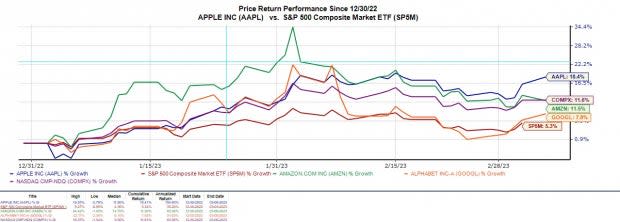

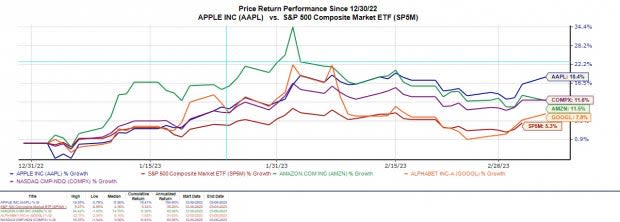

Many tech stocks have seen a strong start to 2023 with the Nasdaq up +11% year to date to top the broader S&P 500’s +5%.

This may have many investors wondering if big tech stocks like Apple (AAPL), Alphabet (GOOGL), and Amazon (AMZN) could have extended rallies. Let’s see if it’s time to buy these tech giants’ stocks for 2023 and beyond.

Performance

With high inflation still prevalent in the current economic environment investors will want to monitor the valuation and premium they are paying for tech stocks. This is especially true after extended rallies as a higher inflationary environment is challenging for most technology companies.

Image Source: Zacks Investment Research

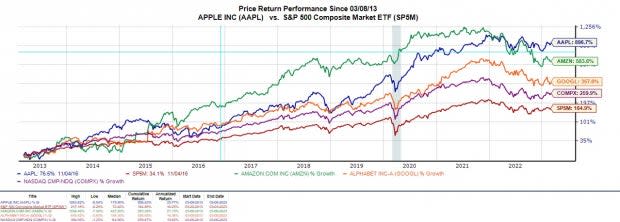

Still, Apple stock is up +18% this year with Amazon up +11% and Alphabet up +8% to all outperform the S&P 500 with only shares of GOOGL trailing the Nasdaq. Over the last decade, Apple’s +897% has led these big tech peers, but Amazon’s +583% and Alphabet’s +357% have also outperformed the broader indexes.

Image Source: Zacks Investment Research

Valuation

Despite Alphabet stock trailing the Nasdaq’s performance so far this year its valuation is more intriguing than Apple and Amazon from a price-to-earnings perspective. Alphabet stock trades at $95 and 17.6X forward earnings which is nicely below its industry average of 25X and the S&P 500’s 18.1X. Shares of GOOGL also trade 44% below its decade-long high of 31.6X and at a 29% discount to the median of 24.7X.

Image Source: Zacks Investment Research

Pivoting to Apple, shares of AAPL trade at $155 per share at 23.9X forward earnings and above the benchmark’s 18.1X. However, Apple trades on par with its industry average and below its decade high of 33.6X but above the median of 14.9X.

Amazon stock also trades above the benchmark’s P/E valuation at 65.1X forward earnings and $93 per share. Amazon does trade well below its own decade-long high of 612X and at a 31% discount to the median of 93.2X but well above its industry average of 32.2X.

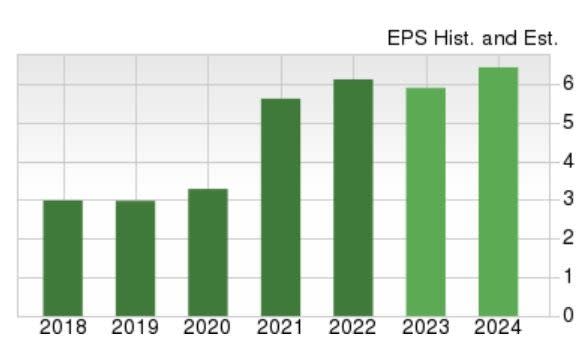

EPS Growth

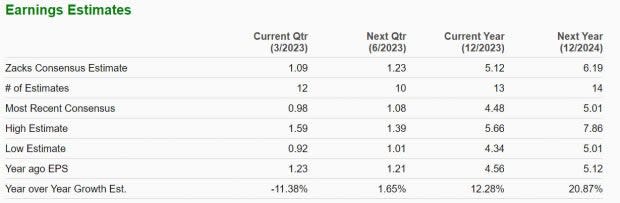

Along with valuation, monitoring the growth of Apple, Alphabet, and Amazon will be important at their mature stages in corporate life.

To that note, Apple stock stands out sporting an “A” Zacks Style Scores grade for Growth and a higher EPS figure projected in its outlook than Alphabet and Amazon. Apple’s fiscal 2023 earnings are projected to dip -1% this year but rebound and jump 10% in FY24 at $6.68 per share. More impressive, fiscal 2024 would represent 125% EPS growth over the last five years with 2019 earnings at $2.97 per share.

Image Source: Zacks Investment Research

Alphabet and Amazon’s outlooks are attractive in their own right, with both carrying a “B” Style Scores grade for Growth. Alphabet’s earnings are expected to rise 12% in FY23 and leap another 21% in FY24 at $6.19 per share. Fiscal 2024 would represent 140% EPS growth over the last five years with 2019 earnings at $2.58 per share.

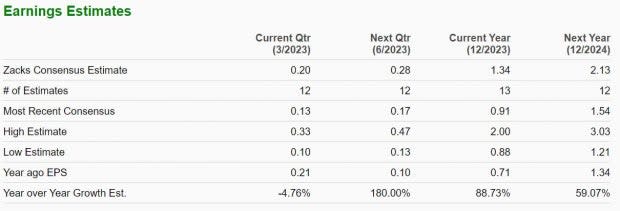

Image Source: Zacks Investment Research

Lastly, Amazon’s earnings are forecasted to climb 89% this year and jump another 59% in FY24 at $2.13 per share. Fiscal 2024 would represent 85% growth over the last five years with 2019 EPS at $1.15.

Image Source: Zacks Investment Research

Bottom Line

Apple, Alphabet, and Amazon stock all land a Zacks Rank #3 (Hold) at the moment. Despite broader economic concerns still very much prevalent and strenuous on technology companies, their stocks trade attractively relative to their past from a P/E valuation standpoint along with solid EPS growth expected.

For now, holding on to these unique and innovative tech giants at their current levels could be rewarding long-term especially when looking at their historical performances.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Add Comment