The coronavirus death toll continues to rise across the U.S., as do the number of job losses, with an increasing number of companies reporting on the deep damage the pandemic has already inflicted. Yet the stock market, despite its volatile stretches, continues to hold up relatively well.

This viral tweet captured the disconnect last month:

Doug Ramsey, the chief investment officer of The Leuthold Group, warned clients that the day is coming when the dire state of the economy catches up with equity investors. “The stock market punishment doesn’t fit the economic crime,” he said. “We expect it eventually will.”

Ramsey explained that buy-and-hold investors have mostly dodged serious damage even though we’ve seen a “cataclysmic” hit, considering those who own only the S&P and reinvest dividends have seen no more than a peak-to-trough loss of 19.6%.

“The depth and duration of this economic calamity are unknowable, but values don’t yet reflect it,” he told clients in a recent note. “S&P 500 valuations are 30-40% higher than seen at even the comparatively-shallow market low of 2002.”

Ramsey went on to show that the median S&P 500 stock is still historically pricy based on several metrics, including price-to-sales and price-to-earnings.

“If the median S&P 500 stock traded down to the average valuation seen at the last three bear market bottoms, it would have to decline another 46% from April 30th levels” he said. “If we play along and assume that valuations bottom at the ‘richest’ levels ever seen at a bear market low, there’s still 32% downside remaining in the median S&P 500 stock.”

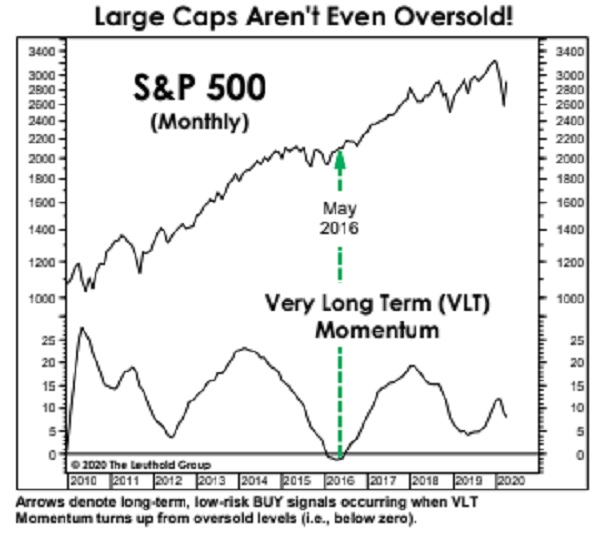

He posted this chart and said that the “eventual retribution for a full decade of negative real interest rates” will be “much more severe” than the downturn earlier this year.

“Not only does the setback look rather mild, it has so far been insufficient to drive VLT Momentum even close to its oversold zone!” Ramsey wrote. “And that follows an entire decade in which VLT spent only five months in negative territory.”

Yet the market keeps holding up nicely, with the Dow Jones Industrial Average DJIA, +1.90% closing up 455 points in Friday’s trading session. The S&P 500 SPX, +1.68% and tech-heavy Nasdaq Composite COMP, +1.57% also staged strong rallies.

Add Comment