Analysts say there are two key reasons why Stitch Fix Inc. is on a growth trajectory while others with similar business models may not be: its ongoing data collection efforts and the addition of new categories that take an increasing share of household spend.

Stitch Fix SFIX, +14.72% reported better-than-expected fiscal third-quarter revenue of $408.9 million, up from $316.7 million last year and ahead of the $395 million FactSet expectation. Earnings per share totaled 7 cents, compared with FactSet’s guidance for a loss. And the number of active clients, defined as those who checked out a “Fix” during the previous year, rose 17% to 3.1 million.

The results sent Stitch Fix stock soaring 17.4% in Thursday trading.

KeyBanc Capital Markets analysts led by Edward Yruma called the results “impressive” on the surface, but “even more impressive” when taking into account the fact that the first calendar quarter “was one of the worst in apparel retail since 2009.”

See: Every clothing store stock is down for the past month – Mitch Nolen

One of the things the personal styling service has going for it is lots of data, which allows the company to be more personal in its selections for customers, KeyBanc analysts wrote in a note.

“Style Shuffle, a game that lets users ‘rate’ outfits and clothing items, has generated over two billion ratings for Stitch Fix to feed into its algorithms,” the analysts said. “We believe revenue per active client is the best proxy for customer satisfaction, with four consecutive quarters of year-over-year increases pointing to accelerating momentum.”

KeyBanc rates Stitch Fix shares overweight with a $40 price target.

Customers get their “Fix” first by filling out a style profile that includes information like price range and style preferences. Customers pay a $20 styling fee for each shipment they receive, which is applied to the final tally, try on the items and send back what they don’t want.

The company blends the use of digital algorithms with human stylists.

Read: Gap shares plunge as bland merchandise ‘cycle of pain’ continues at namesake brand

“In an environment where many retailers face growth challenges, we remain confident in our ability to deliver personalization at scale, using our unique combination of human judgment and data science that continues delighting clients and growing our business,” said Katrina Lake, Stitch Fix’s chief executive and founder on the earnings call, according to a FactSet transcript.

Besides the data, Stitch Fix has been expanding what it offers and who it offers its services to. The company officially launched in the U.K. last month.

“After launching its women’s business in 2011, the company focused on its core product and remained quiet with expansion until 2015,” wrote Wells Fargo analysts led by Ike Boruchow. “Since then, Stitch Fix has added a new product category each year including maternity, petite, men’s, plus-size and kid’s. The company now has a product for everyone in the household which should encourage incremental sales growth under the same roof.”

Also: J.Jill shares plummet 53% as execution and decision issues take a toll on sales

Even with these two factors working in its favor, there are questions about the Stitch Fix stock.

“Stitch Fix is accelerating top-line due primarily to increased spend per member and for an e-commerce business that had question marks around their ability to sustain growth, this is likely to lead to further share price appreciation,” Wells Fargo wrote. “With margin deleverage (largely attributable to advertising and market expansion) remaining a concern, we think this will remain a highly debated stock.”

In its letter to shareholders that details the third-quarter results, Stitch Fix said advertising expense was $50.4 million for the most recent quarter, or 12.3% of net revenue. Last year, the advertising expense was $25.2 million, or 8% of net revenue.

Third-quarter gross margin was 45.1% compared with 43.6% last year.

“Stitch Fix is doing a lot to drive its sales through the expansion into new product categories but for the time being they are lower margin due to sub-scale,” said Wells Fargo, which lists the many actions associated with new business segments that will incur costs, including warehousing and distribution.

“We think the majority of pressure will come from a combination of a higher mix of low price products and higher costs associated with managing a more robust inventory pipeline,” Wells Fargo said.

Wells Fargo rates Stitch Fix shares market perform with a $30 price target.

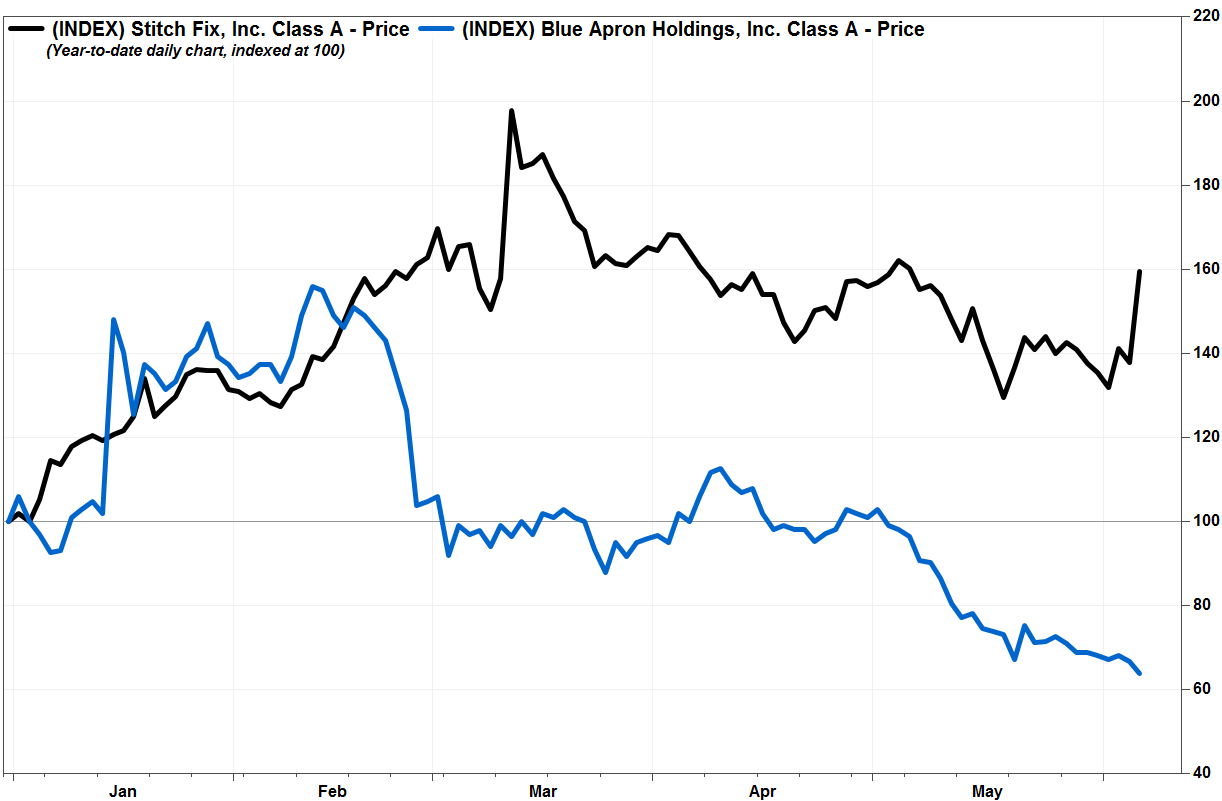

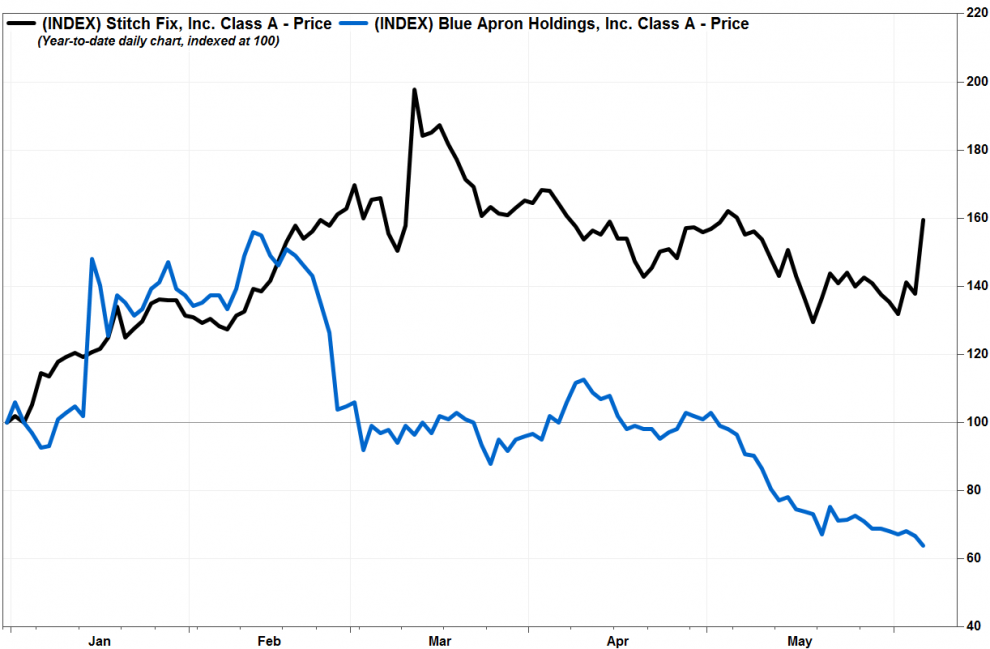

Stitch Fix is beating Blue Apron at a similar game

While Stitch Fix is growing, the struggle at Blue Apron Holdings Inc. APRN, -2.38% , a meal kit company that also operates on a similar e-commerce model, is ongoing. It’s most recent quarterly report included a revenue miss, and it’s pursuing plans for a reverse stock split to increase share price and liquidity.

Blue Apron was trading at 64 cents on Thursday morning.

See: Opinion: Blue Apron’s new CEO has a thankless task

FactSet, MarketWatch

FactSet, MarketWatch

According to YouGov data cited in a May eMarketer report, between 80% and 85% of U.S. internet users have never signed up for a retail subscription service, which includes grocery and meal kits. Apparel wasn’t included in the report data.

“For companies offering beauty or food boxes, the numbers of lapsed users may be a bigger red flag than the low penetration,” eMarketer wrote. Value proposition is the big problem.

“The greatest concerns included spending more money than otherwise intended (53%), not getting the right number of products at the right time (52%), and shipments not arriving on schedule (34%),” eMarketer wrote. “This skepticism explains, at least partly, why shoppers are not ready to offload their weekly shopping responsibilities to third parties.”

Stitch Fix stock has rallied nearly 62% for the year to date, outpacing the Amplify Online Retail ETF IBUY, +0.67% which is up 16.1%, and the S&P 500 index SPX, +0.61% , up 13.1% for the period.

Add Comment