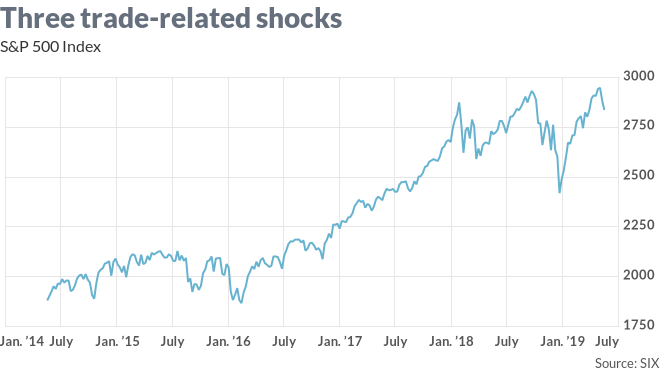

As unpredictable as President Donald Trump is, the word “unpredictable” doesn’t fit him. So as U.S. stock markets go through their third trade-related shock since 2015-16, the last two caused wholly or partly by the president’s tantrums and threats to impose tariffs on nearly all Chinese-made goods entering the U.S, it’s worth asking what happens next.

The answer is that these things do end, it usually takes no more than a few months, and there’s a pretty clear template for what to do at or near the bottom — including, quite possibly, now, since the Dow Jones Industrial Average DJIA, +0.82% rose 207 points on Tuesday and even the recently battered Nasdaq Composite COMP, +1.14% joined the fun with a 1.1% gain.

That is, buy what most recently got hammered. At least, that’s the advice from CFRA Research strategist Sam Stovall, who has studied the snapbacks from the last two busts.

It’s always something

“I like to say: “from worst to first”, or in New York parlance, “From Woist to Foist,” said Stovall, who grew up in the distinctly non-Noo Yawk confines of the same New Jersey suburb I did and doesn’t actually speak like that. (He’s a few years older; we went to school with each other’s siblings, not together). “Since those sectors that were the downside leaders tend to be the upside leaders emerging from the decline.”

In the May 2015-February 2016 bust, what got hammered worst, of the 11 sectors in the Standard & Poor’s 500 SPX, +0.80% , were energy stocks, materials, and financials, in that order, according to data compiled by Stovall. In the next five months, those three posted the biggest, second-biggest, and fifth-biggest gains, with energy stocks rising 25%.

Last fall, the biggest drops came in energy, industrials and technology stocks — and tech giants like Apple AAPL, +1.58% , Microsoft MSFT, +1.12% and Facebook FB, -0.45% led the snap back, followed by consumer discretionary (where briefly-battered tech titan Amazon.com AMZN, +0.96% is classified), and industrials. Energy placed fifth, but the sector led by giants Exxon Mobil XOM, +0.13% and Chevron CHV, +0.44% still had a 27% gain between Christmas Eve 2018 and late April.

This month, the biggest drops are in technology (7%) and materials (6.3%), with industrials, energy and consumer discretionary in a virtual tie for third-worst around 5.2%.

So this is where to look, right? By Stovall’s rule yes, at least.

Are we there yet?

The other question is whether it is time to act yet.

At Merrill Lynch, at least, clients are buying the trade dip, Merrill quantitative strategist Jill Carey Hall said in a report Tuesday. In fact, they’ve been net buyers of equities for the last two weeks, and company stock buybacks are peaking as well. Hedge funds, the shorter-term players in the market, have been the notable sellers, Merrill said.

And yes, the bounce back in flows looks a lot like you might think — the top sectors are tech, financials, health care and materials, all at or near record inflows, Hall wrote. Last week was the first time since February there were net inflows into financial stocks like JPMorgan Chase JPM, +0.79% , which have been held back by the Federal Reserve’s newfound caution about interest-rate hikes.

There’s a common element in the flows news, Hall writes — clients and companies buying back their own stock both expect a peaceful resolution to the current trade brouhaha with China.

The questions are how soon all of this might happen — and whether the market will act differently and refuse to bounce back this time, partly because there’s no real prospect of a rate cut from the Fed, which helped cure the late-2018 bear market by getting all dovish all of a sudden after complaints from the White House.

But there’s no need for the Fed to rescue U.S. markets, absent a long, rather dumb war of attrition between the administration and China. All that needs to happen is for the president to stop making threats he’s unlikely to keep, or keep for long, if they rattle U.S. stocks. After all, December was as much about trade as rates — stocks fell 3% the day Trump nicknamed himself “Tariff Man” on Twitter.

When the president might stop making threats and promises he won’t make stick is an excellent question. But that’s been true since he was a young-turk developer. With Trump set to meet with Chinese President Xi Jinping in June, at the same G-20 summit where Trump wants to parley with Russian strongman Vladimir Putin, anything could happen.

Want news about Asia delivered to your inbox? Subscribe to MarketWatch’s free Asia Daily newsletter. Sign up here.

Add Comment