On thing’s for certain: Last week’s volatile stock-market action was a dead-cat bounce. Or a clear bottom. Or something in between. Or none of the above.

Does that help? Of course not. Truth is, nobody has a clue. But that didn’t stop Ben Carlson, portfolio manager at Ritholtz Wealth Management, from taking a deep dive into the numbers in search of some helpful data nuggets that could prove useful as investors mull their next moves.

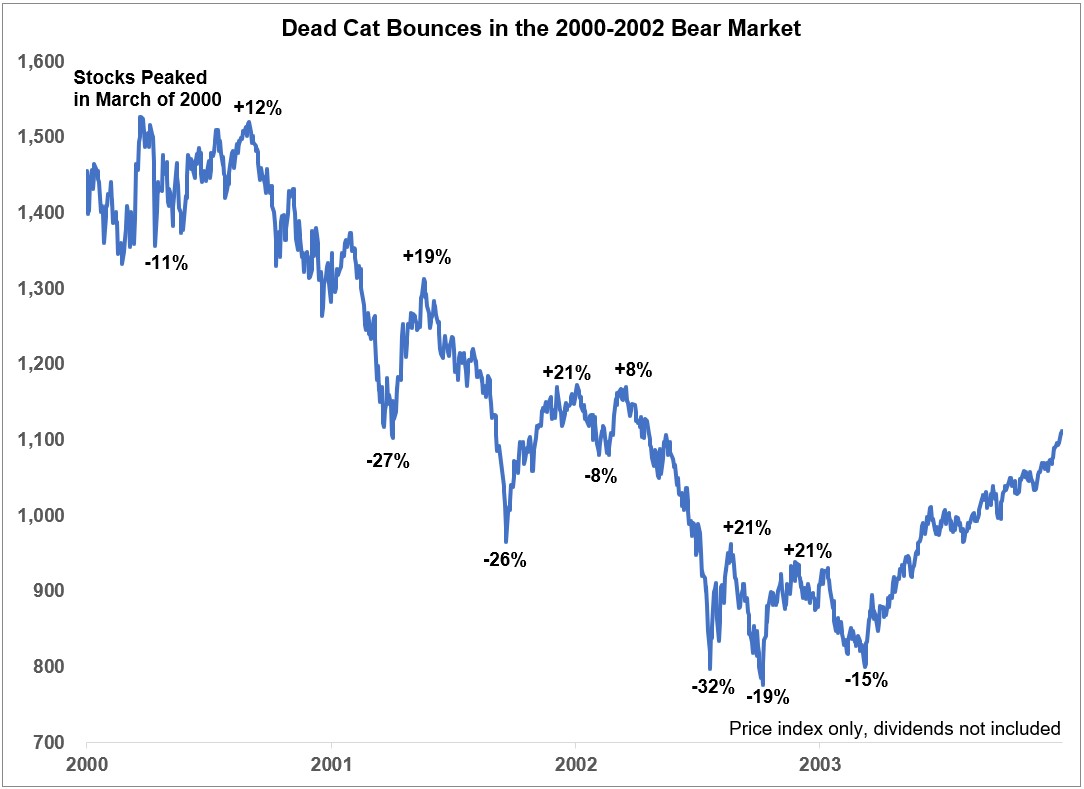

“This type of move has precedent,” he wrote in a blog post. “Many of histories [sic] great crashes have exhibited head-fake rallies that offered investors a false sense of hope that proved to be fleeting.” He used this chart of the dot-com implosion as an example:

As you can see, the bear market above delivered three separate rallies of about 20% that ultimately proved to be just head-fakes in a broader downtrend. By the end, stocks had bottomed out at more than 50% below prior peak levels. Dead-cat bounces. All of them.

“There’s a good reason why it’s so difficult to tell the difference between a dead-cat bounce within the context of a bear market and an actual market bottom,” Carlson wrote. “When stocks do eventually bottom, they tend to see strong gains coming out of the gate.”

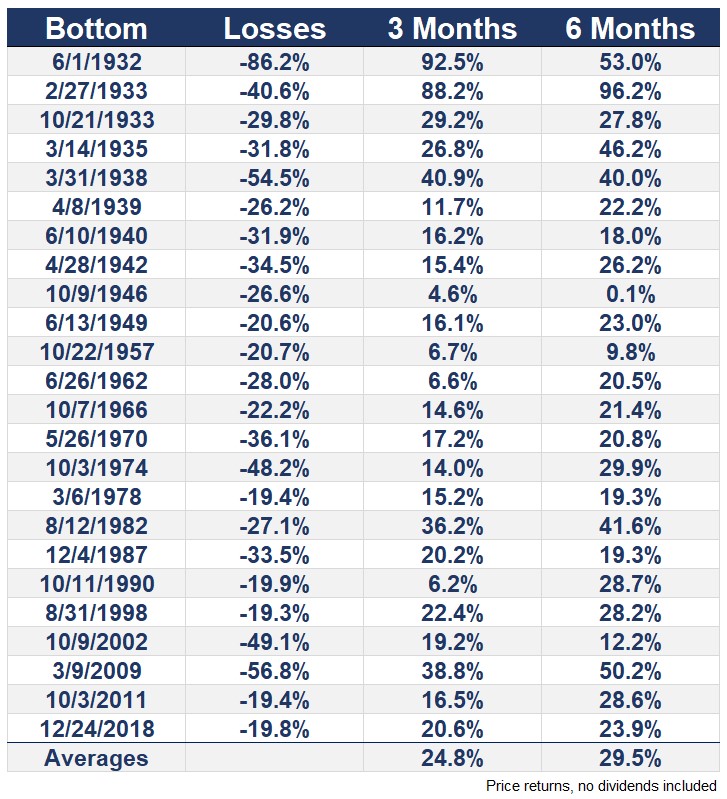

How strong? Just check out this chart of the returns from the past S&P bear-market bottoms:

“I’m sure every one of these recoveries was called a dead-cat bounce, bear market rally, short-covering or junk stock rally,” Carlson explained, adding that hindsight will provide the only answer. “It’s hard to trust the market to give you gains when all it’s done recently is take them away.”

While most investors and analysts interviewed by MarketWatch agree that a retest of last week’s lows is possible — maybe even likely — they remain split over whether stocks have farther to fall, depending on the most important variable going forward: the coronavirus pandemic.

“We have no idea how long this will be,” INTL FCStone’s Yousef Abbasi said. “Right now, fundamentals don’t matter because there is very little clarity as to when the economy can restart — and depending on how long this goes, what the economy will look like when it does restart.”

As it stands now, the week looks to be getting off to a rough start, with futures on the Dow YM00, +0.76% , S&P ES00, +0.62% and Nasdaq NQ00, +0.64% all in the red.

div > iframe { width: 100% !important; min-width: 300px; max-width: 800px; } ]]>

Add Comment