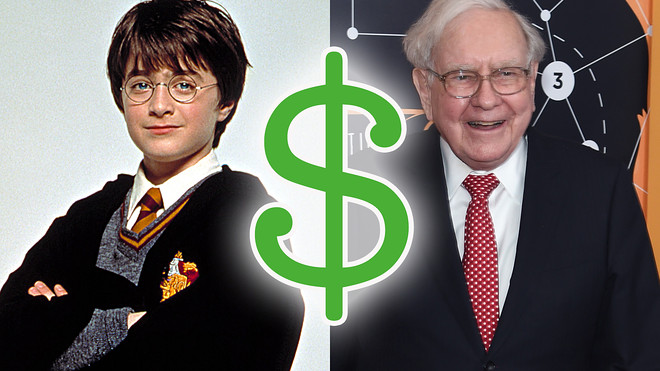

The Moneyist: ‘Your financial adviser is not a Wizard of Omaha or a Wizard from Hogwarts.’

Getty/iStock

Dear Quentin,

I read the letter sent to you by the husband-and-wife and how their wealthy friends shared their financial adviser with them, an act that ultimately destroyed their friendship. It is similar to my own situation, except we recommended our financial adviser to our wealthy neighbors.

My husband and I retired early. We were very frugal. Friends called us cheap. We prefer thrifty or frugal. We had no children, they had three kids; we rarely took vacations, they vacationed every year. Who deserves an annual vacation? There’s a reason why we retired early.

We always paid cash for our modest cars, but then drove our cars for 10 years or more. I don’t think they ever went two months without at least even one car payment.

We love our financial adviser, and our extravagant neighbors, keen to retire early like us, asked for her business card. I asked our friends how the appointment went, and they replied: “Well, she’s a lousy adviser! She doesn’t know what she’s talking about!”

At our annual review, I asked our adviser if they could retire early. She replied, “Warren Buffett and Harry Potter couldn’t get those two retired early.”

Is there anything we can do to help them?

Friendly Neighbor

You can email The Moneyist with any financial and ethical questions related to coronavirus at [email protected].

Dear Friendly,

Everyone deserves an annual vacation. Whether they choose to take one or are fortunate enough to have paid time off is, of course, another matter entirely. But in principle, I’m all for them. We are all temporarily abled, after all, and it doesn’t hurt to remember that. I want to be able to travel while I am young, and while there are no physical limitations holding me back.

Unlike your neighbors, I have never owned a car, so whatever money I may have spent on insurance and upkeep and replacements, perhaps that went to my various holidays over the years, which also gifted me with memories that will last forever. But you know what else everyone deserves? Peace of mind, happiness (that, too, is often a choice) and a comfortable retirement.

“ Sometimes we deserve things today, and other times we believe we deserve them tomorrow — if that tomorrow comes when I’m 67, what of it? ”

That last one is critical, and speaks to the difference between your good neighbors and your good selves. Sometimes we deserve things today, and other times we believe we deserve them tomorrow — if that tomorrow comes when I’m 67, what of it? I have given myself three gifts: money set aside for a rainy day, money set aside for my retirement years, and the gift of knowing I don’t have to worry.

My advice to anyone who is scared and anxious about not having enough money set aside for retirement: Don’t stop trying. It won’t be a straight line. Life throws us challenges, and it’s up to us to deal with them head on and pick ourselves up afterwards. Giving up is not an option, because that fear and anxiety will only get worse if we spend without preparing for the future.

If you can derive a small amount of pleasure from taking the trash out and collecting your laundry, then you can hit that dopamine derby by putting a little something aside every month, maxing out your 401(k) or starting a Roth IRA or investing in a low-cost index fund. Few people in their 30s are thinking ahead to their 60s. They’re too busy paying off credit cards, student loans, and the rent.

“ There is no Wizarding World of Finance, as much as we would like to believe in elixirs like Bitcoin. ”

Your financial adviser is not a Wizard of Omaha or a Wizard from Hogwarts. There is no Wizarding World of Finance, as much as we would like to believe in elixirs like Bitcoin BTC, +316.67%. Investing in the Harry Potter film franchise is, of course, one exception to that rule.

That’s why former MarketWatch writer Shawn Langlois — who was a bit of a wizard when it came to spotting investing stories that would bewitch, bother or bewilder MarketWatch readers — wrote these words about the $12 million Tesla investor who said he’s retiring at 39 after buying stock in the electric-car company at $7.50 a share: “Don’t try this at home, kids.”

Why? Because taking a gamble on an individual stock usually ends up as a bitter, regretful cautionary tale. If your neighbors are the type of people who want everything now and believe they deserve that, they are not going to appreciate the pie charts and graphs that your financial adviser pulls out of her hat. Retirement planning isn’t sexy or exciting to most people, but it should be.

“ Would we love Columbo if he were driving a fancy sports car instead of a beat-up Peugeot 403 convertible? ”

By telling you that your financial adviser is “lousy,” your neighbors are telling you, “We don’t want to know. We don’t want to learn. And we don’t like admitting our mistakes.” That’s a bad recipe for turning your fortunes around. They want what they want when they want it.

During our recent online town hall, “MarketWatch: Mastering Your Money,” I asked Kathleen Kenealy, the director of financial planning at Boston Private, the biggest mistake people make with their retirement. “Controlling spending and making decisions based on emotions,” she replied. “Remember, lots of people wanted to bail out of the market in March of last year.”

Another rule of thumb for your neighbors, and anyone else out there who feels like mixing a drink when they see retirement headlines that say to have one year of your salary saved by 30, twice that amount saved by 35, and six times your salary by 50: Every person’s circumstances are different and these projections are meant as a guide, not as hard-and-fast, ride-or-die rules of retiring.

“ Do something, anything. Just get started. You retired early because you were happy with what you had. ”

“Someone who wants to retire at 50 and travel the world, owns two homes, and plays golf year round is going to need to save a lot more, and faster, than someone who is content working until 65 or 70 and doesn’t anticipate needing to support a lavish lifestyle in retirement,” Kenealy said. “If you are behind, make small changes like setting up an emergency fund with three to six months of savings.”

“If you have been helping your children pay for college, you might be a little behind on your retirement savings by the time you reach 50,” she told me. “But once they’re done with school and off the family payroll you should really ramp up your savings as much as possible in that last decade or two before retirement.” I would tell your neighbors: Make those last peak earning years count.

Do something, anything. Just get started. You retired early because you knew how little you needed. I appreciate an old jalopy. It’s far more interesting than a brand new Porsche, even if the latter is a hell of a lot faster and more luxurious. (Would we love Peter Falk’s Columbo if he were driving a fancy sports car instead of a beat-up Peugeot 403 convertible? Probably not.)

As you discovered, there is a serenity in having patience and going slow. If the coronavirus pandemic has taught us anything, it’s that maybe it’s OK to slow down once in a while, take stock of what we have, and marvel at how fortunate we are to still have our health and our wealth. Anyone who lives a comfortable life with hot water, food and a roof over their head is wealthy in my book.

One final thought: If your financial adviser is talking trash about your neighbors, it’s likely that she could do the same thing about you.

The Moneyist: When my parents died, my sisters and I split their estate. I chose a painting that may be worth $50,000. Should I tell them?

Hello there, MarketWatchers. Check out the Moneyist private Facebook FB, +2.83% group where we look for answers to life’s thorniest money issues. Readers write in to me with all sorts of dilemmas. Post your questions, tell me what you want to know more about, or weigh in on the latest Moneyist columns.

By submitting your story to Dow Jones & Company, the publisher of MarketWatch, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Add Comment