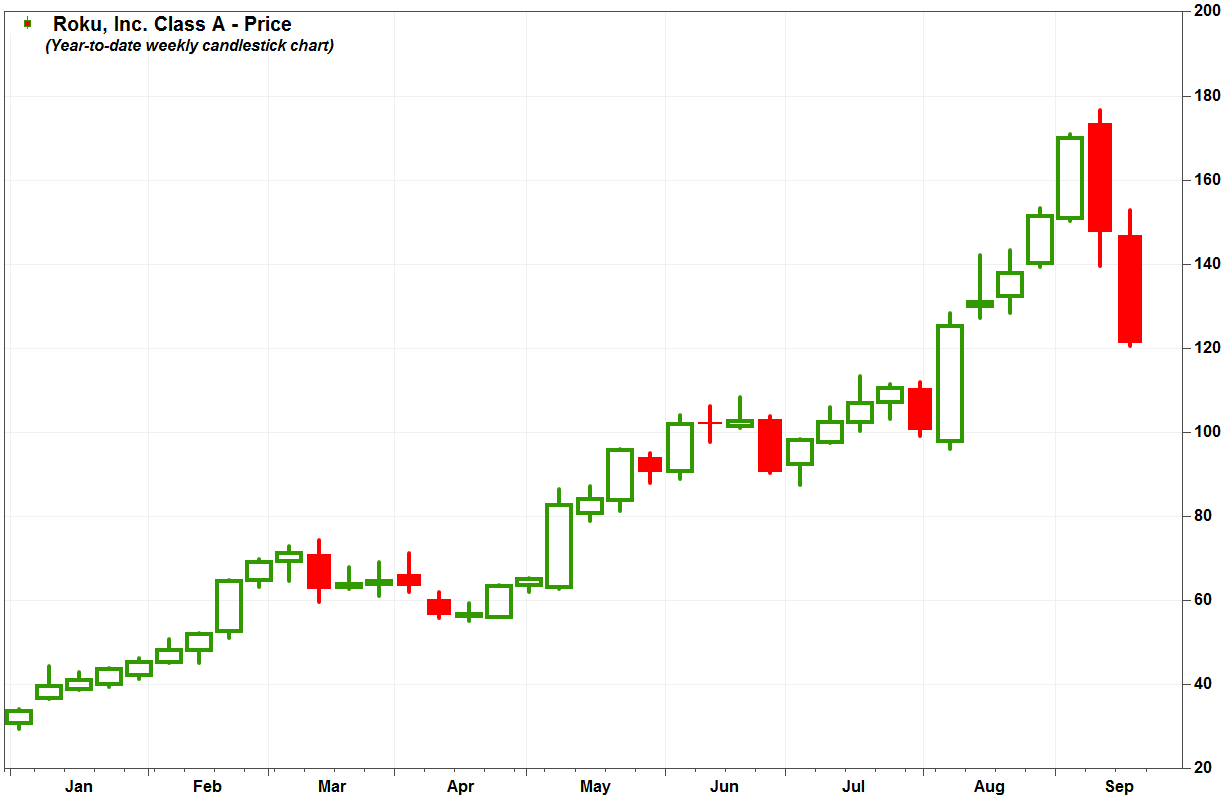

Shares of Roku Inc. sank again Friday, putting them on track for their worst weekly performance this year, as investors continued to express concern over increasing competition and an extreme valuation.

The streaming-media player’s stock ROKU, -11.84% dropped 9.8% in morning trading, and has now shed 18.2% this week. That follows a 13.1% tumble last week, and brings the two-week selloff from the Sept. 6 record close of $169.86 to 29.0%.

This week’s selloff was highlighted by Wednesday’s 13.7% plunge, after Comcast Corp. CMCSA, -0.39% said it will start giving away its Xfinity Flex streaming-media player for free to those who subscribe to the cable operator’s internet-only plans.

Last Tuesday, Roku shares tumbled 10.5% after Apple Inc. AAPL, +0.41% unveiled the price for its Apple TV+ service that was half of what was expected.

This week’s decline is the biggest since it lost 18.4% during the week ending Dec. 21, 2018, while the two-week performance is the worst since Roku went public in September 2017.

FactSet, MarketWatch

FactSet, MarketWatch On Friday, Pivotal Research analyst Jeff Wlodarczak sent a note to clients titled, “Is Roku Broku?,” as he started coverage of Roku with a sell rating and stock price target of $60, which is 50% below current levels.

Wlodarczak said that Roku management “deserves a lot of credit” for creating a pure-play over-the-top (OTT) investment in the move away from traditional cable. But despite the recent pullback in the stock, he believes it remains “dramatically overvalued” following a near than four-fold run up (up 294%) this year.

“We see dramatically more competition emerging that will likely drive the cost of OTT devices to zero and put material pressure on advertising revenue splits, highlighted by Comcast’s recent moves with its free Xfinity Flex product that is likely to be copied by other distributors,” Wlodarczak wrote in a note to clients.

“While Roku management deserves credit for the asset they have created, everyone has realized the living room is too important and the big boys…with massive leverage are likely to make Roku growth much more difficult,” he wrote.

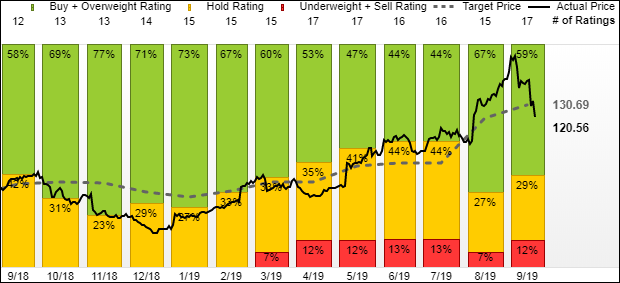

Meanwhile, most analysts on Wall Street remain bullish, as the average rating of the 17 analysts surveyed by FactSet is the equivalent of “overweight,” and the average price target of $130.69 is currently 8.3% above current levels.

FactSet analyst coverage

FactSet analyst coverage On Friday, Oppenheimer analyst Jason Helfstein affirmed the outperform rating he’s had on Roku for the past 14 months, while raising his price target to $155 from $120, as he remains upbeat on international expansion plans and believes Roku has a leg up on its competition.

Helfstein said Roku’s U.S. strategy playbook should allow for “fast international market share,” and its subscription video-on-demand (SVOD) subscriptions will be a “clear tailwind,” as many new services play catch-up in a crowded market.

On Thursday, Roku unveiled new streaming devices, including new offerings for Canada and the United Kingdom, and introduced a new Roku Express that is 10% smaller and costs less than the older model.

“We estimate Apple+, Disney+ and a mix of others (notably HBO Max) will provide $21/share in combined upside,” Helfstein wrote in a note to clients. “We see Roku ‘cashing’ in on their U.S. market penetration (~33%), promoting and selling SVOD subscriptions directly, with competition from new entrants…as being too late.”

He acknowledged that the stock is still “expensive,” but given the current growth and bullish secular outlook, he sees the stock moving higher from current levels.

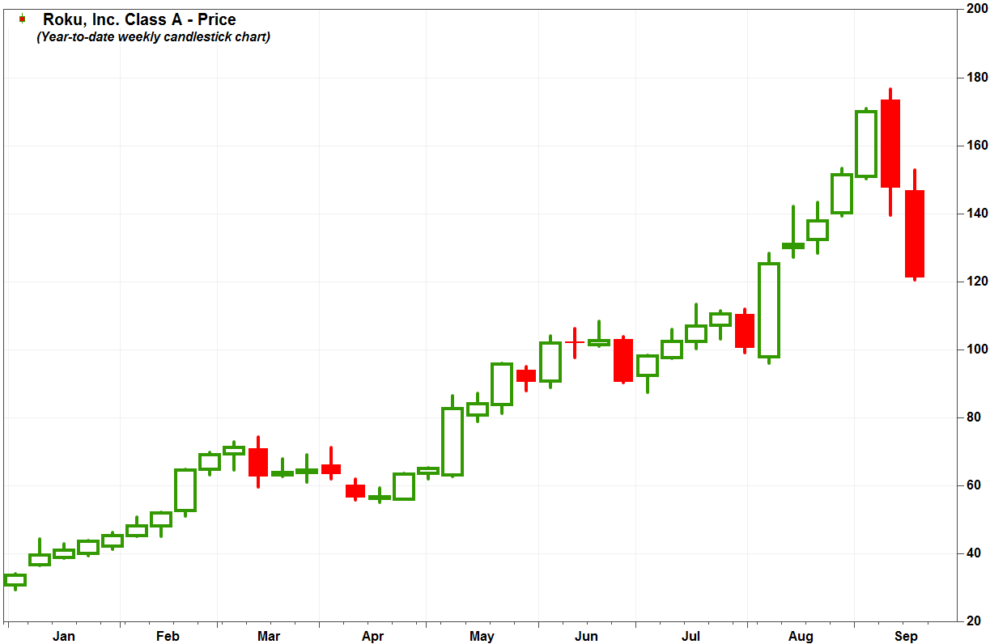

The stock is still up 15% over the past three months, while shares of Comcast have gained 6.0%, Apple have advanced 11.3% and the S&P 500 index SPX, +0.13% has tacked on 2.0%.

Add Comment