Shares of Coinbase Global Inc. sank toward another record low Monday, even as bullish analyst Owen Lau of Oppenheimer attempted to debunk the bears’ reasons to sell the crypto-trading platform.

The stock COIN, -1.66% fell 3.8% in midday trading, putting it on track for the eighth loss in nine sessions, and the third record low in four trading days. It was trading 43.3% below the $250 reference price for its direct public listing a year ago.

Lau reiterated the outperform rating he’s had on the stock, since he started covering it in May 2021. However, he slashed his price target to $314 from $377, citing lower trading volume expectations, but his new target still implied 121.6% upside from current levels.

“We believe the bear thesis is way overblown and that this creates an opportunity for long-term investors to get into one of the most disruptive companies in the market at what we see as a very attractive valuation,” Lau wrote in a note to clients.

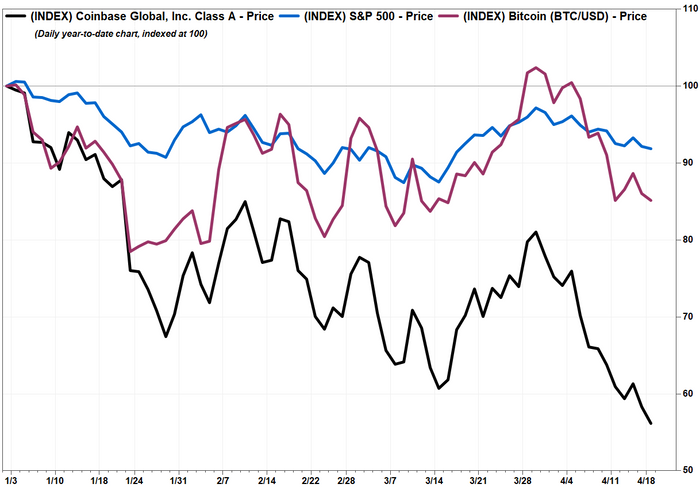

The stock has tumbled 43.9% year to date. And while it remains highly correlated with bitcoin BTCUSD, -0.76%, they cryptocurrency has only declined 14.9% this year while the S&P 500 index SPX, -0.20% has lost 8.2%.

Lau goes through what he believes here are the six main points to the bear thesis on the stock, and give his reasons for why investors shouldn’t be too concerned about them.

Increasing competition and free compression

Lau believes investors are worried about more brokers or exchanges entering into the cryptocurrency market, which will lower fees in an imminent “race to the bottom.”

He said this bear case is based on the assumption that fee rates can be used to predict revenue, and therefore eventually the stock price. Lau called that assumption a “huge stretch,” saying that while the argument could be valid if volume doesn’t grow, he believes the crypto market is in the “very early innings” of a massive adoption in both retail and institutions.

Also read: Coinbase IPO: Everything you need to know about the ‘watershed moment’ in crypto.

“While there are ups and downs in trading volume from quarter to quarter, longer term it shows an increasing trend,” Lau wrote.

Keep in mind that in the fourth-quarter report released in late-February, the company provided a wide guidance range for annual average retail monthly transacting users (MTUs) of 5 million to 15 million, compared with 8.4 million in 2021, saying it was too early to provide a more precise range given “less near-term visibility.”

Coinbase has ‘over-earned’ so will not be profitable this year

Lau said that if Coinbase (COIN) isn’t profitable in 2022, which he agreed is possible, it would be because of “aggressive” investment in technology and development of $4.25 billion to $5.25 billion, and not because it has over-earned. He said the company has committed to reduce this investment if there is a material slowdown in its business.

“We would argue this massive investment makes it much harder for competitors to catch up and that this outlay accelerates COIN’s diversification effort and infrastructure upgrade,” Lau wrote.

Coinbase’s stock is overvalued

Lau said that the stock trades at only 4.4-times consensus analyst estimates for 2022 revenue, which compares with about 12.8-times that for comparable high-growth fintech companies, such as Tradeweb Markets Inc. TW, -2.09% and Shopify Inc. SHOP, -1.64%

“With that multiple, we wonder how COIN can be classified as overvalued,” Lau wrote.

Coinbase may have a high price-to-earnings ratio, but he believes that’s not an appropriate valuation metric for a company that’s only 10-years old, as other companies around similar ages don’t typically generate profits. And the company recorded net earnings of $8.89 a share in 2021, up from $5.68 a year ago.

Low trading volume

Although trading volumes are expected to be soft in the near term, Lau believes that it is short-term issue that has already been price into the stock.

“Counterintuitively, we believe it is the best time to buy the stock, when COIN is brought down by cyclical reasons and the secular trend remains intact,” Lau wrote.

He also believes Coinbase’s efforts to diversify will gradually reduce the company’s reliance on spot trading.

A potential ‘crypto winter’ is coming

Lau said that a crypto winter could certainly weigh on the stock, but the fact that it would also hurt Coinbase’s competitors could end up being a good thing for the company over the longer term.

Depending on the length of any potential crypto winter, he said it could chase away subpar competitors and provide Coinbase with opportunities to make acquisitions.

“While it may not be good for investors with shorter investment horizon, crypto winter provides an opportunity for long-term investors to buy COIN at a discount,” Lau wrote.

Potential regulatory action against crypto companies

Potential regulatory actions are a concern, especially given the cease and desist orders issued by state regulators against Voyager Digital Ltd. VYGVF, -5.48% and Celsius Network LLC, but Lau believes the regulatory environment has actually been improving. He said President Joe Biden’s recent executive order to ensure the responsible development of digital assets marks a “shift in tone” that is positive for the development of the industry.

“In our view, these encouraging signs could pave the way for sensible regulations to foster innovation, job creation and health communication,” Lau wrote.

Add Comment