(Bloomberg) — Inflation in Ukraine may exceed 20% this year, the highest since 2015, as the war disrupts production and supply chains, the central bank said. European Central Bank chief Christine Lagarde also warned that Europe’s record inflation could accelerate further.

Most Read from Bloomberg

The Russian missile cruiser Moskva will be towed back to port after a fire, Moscow said. Ukraine’s armed forces said the flagship warship of Russia’s Black Sea fleet was hit by anti-ship missiles.

The European Union told member states that complying with President Vladimir Putin’s demand for Russian gas imports to be paid for in rubles would violate sanctions. EU leaders plan to discuss common gas purchases at a summit next month as they seek to avoid competing against each other for alternative energy supplies. U.S. President Joe Biden said he may send an official to visit Ukraine.

(See RSAN on the Bloomberg Terminal for the Russian Sanctions Dashboard.)

Key Developments

-

Russian Troops Risk Repeating Blunders If They Try for May 9 Win

-

Damaged Russian Warship Has Been a Symbol of Ukrainian Defiance

-

EU Warns Putin’s Rubles-for-Gas Demand Would Breach Sanctions

-

Russia Weighs Looser Wartime Capital Controls After Ruble Surge

-

Holders of UniCredit Bond Tied to Russia’s Rusal Lose It All

-

Russia’s War in Ukraine: Key Events and How It’s Unfolding

All times CET:

U.S. Lawmaker Sees Ukraine Low on List of Voter Concerns (6:53 p.m.)

U.S. Senator Chris Coons said Americans will “struggle with maintaining focus and attention” on the war in Ukraine ahead of the November midterm elections. The Democrat from Delaware, a member of the Senate Foreign Relations Committee, said he was “very troubled” by recent polling in which Ukraine “doesn’t make the top five” of most pressing concerns for Americans, who are more worried about inflation, the economy, the pandemic, crime, and the border with Mexico.

Biden got a polling bump in the initial weeks of Russia’s invasion of its neighboring country, but that has faded as voters have faced sharp price increases in groceries and gasoline and the coronavirus persists. Democrats aren’t favored to keep control of Congress in the November contests.

Biden Says U.S. Weighing Sending an Official to Visit Ukraine (6:20 p.m.)

Biden said his administration is deciding whether to send a senior U.S. official to visit Ukraine. “We’re making that decision now,” he told reporters before departing Washington for a trip to North Carolina.

He didn’t say which official might make such a visit. Politico reported earlier Wednesday, citing unnamed officials, that the administration is considering sending Secretary of State Antony Blinken or Defense Secretary Lloyd Austin.

Pentagon Says Training on New Weapons Won’t Take Long (6:19 p.m.)

It won’t take much time to train Ukrainian troops on using 15mm towed howitzers and radar for locating enemy artillery, a senior U.S. defense official told reporters Thursday. The equipment is part of the $800 million in new weapons being sent to Ukraine.

The official said Ukrainian officers had previously been trained in the U.S. on the use of Switchblade attack drones and unmanned coastal defense vessels that are also in the package announced Wednesday by Biden.

The official also said that Russian ships near its damaged Moskva cruiser have moved farther south in the Black Sea. The ship has suffered an extensive fire, but the Pentagon is unable to confirm the cause of an explosion on board the ship or the number of casualties, the person said.

Ukraine Energy Industry Lobbies D.C. for Gas Funds (6:05 p.m.)

Ukraine needs international financial aid, including from the U.S., to fill its energy reserves ahead of next winter, according to two representatives of the country’s energy industry who were in Washington to lobby the Biden administration and lawmakers. With domestic production down because of the war, Ukraine will need to import about 11 billion cubic meters of natural gas for heating and agriculture if the conflict lasts into the fall, according to Svitlana Zalischuk, adviser to the chief executive of Naftogaz, the country’s largest state-owned oil and gas company.

“War or no war, we are getting ready for the tough times ahead,” said Olga Bielkova, director of corporate affairs for GTSOU, which runs the country’s natural gas delivery system.

Draghi Seeks Energy Deals in Africa to Exit Russian Gas (5:45 p.m.)

Italy’s Prime Minister Mario Draghi is set to travel to the Republic of Congo and Angola as soon as next week to secure new gas deals that could bring Italy an additional 6.5 billion cubic meters a year in total, according to people familiar with the matter.

The additional supply and the extra volume Italy secured from Algeria earlier this week would cover for more than half the amount the country gets from Russia as early as next year. Italy currently gets about 40% of its gas from Russia.

EU Sanctions Tweak Allows Some Plane Owners to Sell (5:15 p.m.)

An amendment to EU sanctions last week created a potential path for some aircraft financiers to sell jets held in Russia to the airlines now operating them without permission.

The measure allows EU governments to grant permission for entities in their states to keep receiving payments from Russian companies on so-called financial leases signed before Feb. 26. Ownership of the plane can be transfered once the lease is paid off. It’s not clear how many of the 500 or so foreign-owed planes stuck in Russia are potentially eligible for the exception. Most of the aircraft are under a different kind of lease.

Scholz Accused of Slow-Walking Ukraine Weapons Deliveries (4:51 pm.)

German Chancellor Olaf Scholz faces intense pressure from members of his ruling coalition to step up deliveries of heavy weapons such as tanks and fighter jets to help Ukraine fight Russian troops.

Despite initiating an historic reversal of Germany’s previously frugal defense policy in the early stages of the war, Scholz has since appeared hesitant to go beyond initial supplies of protective equipment, munitions and rockets to take out Russian tanks and aircraft.

Pope’s ‘Good Friday’ Plan Draws Kyiv’s Ire (4:03 p.m.)

The Vatican’s decision to put a Ukrainian and a Russian side by side during a Good Friday celebration is being criticized for equating victims to their aggressors, and has drawn attention to the Catholic leader’s refusal to condemn Moscow explicitly for the invasion.

An internal Vatican memo seen by Bloomberg said that Ukrainians working within the Vatican were disconcerted by the plan. It also warned of possible protests during the Stations of the Cross celebration at the Coliseum on Friday in Rome, which Pope Francis is due to lead.

Russian Grain Flows to Top Customers (3:45 p.m.)

Russia is still exporting grain to some of its biggest customers even as shipping costs soar in the Black Sea region. That’s pushing some market observers to raise their estimates for Russia’s shipments this season, despite moves by some traders to avoid Russian commodities. The main buyers remain Egypt, Turkey and Iran, said Dmitry Rylko, general director of the Moscow-based Institute for Agricultural Market Studies.

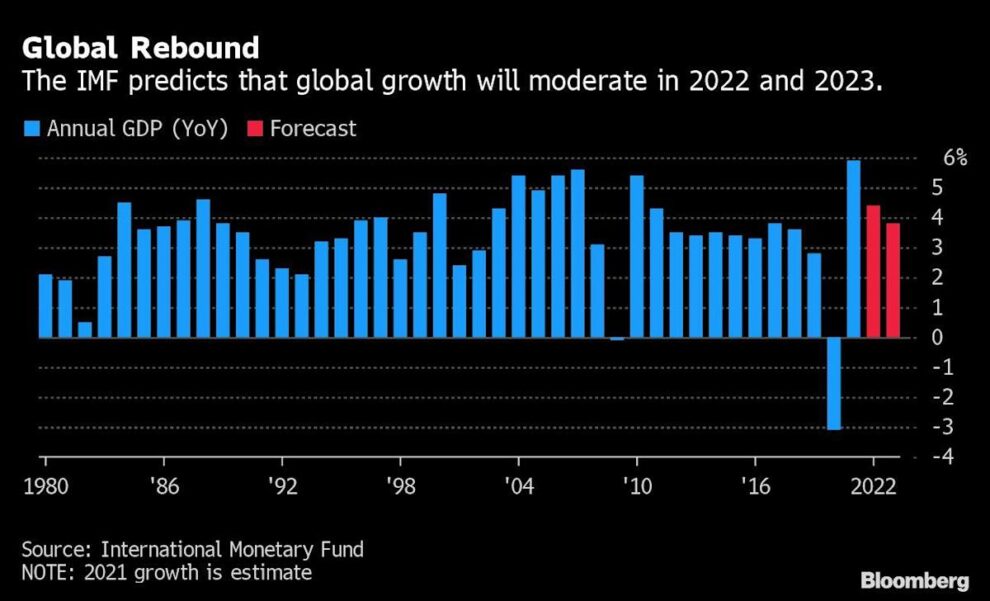

IMF Sounds Warning on Global Growth Outlook, Inflation (3:10 p.m.)

The International Monetary Fund said the war risks eroding the world’s recovery from the Covid-19 pandemic and urged central banks to act decisively to curb inflation.

The world’s financial firefighter next week will cut its global growth forecast for this year and next, Managing Director Kristalina Georgieva said ahead of IMF and World Bank Spring Meetings that start on Monday. The war is spurring the fund to lower its 2022 GDP outlook for 143 member nations — a group that accounts for 86% of global output.

EU Leaders to Discuss Joint Gas Purchases (2:50 p.m.)

The goal will be to avoid competing against each other for alternative energy supplies in the effort to phase out purchases from Russia.

The bloc’s two-day summit starting May 30 is expected to cover a solidarity mechanism to support member states facing gas shortages, energy interconnections in the bloc, the security of energy supplies and possible changes to the EU’s electricity market, according to people familiar with the discussions.

Putin Looks to Diversify Energy Exports Toward Asia (2:45 p.m.)

Russia needs to shift its energy exports to markets beyond Europe, Putin said in a televised statement. He added Europe has no immediate alternative to Russian gas, and that attempts to squeeze Russian energy out of global supplies will destabilize markets and push up prices.

Putin said some “unfriendly” countries are already falling behind in payments to Russia, without going into specifics.

U.S. to Target Entities Evading Sanctions on Russia (2:40 p.m.)

Biden’s National Security Advisor Jake Sullivan told the Economic Club of Washington that the U.S. is focused on stopping evasion of sanctions imposed so far, and will have an announcement in the next week or two on that. He offered no further details.

Ukraine Reports Another Prisoner Swap (2:30 p.m.)

Deputy Prime Minister Iryna Vereshchuk said the swap with Russia involved 30 Ukrainians, including 8 civilians. Vereshchuk said this week that Russia had captured about 1,700 Ukrainian soldiers and civilians.

Ukraine Inflation May Exceed 20% in 2022 (1:38 p.m.)

Ukrainian inflation may exceed 20% this year, the highest since 2015, as Russia’s invasion disrupts production and supply chains, the central bank said.

The bank also expects the country’s economy to shrink by at least third due to decline of consumption as millions of people flee the country, while unemployment is raising amid the Russia’s war on Ukraine. Still, economic activity started to pick up in April and share of companies that have fully ceased operations fell to 23% this month from more than 30% in March.

The National Bank of Ukraine reiterated it will return to inflation targeting with floating hryvnia rate and will stop financing budget after economy starts functioning normally.

Read more: Ukraine Economy to Fall 45% in 2022, Russia 11%, World Bank Says

Russian Warship Will Be Towed to Port, Interfax Reports (1:19 p.m.)

The Russian Moskva cruiser will be towed to port for examination, the Russian Defense Ministry said according to an Interfax report, which added that the ship’s main missile equipment wasn’t damaged.

The Moskva was hit by “Neptune” anti-ship cruise missiles, resulting in significant damage and a fire, according to a statement from Ukraine’s armed forces posted on Facebook: “A powerful explosion of the ammunition toppled the cruiser over and it began to sink.”

The condition of the flagship of Russia’s Black Sea fleet, which typically has a crew approaching 500, remains unclear. Russia says there’s been localized fires aboard, causing ammunition to detonate, with the cause is under review.

Petropavlovsk Plummets as It Considers Selling Gold Mines (12:03 p.m.)

Petropavlovsk Plc, once one of the biggest London-listed gold miners, said it’s looking at selling all its assets as sanctions against Russia mean it can’t sell the bullion it produces in the country or pay its debts.

Shares plummeted as much as 20% in London on the news, and have fallen more than 90% since the start of the Russian invasion of Ukraine.

Netherlands Tells Companies Not to Pay for Gas in Rubles (11:26 a.m.)

The Netherlands said it won’t allow Dutch companies to accept a demand from Moscow to pay for gas in rubles. Russian gas flows to the Netherlands are low by regional standards. But the move may add to pressure on other European countries to fall in line.

Ukraine Needs $7 Billion Per Month, Zelenskiy Tells EU (11:15 a.m.)

Ukraine needs $7 billion per month in immediate financing help to cover social payments and salaries, President Volodymyr Zelenskiy told European Commission President Ursula von der Leyen when she visited Kyiv last week, according to people familiar with the matter.

Zelenskiy also discussed the challenges Ukraine faces trying to export its grain, with von der Leyen saying the bloc would use its expedited border crossing procedures to help, the people said.

Russian Stocks Down for a Fifth Day (10:23 a.m.)

Russia’s stock benchmark MOEX Index fell for a fifth day as Russia reiterated a warning if Norway and Sweden decide to join NATO. Stocks are down about 3.8% for the week.

Stocks and government bonds in Europe were steady as investors await the central bank’s meeting later on Thursday for cues on the path of monetary policy. U.S. equity futures are narrowly mixed so far.

The commodity-fueled jump in costs exacerbated by Russia’s war in Ukraine continues to ripple across the global economy and temper market sentiment.

Russia May Move Nuclear Arms to Baltics if Sweden, Finland Join NATO (9:46 a.m.)

Russia threatened to deploy nuclear weapons in and around the Baltic Sea region if Finland and Sweden join the North Atlantic Treaty Organization as tensions fueled by Vladimir Putin’s invasion of Ukraine spread.

“In this case, there can be no talk of non-nuclear status for the Baltic,” Dmitry Medvedev, deputy chief of the Security Council and former president, said in a Telegram post Thursday, suggesting Russia may deploy Iskander missiles, hypersonic weapons and nuclear-armed ships in the region.

Russia has repeatedly warned both nations of consequences if they decide to join the alliance.

Finns Start Path Toward NATO as Sweden Seen Inching Closer

Oleg Deripaska’s Superyacht on the Move (9:00 a.m.)

Clio, a $65-million superyacht tied to Oleg Deripaska, the Russian aluminum billionaire whose connections to Vladimir Putin have put him on sanctions lists, is on the move again after being anchored off the Maldives.

Authorities in the U.S. and allies in the U.K., Italy, France and Germany are trying to locate the luxury boats and other properties of Russian tycoons. Nearly a dozen yachts have already been seized.

Putin Tells Austria Gas Can Be Paid in Euros (8:41 a.m.)

Putin is continuing to make contracted gas deliveries to Europe and will accept payments in euros, Austrian Chancellor Karl Nehammer told the APA news service days after meeting the Russian president.

It’s unclear what Putin was referring to. Under the new payment procedure demanded by the Kremlin, European buyers would need to have two accounts with Gazprombank — one in euros and one in rubles — and the Russian lender would be responsible for making the conversion.

Irish Foreign Minister Visits Kyiv (8:44 a.m.)

Ireland’s Foreign Minister Simon Coveney visits Kyiv today to meet with Ukrainian counterpart Dmytro Kuleba and defense minister Oleksii Reznikov. Topics will include how Ireland can assist Ukraine in its application for EU candidate status, provide political, security and humanitarian support, and taking forward further EU sanctions on Russia.

Russia Considers Easing Capital Controls (7:40 a.m.)

Russian authorities are considering a step-by-step approach to rolling back the harsh capital controls imposed to stabilize markets after the invasion of Ukraine.

Discussions this week focused on options that included extending the deadline for exporters to carry out mandatory conversions of their overseas earnings into rubles and lowering below 80% the share of foreign proceeds that companies are obliged to sell in the market, according to people informed on the matter.

The wartime controls have created a mismatch between the supply and demand for foreign currency, feeding a rally in the ruble that helped it regain all ground lost after the war began. Some Russian metal and mining companies are now struggling to sell dollars in such big volumes, according to people familiar with the matter.

(Earlier versions misstated the timetable on the U.S. sanctions evasion plan and incorrectly said Norway, rather than Finland, is considering joining NATO)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Add Comment