on young people’s self-esteem. “My parents aren’t pushing me out the door. There’s even the question of would they want me to be alone in the city,” Kristine told MarketWatch. But she says she’s “not fine” with her current situation, “and it is frustrating.”

“I want to have something that I have earned,” she said. “I wish I was paying my parents’ phone bill and cable — not the other way around — but that just isn’t the case right now.”

Add Comment