Think bond yields need to keep rising for investors to keep rotating away from the U.S. stock market’s pandemic winners to shares of companies more sensitive to the economic cycle? Think again, says one market economist.

Sure, the recent rise in the yields of inflation-linked 10-year U.S. Treasurys, known as TIPS, has probably contributed to the rotation seen since Feb. 10. But other factors, like progress on COVID-19 vaccinations and a pickup in economic activity, will probably be more important drivers in the future, said Simona Gambarini, markets economist at Capital Economics, in a Tuesday note.

“So, even though we expect U.S. yields will not rise much further in the coming quarters, we think that the equity rotation will go further,” Gambarini wrote.

It’s certainly reasonable to assume rising real, or inflation-adjusted, yields contributed to the rotation, she said.

For example, growth stocks, like those in the information technology and communications services sectors, should in principle suffer more from rising “risk-free” discount rates than value stocks, like energy and financials. After all, growth stocks are arguably “longer duration”, or more sensitive to changes in interest rates, than value stocks. Also, financials can benefit directly from rising long yields, she noted.

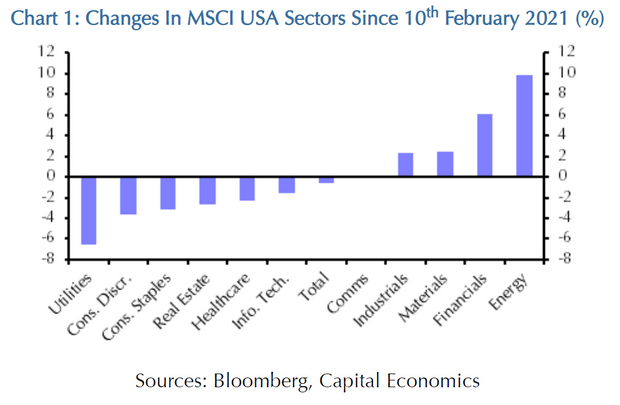

Since Feb. 10, the 10-year TIPS yield has risen by around 35 basis points, while the best-performing sectors have been those that suffered the most in the early stages of the pandemic, particularly energy and financials, she said. The most COVID-resistant sectors, such as communications services and tech, have underperformed over the same stretch (see chart below).

But that’s led to suggestions that rising real yields are a necessary ingredient for further rotation, Gambarini said.

That’s a problem because it ignores other factors that are likely to remain important drivers, the economist argued. Gambarini wrote:

The outperformance of energy and financial stocks has occurred against the backdrop of steps towards another large fiscal stimulus in the U.S. and continued progress in vaccine rollout. The latest survey data also point to the U.S. economy having held up well, despite restrictions on activity. Given that those sectors are particularly sensitive to the economic cycle (and to the lifting of pandemic-related restrictions), they might have just benefited from expectations of a strong rebound in economic activity, which have coincided with a rise in real yields.

Capital Economics is forecasting that vaccines will allow most advanced economies to reopen in the second half of 2021, fueling a further recovery in the global economy.

Stocks wobbled last week as a rise in global bond yields contributed to uncertainty over how central banks would respond, but major equities benchmarks remain not far off all-time highs. Stocks were putting in a mixed performance Tuesday, with the Dow Jones Industrial Average DJIA, -0.07% marginally higher while the S&P 500 SPX, -0.29% and the tech-heavy Nasdaq Composite COMP, -1.07% drifted lower. Major benchmarks saw their biggest one-day gains in months on Monday as the rise in global bond yields relented.

Read: After Australia soothes global market worries, will other central bankers step up?

Meanwhile, investors should keep in mind that some of the biggest stock-market victims of the pandemic still lag far behind the pandemic beneficiaries as a whole, which suggests “that a rapid return to something close to pre-virus life is not fully discounted,” she said.

Add Comment