Shares of Apple Inc. rallied Friday, as the sharp run-up in prices this year didn’t deter some Wall Street analysts to get even more bullish on the technology giant, citing optimism over the outlook of iPhone sales and the “underappreciated” opportunity in advertising.

Apple’s stock climbed 1.2% to close at the seventh record this month, and produce the eighth straight week of gains.

The shares AAPL, +1.19% have rocketed 68.5% this year, to make Apple the most valuable U.S. company with a market cap of $1.18 trillion, above second-place Microsoft Corp. MSFT, +1.29% at $1.14 trillion.

That stock’s surge hasn’t deterred analyst Dan Ives at Wedbush from saying there’s a lot more room for gains. He reiterated his outperform rating, and raised his stock price target to $325, which is about 22% above current levels, from $300. His target is now the highest of the 43 analysts surveyed by FactSet.

“While shares are up [more than 65%] year to date, we believe the tech stalwart is still in the midst of a renaissance of iPhone growth heading into 2020 that will further catalyze the stock higher as it gets re-rated from the Street,” Ives wrote in a note to clients.

Don’t miss: Warren Buffett increases Apple stake despite selling some stock.

He said the combination of a “supercycle” demand driver between the iPhone 11, the coming 5G lineup of smartphones and the company’s estimated $60 billion services business by fiscal 2021 “will be the linchpins of the Apple growth story over the next 12 to 18 months.

JPMorgan’s Samik Chatterjee maintained his overweight rating, while bumping up his price target to $290 from $280, saying he’s more bullish because investors have “overlooked” the potential of Apple’s advertising business, as they focused on identifying new avenues of revenue growth for services, such as Apple TV+, Apple Arcade, Apple Pay and Apple Music.

See related: Apple TV+ seeks production deal with former CEO of HBO.

Also read: The iPhone trade-in program is booming, and saving Apple’s earnings.

“While investors are trying to identify the next big frontier for services, we believe hidden in plain sight and underappreciated by most is the advertising opportunity within Apple’s fingertips, given the secular migration of advertising dollars to mobile platforms, the large installed base of close to [1 billion] iPhone users, and importantly, Apple’s successful exploration of advertising to-date,” Chatterjee wrote in a research note.

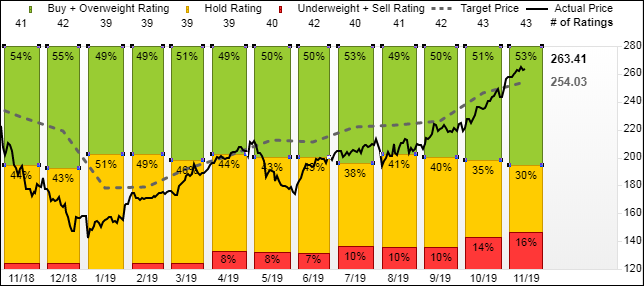

FactSet

FactSet The new bullish calls came a day after Maxim Group’s Nehal Chokshi turned bearish, cutting his rating to sell from hold, suggesting Wall Street may be a little too optimistic on March-quarter and fiscal 2020 revenue growth.

While the percentage of bearish analysts on Apple has increased to 16% from zero in January, the number of bullish analysts also rose to 53% from 49%, as those who were neutral fell to 30% from 51%. The average price target has climbed 43% to $254.35 from $177.81 in January.

Add Comment