(Bloomberg) — Uber Technologies Inc. reported declining revenue in the fourth quarter, showing that demand for food delivery isn’t making up for a falloff in ridership.

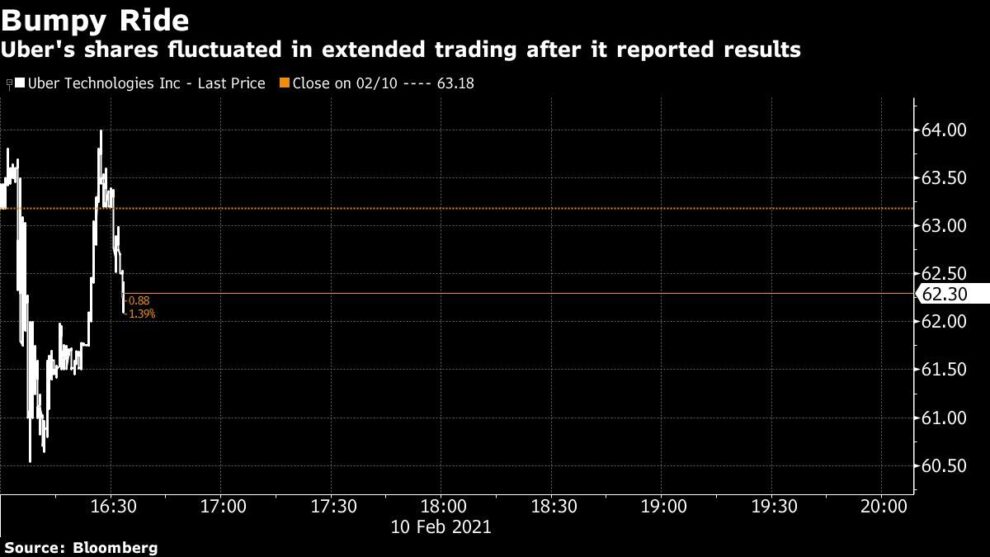

Sales dropped 16% to $3.17 billion, short of an average of analyst estimates compiled by Bloomberg. Performance in Canada, Latin America and the U.S. was particularly dismal. The stock was down about 2.5% Thursday morning in New York.

Despite the shortfall, the San Francisco-based company narrowed its loss in the quarter that ended in December, riding a wave of deals that shed some of its more fanciful pursuits.

It turns out that autonomous vehicles and flying cars weren’t helping Uber achieve its goal of a quarterly profit before interest, taxes and other expenses by the end of this year. In the fourth quarter, when it sold those two business units to startups in exchange for equity, Uber posted an adjusted loss of $454 million, beating analysts’ estimates.

In its quarterly results released Wednesday, Uber said it’s still on track to turn an adjusted profit some time this year. And it disclosed yet another asset sale, confirming a Bloomberg report in September that it was selling part of its stake in the Chinese ride-hailing company Didi Chuxing. Uber said it sold $207 million of the shares and has an agreement to sell $293 million more.

Uber didn’t offer a forecast in the report. But Chief Executive Officer Dara Khosrowshahi indicated that better times may not arrive until the summer. “We’re bullish that we can deliver strong growth and expanding margins in the second half of the year,” he said in a conference call with analysts.

In an interview with Emily Chang of Bloomberg TV Thursday morning, Khosrowshahi said the timing of 2021 profitability will depend on economic re-opening, citing a resurgence of ridership in markets less impacted by the pandemic, such as Taiwan and Australia.

“We cannot predict when a particular city is going to open up, but when they do, not only do we see Uber coming back, but typically we see it coming back faster than other modes of transportations,” Khosrowshahi said.

Before the coronavirus pandemic upended Uber, the company had Amazon.com Inc.-sized ambitions. Cratering demand for Uber’s main product — rides — forced Khosrowshahi to sell off or abandon pricey initiatives and reduce spending. His strategy relies on two businesses: delivery and transportation.

As the pandemic drags on, delivery is the star. The unit continued its surge, with 130% growth in the fourth quarter to $10.05 billion in gross bookings. Analysts expected $9.77 billion.

Amid all the cost trimming, delivery is one area Uber has invested heavily. It finalized the $2.65 billion purchase of food delivery company Postmates late last year and agreed to acquire booze delivery provider Drizly Inc. for $1.1 billion. The latter acquisition complements Uber’s food business and will drive growth, JMP Securities analyst Ron Josey wrote in a report this month. Morgan Stanley noted the opportunities to expand the service internationally and sign advertising deals.

“We will continue into other global expansion as it relates to grocery,” Khosrowshahi said in the interview. “That does set us apart from some of the other competitors, including Instacart.”

Uber also hopes to work with the Biden administration to help get vaccines to underserved communities, he said.

In rides, Uber saw demand rebound unevenly in different regions. Mobility gross bookings were down by half to $6.79 billion in the fourth quarter compared with last year but have been inching up since the darkest days of the pandemic. The performance fell short of analysts’ expectations.

One closely watched metric — the number of customers who use the platform each month — dipped 16% to 93 million in the fourth quarter, better than Wall Street estimates. Uber is adding new customers, but they tend to be more price sensitive, Khosrowshahi said on the conference call.

Uber ended the year with $5.6 billion in cash, more than expected, but only about half of what the company had at the end of 2019.

Khosrowshahi said Uber plans to move into its new headquarters in San Francisco when the city opens up and health authorities determine it’s safe to go back to work in offices. “It will be a hybrid work environment,” he said.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted business news source.

©2021 Bloomberg L.P.

Add Comment