Crescat Capital enjoyed a huge year in 2018, capitalizing on December’s market tumble to post a 41% return for its flagship hedge fund — that was good enough to make it one of the firm’s two entries on this Bloomberg list of top performers:

Bloomberg

Bloomberg

With the stock market bouncing back in 2019, the Crescat Global Macro fund has suffered — down 29% year-to-date through April — but founder and CIO Kevin Smith isn’t all that concerned about what he sees as merely a blip.

“The stock market is susceptible to bouts of bullish sentiment,” he told MarketWatch on Wednesday. “There is a speculative force typical of late-cycle markets that is willing to shrug off deteriorating economic data and a dashed trade deal with China. Too many want to drive that momentum train just a little bit longer. They are not deterred by arguments of excessive valuations.”

Regardless, he’s confident another leg-down is on the way.

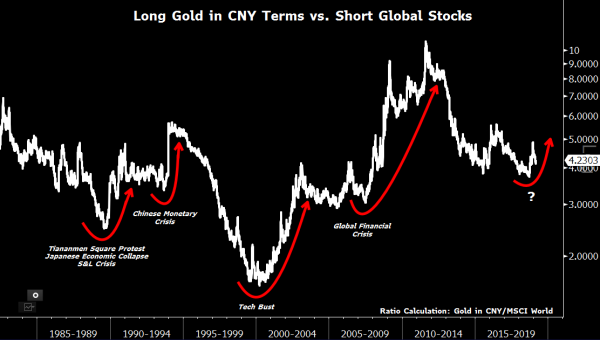

Smith, who oversees $48 million in assets, predicts that there’s a “tremendous shorting opportunity ahead,” and he says “the macro trade of the century” is a great way to play the weakness to come. As you can see by the chart, long gold GCM9, -0.52% in Chinese yuan USDCNY, +0.0713% terms and short global stocks URTH, +0.73% has been a big profit maker in prior downturns.

“It’s remarkable how well this trade would have worked during all major cyclical turns in the Chinese and global economy in the last 40 years,” he said, adding that he’s “extremely” bullish on gold. “This is a value-oriented macro trade that’s likely to perform over the next one to three years in a global economic downturn.”

Smith explained that, in order to reap the biggest gains, short opportunities are best when investors are early to the process, as Crescat’s strong performance proved in 2006, 2007 and again last year.

Now, he’s anticipating another strong stretch.

“Soon the buy-the-dip mentality and bull-market greed will turn to fear,” Smith said. “Selling will beget more selling. That’s how bear markets work. There is so much more ahead to profit from the short side of the market.”

Apparently, that selling will have to wait. At last check, the Dow DJIA, +0.77% was up more than 200 points on Thursday, while the Nasdaq COMP, +0.89% and S&P SPX, +0.92% were also logging gains.

Add Comment