Société Générale’s analyst Albert Edwards sees yields for the bond markets in Europe and the U.S. headed lower, despite much of eurozone debt carrying yields below 0% already and Treasury rates hanging near three-year lows.

“Although the tsunami of negative yields sweeping the eurozone has attracted most attention, yields have also plunged in the US with 30 year yields falling to an all-time low just below 2%. For many this represents a bubble of epic proportions, driven by [quantitative easing] and ripe for bursting,” the SocGen global strategist wrote in a research note dated Thursday.

“We disagree. There is a lot more to come,” he said of the possibility that yields can fall further.

By some reckonings, some $15 trillion in global government debt now carries a negative interest rate, meaning debt holders will receive less than their original investment.

The negative-yield dynamic in the market has proliferated after more than a decade of monetary-policy unorthodoxy intended to juice stubbornly low inflation and anemic growth in Europe and parts of Asia.

Read: Here’s four reasons why investors might snap up negative-yielding bonds

And some economists and strategists believe that negative yields could eventually become a reality in the U.S., with the 10-year Treasury note TMUBMUSD10Y, +2.19% yielding 1.59% on Thursday, around its lowest yield since 2016, while yields for comparable German bonds TMBMKDE-10Y, +7.03% yielding a negative 0.648, around its record low.

Check out: Germany sells nearly $1 billion of 30-year negative yielding bonds

Edwards says that he doesn’t believe that there is a bubble in bonds, however.

“My own view is that this government bond rally is not a bubble but an appropriate reaction to the market discounting the next recession hitting the global economy from all over-leveraged corners of the world (including China), with close to zero core inflation and precious few working tools left at policymakers’ disposal,” the SocGen strategists writes.

Like many other doomsayers, Edwards believes that easy-money policies and a raft of support from central bankers has driven investors into risky corners of the market in search for richer returns or higher yields and he is suggesting that monetary policy has its limits.

Investors will be aiming for more clarity on policy over the next few days as investors convene in Jackson Hole, Wyo., for an annual gathering of central bankers and academics, headlined by a speech on Friday from Fed Chairman Jerome Powell.

Stock-market investors thus far have taken their cues from bonds, with ultra-low and negative rates as well as a so-called yield-curve inversion of the natural slope of yields between the 2-year Treasury note and the 10-year signaling that a recession in the U.S. may be in the offing.

The Dow Jones Industrial Average DJIA, +0.93% has declined 2.4% thus far in a turbulent August, the S&P 500 index SPX, +0.82% and Nasdaq Composite indexes COMP, +0.90% have retreated by 1.9%, and the small-capitalization oriented Russell 2000 index has fallen by 4.1% over the same period.

Read: 5 things investors need to know about an inverted yield curve

How have bonds fared during the same period?

One exchange-traded bond proxy, the iShares Core U.S. Aggregate Bond AGG, -0.05%, which tracks an index of investment-grade bonds and includes Treasurys and mortgage debt, has gained 2.1% and the iShares 20+ Year Treasury Bond ETF TLT, -0.67%, which mostly gives investors exposure to longer-dated government debt, has gained 8.8% so far in August., putting the ETF on pace to register its best monthly gain since a 9.84% rise in January of 2015, according to FactSet data.

“The bubbles are not in the government bond market in my view. They are in corporate equities and corporate bonds,” said Edwards.

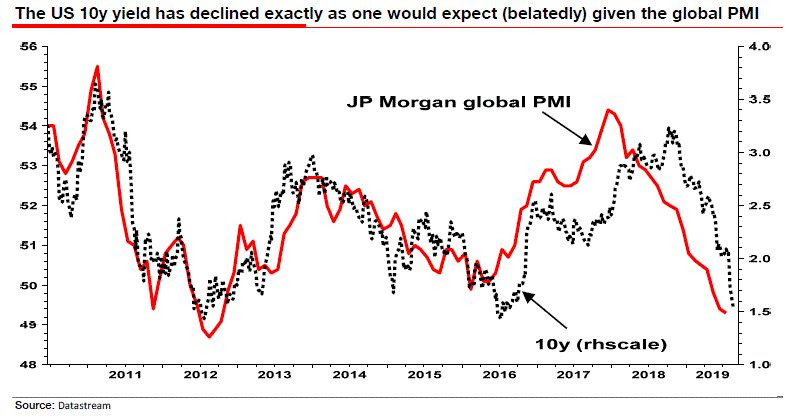

Edwards, who is known for his often pessimistic views, says that weakness represented in a gauge of economic activity in manufacturing from JPMorgan Chase — PMIs or purchasing managers index — correlates with a fall in yields (see chart below):

Datastream via Société Générale

Datastream via Société Générale

Based on this view, with eurozone economic data weak, Edwards sees bonds continuing to rally and yields in the U.S. and elsewhere heading ever lower.

“We show that US and even eurozone government bond yields are not in fact overextended – certainly not on a technical level – but also that fundamentals should carry government bond yields still lower. Of course, I could be wrong. And given my dystopian vision for the global economy, equity and corporate bond investors, I sincerely hope I am,” he said.

Add Comment